HBAR Experiences Late-Session Selloff Amid Market Volatility

Institutional Selling Pressure Erases Earlier Gains in Final Trading Hour

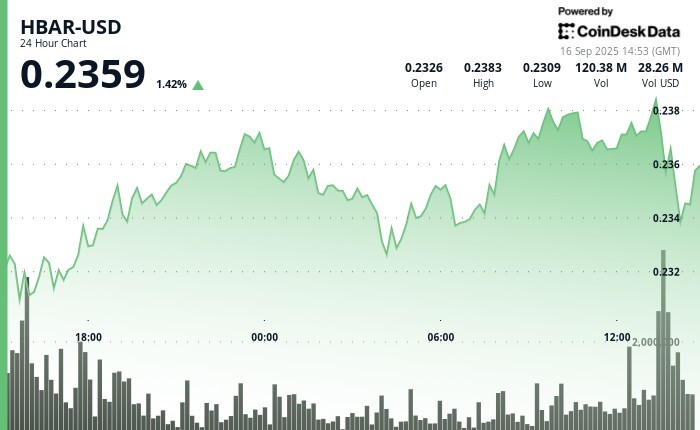

In a dramatic shift that caught many traders off guard, HBAR experienced significant selling pressure in the final hour of trading on September 16, effectively wiping out gains accumulated throughout the day. The digital asset, which had been showing promising upward momentum, suddenly reversed course between 13:15 and 14:14 UTC, dropping from $0.237 to $0.235—representing a 1.05% decline after reaching an intraday high of $0.2385 earlier in the session.

This abrupt reversal stands in stark contrast to HBAR’s performance during the preceding 23-hour period, when the token had steadily climbed from $0.23 to $0.24, reflecting what appeared to be solid bullish sentiment among investors. The late-session downturn came without warning, leaving many market participants scrambling to reassess their positions as support levels quickly gave way under mounting sell orders.

“What we witnessed today exemplifies the volatility inherent in cryptocurrency markets,” explains Dr. Miranda Chen, Chief Market Analyst at Digital Asset Research. “HBAR demonstrated classic signs of institutional distribution—large volumes of tokens being sold in a compressed timeframe, suggesting that major holders may be taking profits or repositioning their portfolios ahead of anticipated market developments.”

Volume Surge Signals Institutional Activity as Support Levels Falter

The most compelling evidence of institutional involvement came between 13:45 and 13:51 UTC, when trading volumes surged dramatically to exceed 5.6 million—nearly double the baseline activity observed throughout the rest of the trading session. This concentrated burst of activity coincided precisely with HBAR breaking through successive technical support levels at $0.237, $0.236, and ultimately $0.235.

What makes this pattern particularly noteworthy is the methodical nature of the decline. Rather than a single catastrophic drop, the price deteriorated in distinct steps, suggesting calculated selling rather than panic. The cryptocurrency’s failure to recover above these key technical levels left momentum deteriorating into the close, setting a potentially concerning tone for subsequent trading sessions.

Market technicians point to this pattern as characteristic of sophisticated institutional trading strategies. “When we see volume spikes coinciding with systematic breakdown through multiple support levels, it typically indicates programmatic selling by larger market participants,” notes James Woodson, Technical Analysis Director at CryptoMetrics Institute. “Retail investors simply don’t coordinate their actions with that level of precision.”

Underlying Resilience Despite Short-Term Reversal

Despite the concerning final hour, a broader view of HBAR’s performance reveals a more nuanced picture. Looking at the complete 23-hour window, the token actually advanced approximately 1% overall, demonstrating significant resilience in the face of the late selling pressure. The cryptocurrency navigated within a relatively wide range of $0.231 to $0.239, with strong buying activity evident during the earlier hours of September 16.

This broader context suggests that while short-term sentiment may have shifted temporarily bearish, longer-term investor confidence remains relatively intact. The day’s trading pattern effectively created a microcosm of market dynamics—periods of accumulation followed by distribution, with institutional players potentially capitalizing on retail enthusiasm.

“What’s particularly interesting about today’s HBAR action is the juxtaposition between the day’s overall gain and the final hour’s reversal,” says Eliza Rodriguez, Cryptocurrency Strategist at BlockchainEdge Advisory. “This isn’t necessarily indicative of a fundamental shift in HBAR’s prospects, but rather demonstrates how intraday volatility can mask underlying trends.”

Technical Analysis Reveals Complex Market Structure

A deeper examination of HBAR’s technical indicators presents a mixed picture that helps explain the day’s contradictory movements. Throughout the session, the token operated within a clearly defined $0.01 range, with a floor at $0.23 and ceiling at $0.24—representing approximately 3% total fluctuation, which is relatively moderate by cryptocurrency standards.

Significant resistance materialized precisely at the psychological $0.24 threshold, where price reversed on elevated volume of 72.03 million during the 13:00 hour. This rejection at a round-number price point aligns with typical market behavior, as such levels often serve as natural targets for limit orders. Conversely, the $0.23-$0.235 zone demonstrated its importance as a support area, with multiple successful defense attempts throughout the trading session before the late breakdown.

The volume profile throughout the session provides perhaps the most illuminating technical insight. Trading activity intensified substantially during the decline, particularly during the critical 13:45-13:51 window when selling momentum accelerated dramatically. This volume signature—relatively moderate activity during price advances followed by intensified activity during declines—often signals a market in transition, with smart money potentially beginning to position for a shift in trend.

Implications for HBAR Investors and the Broader Crypto Market

Today’s HBAR trading activity holds significant implications not only for holders of the token but potentially for the broader cryptocurrency ecosystem. As a prominent layer-1 blockchain project, Hedera’s HBAR token often serves as a bellwether for sentiment toward enterprise-focused blockchain solutions. The inability to sustain prices above $0.235 in the face of concentrated selling pressure underscores the fragility of recent bullish sentiment across similar projects.

“What happened with HBAR today could be the canary in the coal mine for mid-cap layer-1 tokens,” warns Victor Hernandez, Portfolio Manager at Digital Asset Capital. “When we see institutional distribution patterns like this, it often precedes broader repositioning across comparable assets.”

Investors should closely monitor whether this late-session pattern repeats in coming days, as continued distribution would suggest diminishing institutional confidence. Equally important will be whether HBAR can reclaim and hold above the $0.237 level that previously served as support before turning to resistance during the late decline.

For the broader cryptocurrency market, HBAR’s price action serves as a reminder of the importance of volume analysis alongside price movements. While headlines often focus exclusively on percentage gains or losses, the underlying trading activity often tells a more nuanced story about market participant behavior and potential future direction.

As the cryptocurrency market continues to mature, these microstructure analyses become increasingly relevant for understanding probable price trajectories. Today’s HBAR activity demonstrates that even in a market often characterized by retail speculation, institutional footprints remain clearly visible to those who know where to look.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards.