Tesla’s Engineering Exodus Amid Strategic Pivot

In a decisive show of confidence, Tesla shareholders have overwhelmingly approved CEO Elon Musk’s unprecedented compensation package potentially worth $1 trillion over the next decade. However, this vote of financial faith comes at a curious time, as key engineering talent continues to depart the electric vehicle pioneer. Most recently, Emmanuel Lamacchia and Siddhant Awasthi, both eight-year veterans who managed Tesla’s core vehicle programs—Model Y, Model 3, and the controversial Cybertruck—announced their departures within hours of each other. While neither explicitly stated their reasons for leaving, their exits continue a troubling pattern of high-profile engineering talent abandoning ship as Musk steers the company in a new direction. Earlier departures included the company’s head of manufacturing and sales for North America and Europe, the director of Tesla’s battery team, the head of the former “Dojo” supercomputer team, and even the leader of the much-hyped “Optimus” robot project that Musk recently declared would likely become Tesla’s biggest new business venture.

The engineering exodus reflects a fundamental tension within Tesla’s evolving identity. Musk has made it clear he’s prioritizing speculative AI-powered ventures—particularly robotaxis and humanoid robots—that currently generate no revenue, over the company’s proven businesses of selling electric vehicles, batteries, and charging services. This pivot may be exciting for futurists and some investors, but it appears to be alienating automotive engineering talent. As one former Tesla executive noted: “Imagine you’re someone who’s been working in the automotive industry or studying engineering at university and you go to Tesla and there are no new models on the horizon. There’s just a focus on cost reduction. This isn’t exciting at all. They cannot be attracting the best people in the automotive industry.” Despite these concerns, Tesla’s stock rose 3.7% following the most recent departures, suggesting shareholders remain unconcerned about the loss of key engineering leadership.

Tesla’s current business challenges highlight the risks of Musk’s strategic gamble. Despite a temporary spike in third-quarter deliveries (driven by customers rushing to purchase before federal tax credits expired), Tesla’s EV sales have declined approximately 6% year-to-date. The company has introduced cheaper versions of its bestselling Model Y and 3 vehicles, but the absence of genuinely new products and slowing EV adoption in the U.S. and Europe suggest further sales declines in coming quarters. The Cybertruck, once touted to sell hundreds of thousands of units annually, has become one of the automotive industry’s most notable flops, with sales plummeting 38% through the third quarter to just 16,097 units. Beyond its polarizing design, the truck has faced multiple recalls, further damaging its market prospects. Even Musk’s announcement that Tesla will finally begin selling its electric semi truck in 2026 is unlikely to significantly impact the bottom line, given the relatively small size of the Class-8 semi market compared to passenger vehicles.

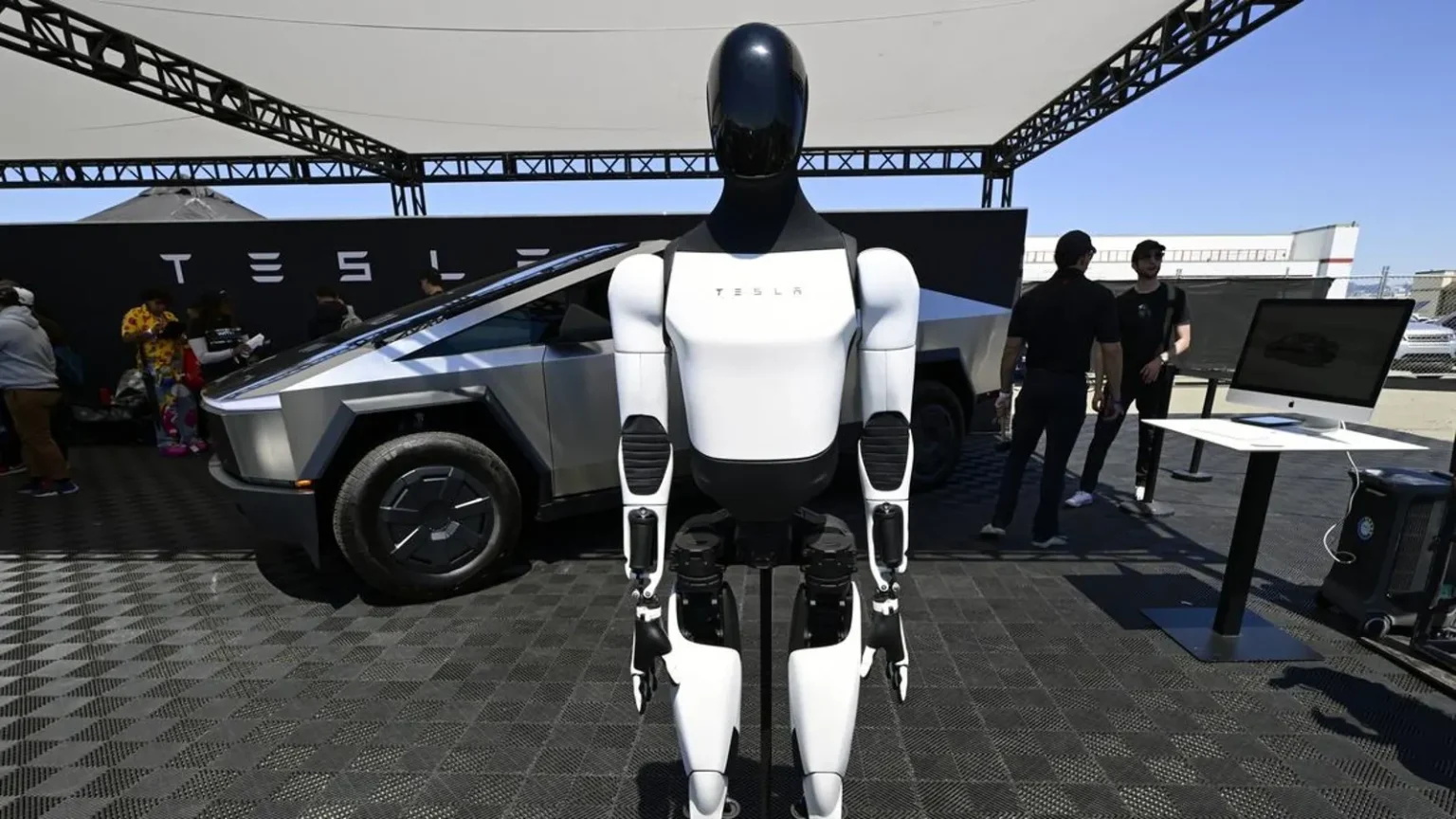

The disconnect between Tesla’s production capacity and its actual sales further illustrates the company’s precarious position. With facilities in California, Texas, China, and Germany capable of producing at least 2 million vehicles annually, Tesla is operating well below capacity with projected annual sales between 1.5 million and 1.6 million vehicles this year. Musk’s solution appears to be repurposing some of this excess manufacturing capability toward robot production, announcing plans for a “million-unit production line” for Optimus robots in Fremont and eventually a “10 million unit per year line” at the Austin plant. However, these ambitious production targets depend entirely on Tesla’s ability to develop workable, affordable robotic technology—something it has not yet demonstrated. Meanwhile, Musk’s announcement of the steering wheel-free Cybercab, targeted for release by the second quarter of 2026, represents another high-risk gamble that assumes Tesla can overcome its ongoing challenges in autonomous driving technology to match industry leaders like Waymo.

Tesla investor and Musk critic Ross Gerber highlights a fundamental misalignment between Tesla’s strategy and automotive industry fundamentals. “The thing about how car companies work is people want new models, new features and they want new designs for their car that’s not too different than the original, but is different,” explains Gerber, whose firm manages approximately $80 million in Tesla shares. “Tesla has acted unlike any car company. They just refreshed the Model Y and said, ‘Okay, we refreshed the car. We made it better and made the Model 3 better.’ But it’s not a new model, and that’s the problem.” Gerber suggests Tesla would be better served by releasing the proposed Cybercab as a conventional, affordable EV—the long-rumored “Model 2” that could sell for around $30,000—rather than betting everything on unproven autonomous technology. This perspective highlights the tension between Musk’s futuristic vision and the practical realities of the automotive market.

Perhaps most concerning for Tesla’s long-term prospects is the ongoing lack of a clear succession plan and robust executive leadership structure. The departures of Lamacchia and Awasthi underscore a persistent organizational vulnerability that Tesla’s board appears unwilling to address. Beyond its CFO, Tesla’s executive team lacks a president, COO, or executive vice presidents—roles that would typically provide leadership depth and stability. Yale School of Management professor Gautam Mukunda captures the extraordinary nature of this situation: “I cannot imagine a scenario where the valuation of Tesla does not collapse following Elon Musk’s departure. We have to invent whole new terms for the key man risk involved here. Normal key man risk doesn’t even apply—and in particular doesn’t apply when you’re talking to someone who has, by his own admission, behaviors that are remarkably risky.” By approving Musk’s trillion-dollar compensation package while core engineering talent continues to depart, Tesla’s board has doubled down on a strategy that ties the company’s entire future to one visionary but increasingly distracted leader, betting everything on speculative technologies while its established business shows signs of serious strain.