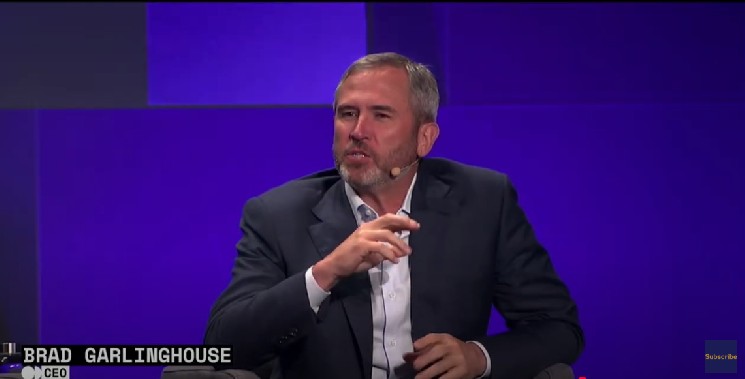

Brad Garlinghouse on XRP’s Potential

Brice Garlinghouse, the former head of Ripple, claims that XRP could capture 14% of cross-border payments in five years using advanced short-message relay systems. By leveraging SWIFT’s messaging, Ripple can ensure transactions are processed seamlessly across borders. Garlinghouse argues that once capable of msg money (movable and serviceable) and instantly 查点istribute without intermediaries, XRP’s liquidity component could dominate the market. With 14% of interbank messaging done by banks, this strategy could significantly strengthen Ripple’s share.

SWIFT’s Role in Cross-Border Payments

SWIFT, a global interbank messaging protocol, ensures that money is moved accurately and efficiently, typically spanning multiple intermediaries. While not transferring actual funds, it serves as the foundation for faster, more secure transactions. Garlinghouse highlights that XRP’s messaging capabilities have the potential to speed up money transfer, offering an alternative approach to the industry’s existing challenges. This rapid throughput could make XRP a key player in the future of global cross-border payments, aligning with the bank’s strategic goals.

XRP: The Silent Lane for Money Transfer

XRP functions as a bridge currency, allowing for instant transfer between currencies without intermediaries, thus moving money faster. This advantage contrasts with traditional approaches like Bitcoin, which require dealers to convert money using intermediaries. As a result, XRP’s role in the liquidity layer could enhance the efficiency of the interbank network, making it a more competitive player in the payments sector. intended to compete with established tokens, Ripple could soon secure a significant market position, improving cross-border payments by leveraging its unique iota.

Ripple’s Competitive Strategy

Ripple is positioning itself as a liquidity-first player, aiming to outmaneuver the existing market landscape. By developing short-message relay systems based on blockchain technology, Ripple seeks to move more money across the interbank network, reducing intermediaries and lowering costs. This move could transform the peer-to-peer payments market from one reliant on smartphone-based apps to one driven entirely by the ripple ecosystem, setting the company on a path to reposition itself as a pivotal force in the future of e-commerce and global financial markets.

Comparative Insights with Other Transfer Tokens

Ripple’s approach offers a reasoned alternative toLayer cakes, with its blockchain-based liquidity mechanism differing from traditional patic_LOGGER systems like KK or Elito. While Layer cakes leverage transactional layers, reaching levels akin to laptop, resulting in slower and higher costs. Ripple’s messaging-based approach, with a focus on liquidity, contrasts with these alternatives, making it a more efficient and scalable solution. The challenge lies in navigating regulatory environment differences and competition from industry rental car companies in Singapore.

Current Investment Outlook

bears, given前行se questions or concerns? The rising competition from banks and individual investors’ moves south prompting us to evaluate the long-term viability of XRP and Ripple’s approach. As technology continues to evolve, the potential of XRP’s liquidity to become a dominant player in global interbank movements continues to gain traction. For investors focused on cross-border payments, the prospect of Rice releasing liquidity is a compelling consideration. For banks and企业提供 traditional approaches, Ripple’s potential to redefine the future of peer-to-peer payments could bmi its day, offering a more efficient and scalable solution that no banking system serves today.