ByteDance’s Growing Tech Empire in America: Beyond TikTok

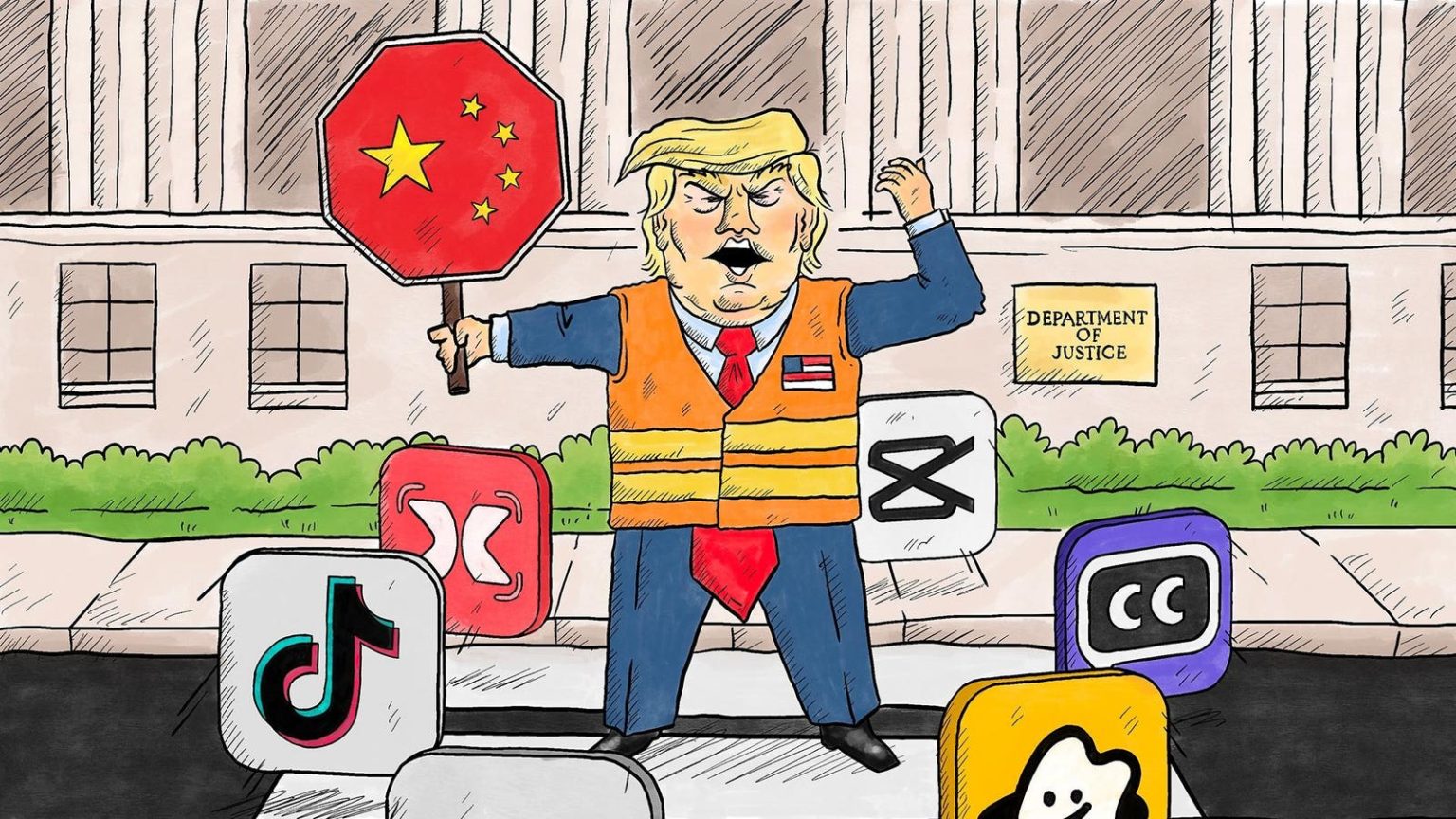

In an unexpected turn of events, Chinese tech giant ByteDance continues to expand its footprint in the American digital landscape despite legislative attempts to restrict its operations. Last year, Congress passed a law mandating that TikTok and all other ByteDance-owned applications must either be sold to American interests or face a complete ban in the United States. This legislative action formalized threats previously made by both the Trump and Biden administrations, citing national security concerns about the Chinese-owned platform’s influence and data collection practices. However, in early 2024, President Trump issued an order directing the Department of Justice not to enforce this law, effectively granting TikTok a reprieve beyond the January deadline for compliance. This non-enforcement order has done more than just preserve TikTok’s presence in America; it has enabled ByteDance to continue developing and launching new products into the U.S. market, many leveraging cutting-edge artificial intelligence technologies.

