China’s Nuclear Dominance: How the East is Leading the Global Atomic Energy Race

The New Global Powerhouse in Nuclear Energy

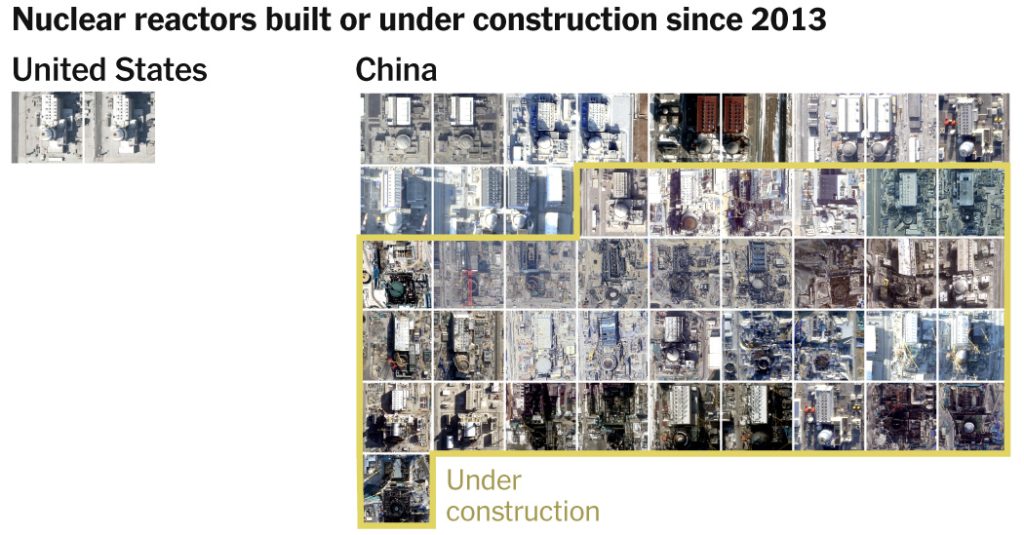

China is rapidly ascending to become the world’s preeminent nuclear power nation, constructing nearly as many reactors as the rest of the world combined in an unprecedented display of atomic ambition. While China’s dominance in solar panel production and electric vehicle manufacturing has captured headlines for years, its extraordinary progress in nuclear power plant development has received less attention but may prove equally consequential for global energy markets and geopolitics.

By 2030, China is projected to surpass the United States in nuclear power capacity—a remarkable milestone considering America pioneered atomic energy generation. This rapid advancement is no accident but rather the result of strategic planning, sustained investment, and efficient execution that has allowed China to overcome challenges that have stymied Western nuclear development for decades.

“The Chinese are moving very, very fast,” explains Mark Hibbs, a senior fellow at the Carnegie Endowment for Peace and author of a book on China’s nuclear program. “They are very keen to show the world that their program is unstoppable.”

What makes China’s nuclear success particularly noteworthy is that many of its reactors are based on American and French designs. Yet while Western nuclear projects frequently suffer from crippling delays and budget overruns, China has mastered the art of building these complex facilities quickly and cost-effectively. The country is simultaneously pushing boundaries in next-generation nuclear technologies that have long eluded Western developers, including investments in fusion power—potentially the holy grail of limitless clean energy.

Beijing’s ultimate ambition extends far beyond domestic energy production. China aims to join the elite club of nations—currently limited to the United States, Russia, France, and South Korea—capable of designing and exporting nuclear technology globally, transforming the country from an energy importer to a supplier of some of humanity’s most sophisticated technological achievements.

The Geopolitical Energy Battlefield

As the United States and China compete for global influence, energy has emerged as a critical battleground with profound implications. Under former President Trump, the United States positioned itself as the world’s premier supplier of fossil fuels, emphasizing oil, gas, and coal exports. China, meanwhile, has dominated manufacturing in renewable energy technologies, seeing wind turbines, solar panels, and battery storage as the multi-trillion-dollar markets of the future.

Nuclear power occupies a unique position in this competition. The technology is experiencing renewed global interest as climate change concerns mount, offering the rare combination of zero-emission operation with reliable 24/7 power generation—unlike intermittent renewable sources such as wind and solar that depend on weather conditions.

The Trump administration has set an ambitious target of quadrupling U.S. nuclear capacity by 2050, despite its generally dismissive stance toward climate change initiatives. This plan includes developing next-generation reactor technologies both for domestic data centers and for export to energy-hungry nations worldwide. U.S. officials are increasingly concerned that if China dominates the nuclear export market, it could significantly expand its global influence, as nuclear plant construction establishes deep, decades-long relationships between supplier and recipient nations.

