Global Trade Shift: China’s Export Strategy Adapts to Trump’s Tariffs

Despite American Pullback, China’s Global Exports Reach Record Heights

In a dramatic reshaping of global trade patterns, China has demonstrated remarkable resilience in the face of steep tariffs imposed by President Trump’s administration. While American importers have significantly reduced their purchases from China, the Asian manufacturing powerhouse has swiftly pivoted to alternative markets, setting the stage for another record export year despite the trade tensions with the United States.

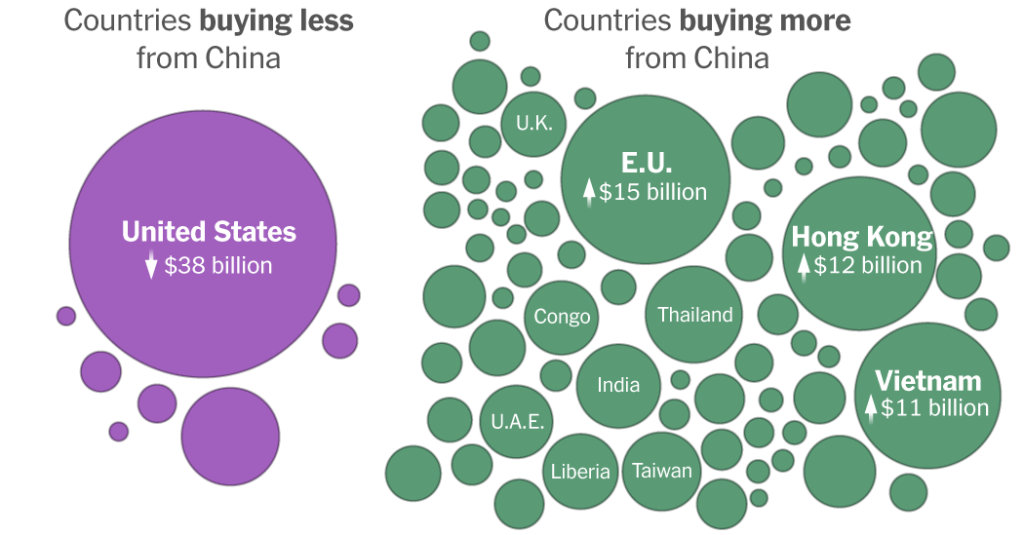

The data reveals a striking dichotomy in global commerce: as U.S. imports from China plummet across numerous sectors, nations throughout Africa, South America, Europe, and Asia are dramatically increasing their Chinese imports. This rapid market diversification highlights China’s strategic foresight and manufacturing prowess, which continues to position it as the world’s preeminent production hub despite growing geopolitical challenges.

“They should not be surprised that China is able to find markets outside of the advanced economies,” notes Mary Lovely, a senior fellow at the Peterson Institute for International Economics. This assessment underscores how China’s years-long strategy to diversify its customer base, coupled with its massive manufacturing infrastructure that enables competitive pricing, has prepared it for precisely this scenario of American market restriction.

America Pulls Back While the World Steps Forward

The transformation of U.S.-China trade relations is both broad and profound. American consumers and businesses, who for decades relied on China to outfit homes and offices, are now purchasing significantly less across virtually all product categories. Recent quarterly comparisons show steep declines in imports of plastic goods (down 16%), furniture, mattresses, and lamps. Perhaps most dramatically, Chinese exports of phones and computers to the U.S. have plummeted by 47% and 54% respectively, despite Trump exempting many consumer electronics from his most recent tariffs.

This shift reflects not just tariff impacts but also deliberate supply chain diversification by American technology giants. Companies like Apple and Hewlett-Packard have accelerated their movement away from Chinese manufacturing, with the majority of smartphones now coming to the U.S. from India and laptop computers predominantly arriving from Vietnam, according to the latest government trade data.