ByteDance’s recent product launches demonstrate the company’s ambitious strategy to diversify beyond social media and establish itself as a major player in the AI technology space. The company has introduced a range of English-language tools including Trae (an AI coding assistant), Dreamina (an AI image generator), PicPic (a creator of AI avatars), EasyOde (a music licensing platform), and Agent TARS (an open-source AI agent). These new applications follow earlier launches of hosting infrastructure tools like Katalyst and KubeAdmiral, as well as AI music generators Mawf and Ripple. Many of these products are released through Singapore-based subsidiaries, with some not explicitly disclosing their connection to ByteDance. While these offerings largely parallel products from American tech giants—Trae competes with Microsoft’s VS Code, Dreamina with Midjourney and Google Veo—they collectively position ByteDance as a central player in the geopolitical competition for AI dominance between the United States and China.

As ByteDance’s global presence has grown, the company has taken deliberate steps to distance itself from its Chinese origins. Despite employing hundreds of people with ties to Chinese state media, including some who have worked directly on TikTok, many ByteDance executives—including founder Zhang Yiming—have relocated to Singapore. The company consistently presents itself as “born to be global” rather than specifically Chinese. However, China remains ByteDance’s primary profit center and the main market for its AI initiatives. Last year, the company’s ChatGPT competitor, Doubao, became China’s most popular chatbot, notably complying more readily with state censorship requirements than other Chinese alternatives, according to research from Fudan University. Domain registration records reveal further ambitions in the AI space, with a Chinese ByteDance subsidiary having owned the domain chinese.ai for four years, though the site appears not yet active. This dual identity—presenting as global while maintaining strong Chinese ties—continues to complicate ByteDance’s relationship with American regulators and consumers.

Children’s educational technology represents another significant focus of ByteDance’s expansion strategy. Under Trump’s non-enforcement order, the company’s homework helper app, Gauth, has remained available in the United States, but ByteDance has also explored other products targeting younger users. For years, even as Congress deliberated potential TikTok restrictions, ByteDance operated Rex and Friends, an application designed to help children learn English. Domain registrations show additional interest in this demographic, with the company securing—though apparently not yet developing—domains like byteprek.com, kids.app, and aikids.app. Beyond educational technology, domain registrations suggest ByteDance may be considering a return to news aggregation, an area it previously explored with now-discontinued apps TopBuzz and News Republic. Recent registrations by ByteDance subsidiary Spring SG Pte. Ltd. include buzzbriefnews.com, cubenewsai.com, and linkernewai.com, indicating possible plans for AI-enhanced news applications.

The implications of ByteDance’s continued operation in America extend far beyond TikTok itself. In less than a month, Trump’s third non-enforcement order allowing ByteDance to maintain its U.S. presence will expire, creating uncertainty about the future of not just TikTok but the company’s entire application ecosystem. While public discussion has centered on TikTok, the congressional sell-or-ban law applies to all ByteDance products. Today, these applications exist on millions of American devices, providing services ranging from video editing through CapCut to AI tutoring via Gauth and developer tools through TARS. Trump has indicated his intention to broker a deal involving ByteDance selling at least a portion of TikTok’s U.S. operations to American investors, and industry insiders suggest such an arrangement would likely encompass other ByteDance applications as well.

The resolution of this regulatory challenge will have far-reaching consequences for global technology markets. While ByteDance has become virtually synonymous with TikTok in American discourse, internationally the company operates numerous successful products beyond its flagship social media platform. The congressional sell-or-ban legislation will ultimately determine not just TikTok’s fate but the future role of one of the world’s largest technology companies in the American market for years to come. This situation represents a pivotal moment in the ongoing technological competition between the United States and China, with implications for data privacy, national security, and the future development of artificial intelligence. As ByteDance continues to expand its technological capabilities and product offerings, the question of how America will balance innovation, competition, and security concerns remains unanswered.