China’s clear competitive advantage lies in its ability to produce reactors efficiently. The country now completes reactor projects in five to six years—twice as fast as typical Western timelines. While U.S. nuclear construction costs have skyrocketed since the 1960s, they decreased by half in China during the 2000s and have since stabilized, according to recent data published in Nature. For comparison, the only two U.S. reactors built this century at Georgia’s Vogtle nuclear plant required 11 years and cost a staggering $35 billion.

“When we first got this data and saw that declining trend in China, it surprised me,” admitted Shangwei Liu, a research fellow at the Harvard Kennedy School of Government who led the study on nuclear construction costs. The critical questions now facing the industry are how China achieved such remarkable efficiency—and whether the United States can possibly catch up.

How China Mastered Nuclear Power

A modern nuclear power plant represents one of the most complex construction projects on Earth, requiring extraordinary precision, materials science expertise, and regulatory compliance.

The reactor vessel—where atomic fission occurs—requires specialized steel up to 10 inches thick capable of withstanding decades of radiation bombardment. This vessel sits inside a massive containment dome, often three stories high and approximately as wide as the U.S. Capitol dome, constructed from steel-reinforced concrete to prevent radiation leaks. Thousands of miles of piping and electrical wiring must adhere to exacting safety standards.

Financing these multibillion-dollar projects presents enormous challenges. Even minor complications requiring regulatory approval can cascade into lengthy delays that cause borrowing costs to spiral out of control. China, however, has systematically conquered these obstacles through a comprehensive approach.

Government support forms the foundation of China’s nuclear success. Three state-owned nuclear developers receive subsidized government-backed loans to build new reactors, significantly reducing financing costs that typically account for about one-third of total project expenses. The Chinese government also requires electric grid operators to purchase power from nuclear plants at favorable rates, ensuring steady revenue.

Equally important is China’s standardized approach. Nuclear developers focus on a small number of reactor designs and replicate them consistently across multiple sites. “That’s essential for scaling efficiently,” explains Joy Jiang, an energy innovation analyst at the Breakthrough Institute, a pro-nuclear research organization. “It means you can streamline licensing and simplify your supply chain.”

China’s national commitment to nuclear expansion creates confidence throughout the supply chain. Companies invest in domestic manufacturing facilities and a specialized workforce knowing future projects will provide steady demand. Near Shanghai, a massive industrial complex continuously forges reactor pressure vessels ready for immediate deployment to new construction sites. Teams of specialized welders move efficiently between projects, maintaining productivity and institutional knowledge.

The contrast with Western nuclear development is stark. During the 1970s and 1980s, U.S. nuclear construction virtually ceased as rising interest rates and increasingly stringent safety regulations caused delays and cost overruns. Public concerns about nuclear waste disposal and fears following the 1979 Three Mile Island accident in Pennsylvania further dampened enthusiasm. Meanwhile, private developers continued experimenting with new reactor designs, introducing additional complications and preventing standardization. American nuclear power effectively died from a lack of predictability.

This difference became glaringly apparent in the late 2000s when U.S. utilities attempted to revitalize nuclear power with the AP1000 reactor design featuring enhanced safety systems. Developers struggled with the technology, leading to repeated delays and astronomical cost increases. By the time Georgia’s two reactors were finally completed last year, most utilities had lost appetite for similar projects.

China built AP1000 reactors during the same period and encountered similar difficulties, including problems obtaining specialized components and unexpected cost increases. But rather than abandoning the technology, Chinese officials analyzed the challenges and determined they needed to modify the design and develop domestic supply chains.

“What the Chinese did was really smart,” says James Krellenstein, CEO of nuclear consultancy Alva Energy. “They said, we’re going to pause for a few years and incorporate every lesson learned.” China is now constructing nine more of these reactors—now called the CAP1000—all projected for completion within five years at dramatically lower costs, according to U.S. Energy Department findings.

While nuclear advocates in the United States often blame strict safety regulations for high costs, China’s safety requirements are comparable. The difference lies in process predictability and fewer opportunities for project opposition. Most Chinese reactors begin construction within weeks of regulatory approval. In the United States, projects frequently require additional permits from state governments, adding months or years to timelines.

“China is practiced at building really big things, everything from dams to highways to high-speed rail, and those project management skills are transferable,” observes David Fishman, a power sector consultant at the Lantau Group.

