XRP Faces Technical Setback as Cryptocurrency Retreats from Key Resistance Levels

Market Momentum Stalls as XRP Struggles to Maintain Recent Gains

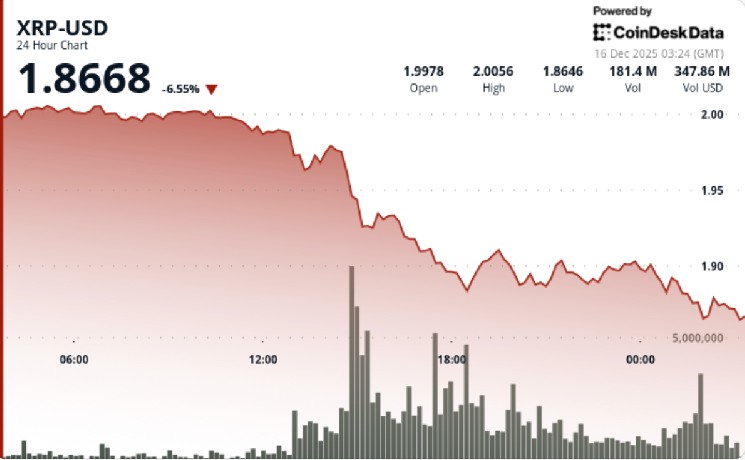

In a notable shift that has captured the attention of cryptocurrency traders worldwide, XRP experienced a significant technical rejection yesterday, falling 2.6% over a 24-hour period from $1.95 to $1.90. This movement occurred against the backdrop of broader fatigue across cryptocurrency markets, signaling what analysts describe as a potential transition from bullish to bearish control in the short term. The digital asset, which has enjoyed periods of substantial growth in recent months, now faces renewed scrutiny as investors reassess its immediate trajectory amid increasing selling pressure.

The downward movement didn’t emerge from any specific fundamental announcements or regulatory developments that typically influence cryptocurrency valuations. Instead, market observers point to a purely technical rejection following multiple unsuccessful attempts to sustain momentum above established resistance barriers. “What we’re witnessing appears to be a classic case of exhaustion at technical resistance,” explains Marcus Reynolds, cryptocurrency market analyst at Digital Asset Insights. “XRP had made several attempts to break through the $1.95 ceiling, but each push was met with increasingly organized selling pressure, particularly during European trading hours when liquidity tends to be robust.”

Technical Structure Shifts as Critical Support Level Falls

The breakdown below the critical $1.93 Fibonacci level represents a significant technical failure that has altered the short-term market structure in favor of sellers. This price point had previously functioned as a pivotal level during recent consolidation phases, providing both support during declines and resistance during recovery attempts. Its decisive breach suggests a fundamental shift in market sentiment that could have implications for XRP’s price action in the coming sessions.

What makes this technical breakdown particularly noteworthy was the accompanying volume profile, which expanded dramatically during the rejection phase. Trading volume surged 107% above daily averages, confirming that the downward movement represented deliberate and coordinated distribution rather than a low-volume drift that might be more easily reversed. This volume signature is often considered a validation of technical movements, lending credibility to the bearish interpretation of recent price action. The initial rally toward $1.95 had shown promising momentum with formation of higher highs on shorter timeframes, but the market’s inability to sustain positions above $1.92 ultimately triggered systematic selling into what had appeared to be strength – a pattern that experienced traders recognize as a warning sign.

Session Volatility Highlights Shifting Market Dynamics

Throughout the trading session, XRP navigated through a relatively wide $0.09 range, initially demonstrating upward momentum toward the $1.95 mark before encountering the decisive reversal that defined the day’s activity. The selling intensified notably once price action retreated into the $1.92-$1.94 band, with bid support becoming increasingly scarce near the lower boundary of this range – another indication that buyer conviction has waned in the immediate term.

Following the breakdown, XRP found temporary equilibrium near the $1.90 level, where selling pressure moderated and volume patterns began normalizing toward more typical levels. Analysis of hourly price action reveals an emerging consolidation pattern forming just above the $1.88-$1.90 support zone, though technical analysts emphasize that no compelling reversal signals have materialized at this juncture. “The market is currently in price discovery mode following the breakdown,” notes Sarah Chen, technical strategist at Blockchain Capital Research. “Until we see clear evidence of accumulation through volume patterns and price action, traders should approach any rebounds with caution, as they may represent short-covering rather than genuine strength.”

Key Levels and Strategic Considerations for Traders

The recently lost $1.93 level has now transformed into the first significant resistance barrier that XRP must overcome to neutralize the current bearish bias. Market technicians emphasize that any credible recovery attempt must reclaim this threshold with convincing volume to shift momentum back toward a neutral stance. Failure to recapture this level keeps downside risk as the dominant scenario for short-term traders and could invite further selling pressure should support levels be tested again.

On the support side of the equation, the immediate zone of interest spans from $1.88 to $1.90, representing the first substantial defense against further declines. A decisive break below this foundation would potentially expose deeper support levels and confirm the transition to a more pronounced corrective phase. Conversely, successful defense of this range could allow XRP to establish a stabilization pattern before its next directional move. Volume behavior remains the critical metric for traders to monitor in the coming sessions. Persistent selling pressure emerging on rally attempts would validate the distribution thesis, while diminishing volume near support levels could indicate the market is transitioning from the breakdown phase toward stabilization – a potentially constructive development for those anticipating eventual recovery.

Market Implications and Outlook Moving Forward

The current technical realignment comes at a crucial juncture for XRP and potentially carries broader implications for sentiment across the cryptocurrency sector. While isolated technical failures don’t necessarily invalidate longer-term uptrends, they do highlight the inherent volatility and risk associated with digital asset markets. Institutional traders in particular will be monitoring whether this rejection represents a temporary setback within a larger constructive pattern or signals a more substantial shift in market structure.

“Context matters tremendously in cryptocurrency markets,” explains Dr. Alexandra Patel, cryptocurrency economist at Digital Frontiers Institute. “XRP’s recent technical rejection must be viewed against both its prior performance and broader market conditions. While the immediate picture has turned bearish from a technical perspective, investors should remember that these markets remain highly dynamic, with sentiment capable of shifting rapidly based on both technical developments and external factors including regulatory news, institutional participation, and overall risk appetite.” As traders digest the implications of this technical development, many will be closely monitoring key support and resistance levels while maintaining heightened awareness of volume patterns that might signal the next significant directional move for this widely-traded digital asset.

![Standard Chartered Cuts Bitcoin and Ethereum Forecasts, Predicts Bottom by [Date] at $[Price]](https://commstrader.com/wp-content/uploads/2026/02/3f2a2e40b5435ea86ade84c25b7ee76c02e7fe3c-450x300.jpg)