Meanwhile, China has executed a remarkably effective pivot to alternative markets. Developing economies in Africa have increased imports by 42%, while South American nations have boosted Chinese purchases by 13%. European and Asian markets have expanded their imports by 7% and 14% respectively, with particular emphasis on batteries and iron products. The numbers tell a compelling story of China’s adaptive trade strategy, with countries like Nigeria witnessing a transformation from importing roughly 100 Chinese electric vehicles two years ago to thousands in the current year. Similarly, Algeria’s imports of Chinese solar panels have quadrupled compared to the previous year.

Strategic Manufacturing and Global Market Expansion

Beijing’s decades of industrial policy have positioned China as the global leader in manufacturing critical technologies, including automobiles, batteries, and solar panels. This manufacturing dominance, combined with weakening domestic consumer demand, has intensified the push for Chinese companies to secure new international markets. The results are evident in China’s export data, which shows record production levels of steel and other industrial goods now being sold worldwide at extraordinarily competitive prices – sometimes cheaper than bottled water.

“The margins may not be as high,” explains Ilaria Mazzocco, deputy director at the Center for Strategic and International Studies, “but for those markets, it’s entirely transformational to have access to this technology at affordable prices.” This assessment highlights how China’s export strategy extends beyond mere revenue replacement to building long-term market influence, particularly in developing regions where access to affordable technology can catalyze economic modernization.

This approach is especially evident in Africa, where China’s growing exports coincide with Trump’s reduction of American aid to the continent. Though Chinese companies may sacrifice short-term profits by offering products at competitive prices, they gain something potentially more valuable: economic and political influence in rapidly developing regions. This strategy could reshape global economic alignments for decades to come as nations across Africa and South America develop deeper commercial ties with Chinese manufacturers and technology providers.

Challenges and Limitations to China’s Trade Adaptation

Despite China’s impressive trade pivot, certain sectors demonstrate the limits of this adaptive strategy. The toy industry provides a notable example, where China has long dominated global production and the United States has been its largest customer. Recent data shows Chinese exports of video game consoles, costumes, and board games fell by $3.5 billion compared to the previous year, primarily due to steep declines in U.S. shipments. This suggests some specialized manufacturing sectors remain particularly vulnerable to American market restrictions.

The effectiveness of Trump’s trade policies also faces challenges from potential circumvention through third countries. During his first term, Chinese exports were often rerouted through other Asian nations before reaching American consumers, limiting the impact of tariffs. Recent trade data indicates this pattern may be repeating, with Thailand’s exports to the United States rising by 33%, Taiwan’s growing by 51%, and Singapore’s increasing by 13% in September alone. How effectively Trump can pressure these countries to reject rerouted Chinese exports during trade negotiations remains uncertain.

The Evolving Trade Landscape Under Trump’s Second Term

The future of U.S.-China trade relations appears poised for continued volatility. President Trump’s recent tariff reduction, which lowered overall duties on Chinese goods from approximately 55% to 45%, may temporarily stabilize China’s exports to the United States according to Gerard DiPippo, associate director of the RAND China Research Center. However, this adjustment represents more of a tactical shift than a fundamental change in trade policy direction.

Despite agreeing to a one-year trade truce with China, Trump is already contemplating additional tariffs on industries where China maintains significant market share, including pharmaceuticals and drones. The administration has also declared intentions to reduce American dependence on Chinese sources for critical minerals. With more than three years remaining in Trump’s second term, his campaign to reshape global trade patterns and revitalize American manufacturing seems likely to continue evolving through policy adjustments and new trade measures.

This ongoing transformation of international commerce underscores the complexity of global supply chains and the adaptive capacity of manufacturing powerhouses like China. While President Trump’s policies aim to revitalize American factories and create domestic jobs – objectives contested by many economists and manufacturing experts – China’s successful pivot to alternative markets demonstrates that reshaping established global trade patterns will likely be a gradual and unpredictable process with significant implications for economies worldwide.