As China—the world’s largest greenhouse gas emitter—works to reduce pollution, nuclear power plays an essential role in its energy strategy. While solar and wind power are expanding rapidly and provide most of China’s clean electricity, the country still relies heavily on coal for baseload power when renewables are unavailable. Nuclear expansion could help support renewable integration while displacing coal-fired generation.

China’s nuclear growth does face challenges. A minor radioactive leak at one plant in 2021 raised safety concerns, and a more serious accident could trigger public backlash. The country continues working on nuclear waste disposal solutions, with some cities experiencing protests against proposed waste reprocessing facilities. Beijing has also restricted new reactor construction in much of China’s interior due to water usage concerns, potentially limiting future growth.

Nevertheless, China continues its ambitious expansion with plans to construct hundreds of additional reactors by mid-century.

Can the U.S. Catch Up?

In the United States, nuclear power enjoys rare bipartisan support as electricity demand increases. Even environmentalists like Al Gore who once opposed nuclear energy due to accident risks and waste concerns are reconsidering the technology’s merits.

However, America is pursuing a fundamentally different approach to nuclear expansion than China, emphasizing private innovation over government coordination. Dozens of startups are developing smaller reactor designs intended to be more economical than traditional large plants. Technology companies including Google, Amazon, and OpenAI are investing billions in nuclear startups like Kairos Power, X-Energy, and Oklo to power artificial intelligence data centers. Early projects are underway in Wyoming, Texas, and Tennessee, though few if any new reactors are expected to operate before the 2030s.

The Trump administration aims to accelerate nuclear development by streamlining regulations at the Nuclear Regulatory Commission, which certifies reactor safety. Critics argue the agency has become too inflexible to efficiently evaluate advanced reactor designs with inherently safer characteristics.

Energy Secretary Chris Wright believes private capital flowing into nuclear projects will drive American innovation and ultimately outpace China. “Entrepreneurial capitalist competition is where the U.S. thrives, and I think it’s an advantage over China,” he stated in an interview.

Some experts worry the United States is overemphasizing technological breakthroughs rather than focusing on the financing, workforce development, and infrastructure needed for practical deployment. The U.S. has lost almost all domestic heavy forging capacity essential for large reactor components. Additionally, perfecting advanced reactor designs could require years of development while China continues deploying proven technology.

“You look at the number of designs, particularly in the U.S., you think, Oh, God, help us,” said Philip Andrews-Speed, senior research fellow at the Oxford Institute for Energy Studies. “I would think narrowing down is the sensible thing to do.”

While the Trump administration has worked to accelerate nuclear permitting and increase domestic nuclear fuel production, key government resources for advancing new reactors, such as the Energy Department’s loan office, have been hampered by staffing reductions. Proposals to reduce safety regulations could face significant opposition. There’s also uncertainty about whether tech companies’ interest will remain if artificial intelligence development slows.

“There’s no reason the United States couldn’t expand nuclear power,” argues Stephen Ezell, vice president for global innovation policy at the Information Technology and Innovation Foundation. “But are we just going to see a few small reactors power a few data centers, or are we going to see a serious whole government approach to bring back nuclear power as an essential source of electricity?”

A Race to Power the World

China’s accelerated nuclear development serves as preparation for its larger ambition: dominating the global market for nuclear technology. Chinese companies have already constructed six reactors in Pakistan and plan to export many more worldwide.

Simultaneously, China is working to surpass the United States in technological innovation. The country has built what it describes as the world’s first “fourth generation” reactor—a gas-cooled design capable of providing industrial heat and steam in addition to electricity. Chinese researchers are also pursuing technologies requiring less uranium, such as thorium reactors, and developing spent fuel recycling methods. These initiatives acknowledge China’s limited domestic uranium reserves, which could constrain a massive expansion of conventional reactors.

Even if American companies and laboratories maintain leadership in basic innovation, a recent report warned that China is 10 to 15 years ahead of the United States in its capability to widely deploy next-generation reactors.

The pattern is familiar: the United States invented solar panels and battery technology, only to watch as China scaled production and now controls global markets for these critical clean energy technologies.

“Maybe we can convince some of our allies not to buy Chinese reactors, but there are going to be plenty of other countries out there with growing energy demands,” cautions Paul Saunders, president of the Center for National Interest. “And if America isn’t ready, we won’t be able to compete.”

As the world seeks to decarbonize while meeting growing electricity demands, China’s nuclear ascendancy represents both a model of successful deployment and a challenge to America’s traditional technological leadership. The question remains whether the United States can revitalize its nuclear industry through innovation or if China’s methodical approach to deployment will secure its position as the world’s nuclear energy superpower for decades to come.