Institutional Investors Embrace Dogecoin Amid Price Dip and ETF Anticipation

Corporate Giants Accumulate Millions of DOGE Tokens as Regulatory Landscape Evolves

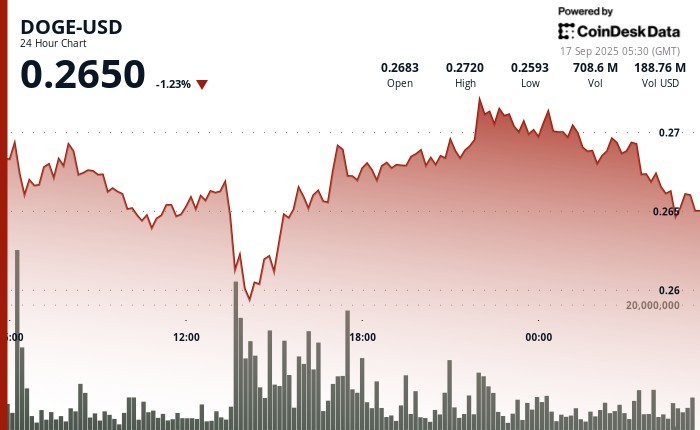

In a striking display of market contrarianism, institutional investors are aggressively accumulating Dogecoin (DOGE) despite the cryptocurrency’s recent price decline. The popular meme token has experienced a nearly 5% drop this week, settling at approximately 26 cents according to CoinDesk data. However, rather than triggering a sell-off, this dip has catalyzed substantial institutional buying activity, with corporate players acquiring an estimated 680 million DOGE tokens during the downturn.

The timing of this institutional interest is particularly noteworthy as it coincides with improving regulatory clarity in the cryptocurrency space. Market analysts at CD Analytics suggest this accumulation wave is directly connected to the anticipated approval of the first U.S.-listed spot Dogecoin ETF, which could significantly expand the token’s accessibility to mainstream investors. CleanCore Solutions exemplifies this institutional enthusiasm, having announced on Tuesday the purchase of an additional 100 million DOGE tokens, bringing its treasury holdings to an impressive 600 million DOGE. This strategic accumulation by established corporate entities signals growing confidence in Dogecoin’s long-term prospects despite short-term price volatility.

“What we’re witnessing is a fundamental shift in how institutional investors perceive Dogecoin,” explains market analyst Sarah Whitman. “Once dismissed as merely a joke cryptocurrency, DOGE has evolved into a serious investment vehicle for corporate treasuries looking to diversify their digital asset exposure. The imminent launch of the Rex Shares-Osprey Dogecoin ETF (DOJE) this week represents a watershed moment, allowing traditional investors to gain cryptocurrency exposure without the technical complexities of direct ownership.”

Technical Analysis Reveals Strong Institutional Support at Key Price Levels

The institutional activity surrounding Dogecoin extends beyond simple accumulation patterns, with sophisticated trading desks carefully monitoring DOGE’s tight $0.01 trading range. This narrow band represents approximately 5% volatility between established resistance at $0.27 and support at $0.26, creating a defined framework for strategic buying and selling. According to market data, institutional selling targeting the $0.26 support level occurred on exceptional volume of 945.89 million DOGE, effectively establishing robust corporate support parameters. This was subsequently balanced by evening institutional buying that created resistance around $0.27 on a volume of 629.60 million DOGE, indicating deliberate corporate accumulation strategies.

The volume-based support confirmation at the critical $0.26 level following immediate institutional recovery has validated the corporate adoption thesis that many analysts have proposed. Perhaps most telling is the resilience of this support zone during periods of intense 60-minute selling pressure, demonstrating institutional commitment to current price levels. Technical analysts have also identified a breakout from a multi-month consolidation pattern that has attracted significant corporate treasury attention, with many establishing a $0.50 price objective for DOGE in the medium term.

“The technical structure we’re seeing in Dogecoin trading patterns reveals sophisticated institutional positioning,” notes crypto market technician Marcus Johnson. “The volume profile at key support levels suggests corporate buyers have established price floors they’re willing to defend. This isn’t speculative retail trading—it’s calculated institutional accumulation with specific price targets and risk parameters. The breakout from the consolidation pattern that began forming in July potentially signals the next major move upward.”

DOGE/BTC Ratio Signals Potential Outperformance as Fed Decision Looms

While absolute price movements in Dogecoin have captured headlines, sophisticated investors are increasingly focusing on the Binance-listed dogecoin-bitcoin ratio (DOGE/BTC) as a key indicator of relative strength. This ratio could experience sharp gains following the Federal Reserve’s anticipated rate cut on Wednesday, particularly if the central bank lays groundwork for aggressive monetary easing in the coming months. Technical analysis reveals that the DOGE-BTC ratio has carved out a bullish inverse head-and-shoulders pattern—a formation that typically precedes significant upward price movement.

This technical setup effectively creates the stage for an outsized DOGE rally relative to Bitcoin, potentially allowing the meme token to outperform the market leader during the next crypto market cycle. The Federal Reserve is widely expected to cut interest rates by 25 basis points to 4% on Wednesday, a move that has a 99% probability according to market pricing mechanisms. With this rate cut essentially priced into current market valuations, investor focus has shifted to the Federal Reserve’s forward guidance regarding future monetary policy decisions.

Dogecoin bulls are particularly hopeful that the Fed will downplay inflation concerns during its policy announcement, potentially signaling faster and more aggressive rate reductions in the months ahead. Such a dovish stance would likely benefit risk assets broadly, with historically high-beta assets like Dogecoin potentially experiencing amplified upside movements. “The DOGE/BTC ratio serves as a barometer for risk appetite within the crypto ecosystem,” explains monetary policy analyst Jennifer Torres. “A breakout in this ratio following dovish Fed signals would indicate capital flowing toward higher-risk, higher-reward assets like Dogecoin.”

ETF Approval Expected to Revolutionize Dogecoin Accessibility

The anticipated approval and launch of the Rex Shares-Osprey Dogecoin ETF (DOJE) represents a potential paradigm shift in how mainstream investors can access cryptocurrency exposure. Traditional investment vehicles like exchange-traded funds eliminate many barriers to entry that have historically limited institutional participation in the digital asset space. By providing regulated, familiar investment structures, ETFs allow portfolio managers to gain cryptocurrency exposure without concerns about custody solutions, private key management, or direct interaction with cryptocurrency exchanges.

Industry experts predict the DOJE ETF launch could trigger substantial new capital inflows into the Dogecoin ecosystem as financial advisors, retirement accounts, and institutional portfolios gain a compliant mechanism for DOGE exposure. The development parallels the transformative impact that Bitcoin ETF approvals had on BTC price and institutional adoption earlier this year. “ETF vehicles fundamentally change the accessibility equation for assets like Dogecoin,” notes financial products specialist Michael Rothman. “They transform what was once considered a speculative digital token into a mainstream financial instrument that can be purchased through conventional brokerage accounts with familiar tax treatment and reporting structures.”

The timing of this ETF development coincides with broader institutional cryptocurrency adoption trends, as major financial institutions increasingly incorporate digital assets into their strategic planning. The DOJE ETF is expected to begin trading this week, potentially catalyzing new interest in Dogecoin from investor demographics that previously remained on the sidelines of cryptocurrency markets.

Looking Ahead: Convergence of Technical, Institutional, and Regulatory Catalysts

The current Dogecoin market dynamics represent a rare convergence of favorable technical, institutional, and regulatory catalysts that could significantly impact the token’s trajectory. The combination of a technical breakout pattern, substantial institutional accumulation, an imminent ETF launch, and potentially dovish Federal Reserve policy creates a multifaceted bullish case that extends beyond typical cryptocurrency market speculation.

Market observers note that this convergence of positive factors does not guarantee price appreciation, as cryptocurrency markets remain inherently volatile and subject to rapid sentiment shifts. However, the fundamental backdrop has rarely been more supportive for Dogecoin since its inception. The transformation from internet meme to institutional portfolio component represents a remarkable evolution in how this particular digital asset is perceived by sophisticated market participants.

As the cryptocurrency ecosystem continues maturing, the line between alternative assets and traditional financial instruments increasingly blurs. Dogecoin’s journey from internet joke to institutional treasury holding exemplifies this transformation. With regulatory clarity improving and accessible investment vehicles emerging, the coming months could prove pivotal for Dogecoin’s position within the broader digital asset landscape. Whether the token can fulfill the ambitious price targets set by technical analysts remains uncertain, but what’s clear is that Dogecoin has transcended its origins to become a serious consideration for institutional capital allocation strategies in today’s evolving financial ecosystem.