No, Crypto ETFs Are Not Getting “Auto-Approved” During the Government Shutdown – Here’s Why

Social Media Misinformation Creates False Hope in Crypto Markets Amid Regulatory Limbo

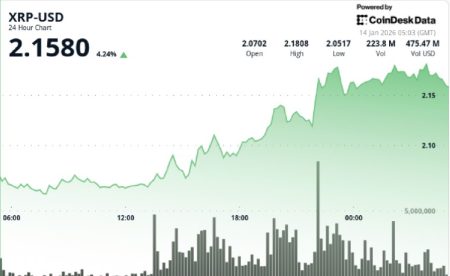

In the wake of the recent U.S. government shutdown, a wave of misinformation has swept through cryptocurrency communities, generating unfounded optimism about regulatory approvals. Claims that certain cryptocurrency Exchange-Traded Funds (ETFs), particularly an XRP ETF filed by Teucrium, were being “automatically approved” due to the Securities and Exchange Commission’s (SEC) operational limitations have gained significant traction on social media platforms. These assertions, however, reflect a fundamental misunderstanding of the regulatory framework governing different types of financial products in the United States.

The Rumor Mill: How Shutdown Speculation Fueled Crypto Market Confusion

The narrative gaining momentum across Twitter, Reddit, and other platforms suggested that Teucrium’s XRP ETF application had effectively bypassed the standard SEC approval process, becoming “automatically activated” as the decision period expired during the partial government shutdown. This misinterpretation quickly circulated among cryptocurrency enthusiasts and investors eager for positive regulatory developments in a market that has long sought mainstream legitimacy through ETF approvals. The claim appeared plausible to many because of the real constraints the government shutdown places on certain federal operations, including aspects of the SEC’s regulatory functions. However, this simplistic interpretation fails to account for the nuanced regulatory distinctions between different types of financial products.

Regulatory Reality: Breaking Down the Different ETF Classification Systems

Veteran cryptocurrency journalist Eleanor Terrett has stepped forward to dispel these rumors, explaining the crucial distinction in how various investment products are classified and regulated. According to Terrett, Teucrium’s XRP ETF application falls under the Investment Company Act of 1940 (Section 40), primarily because of its specific structure built around Treasury bonds, cash, and derivative receivables. This classification is fundamentally different from what most people envision when discussing a “pure” cryptocurrency ETF. Products falling under this classification don’t necessarily require active SEC intervention to proceed after their application period concludes – they can indeed become active automatically once specific filing requirements are met and the statutory waiting period has elapsed.

The Critical Distinction: Why Spot Crypto ETFs Require Explicit SEC Approval

The misunderstanding stems from conflating different regulatory frameworks that govern various financial products. Futures-based ETFs – which don’t directly hold cryptocurrencies but instead trade in futures contracts tied to crypto assets – typically follow a similar process to what was described for Teucrium’s product. However, spot cryptocurrency ETFs represent an entirely different regulatory challenge. These products, which directly hold the underlying cryptocurrency assets, are registered as “commodity trusts” under Section 33 of the Securities Act of 1933. This classification necessitates an explicit, affirmative approval from the SEC before they can begin trading on public exchanges. Without this specific regulatory green light, these products cannot legally launch, regardless of any government shutdown circumstances or application timeframes.

Implications for the Broader Crypto ETF Landscape During the Shutdown

The clarification provided by industry experts has significant implications for the broader cryptocurrency ETF landscape during this period of limited government operations. Spot cryptocurrency ETFs for assets like Litecoin (LTC), Solana (SOL), or XRP cannot receive the regulatory approvals necessary to begin trading while the government shutdown persists. These products require the SEC to be operating at full capacity to review their S-1 registration filings – the comprehensive disclosure documents that outline the specifics of the investment offering. The current limitations on SEC operations effectively place these applications in regulatory limbo until normal government functions resume. This reality check is particularly important for investors who might otherwise make financial decisions based on misinterpreted information circulating on social media.

Market Education: Understanding Regulatory Processes Essential for Crypto Investors

This episode highlights the critical importance of regulatory literacy within cryptocurrency investment communities. The complex intersection of traditional financial regulations and emerging digital asset classes creates an environment where misunderstandings can rapidly propagate, potentially leading to misinformed investment decisions. As cryptocurrency continues its journey toward mainstream financial integration, the ability to distinguish between different regulatory frameworks and understand their practical implications becomes increasingly valuable for investors. While the cryptocurrency market eagerly awaits clearer regulatory guidance and potentially more ETF approvals, it’s essential that market participants base their expectations on accurate regulatory information rather than wishful interpretations that gain traction on social media. When government operations fully resume, the formal processes for reviewing and potentially approving various cryptocurrency investment products will continue according to established regulatory procedures – no shortcuts or automatic approvals for spot crypto ETFs will materialize simply because of administrative limitations during a shutdown period.

The continued interest in cryptocurrency ETFs reflects the sector’s growing maturity and the demand for regulated investment vehicles that provide exposure to digital assets. However, as this situation demonstrates, the path to regulatory approval remains governed by specific legal frameworks that operate according to their own distinct rules and timelines – regardless of temporary government operational constraints.