Bitcoin Approaches All-Time High Amid Market Rally, Reinforcing Its Safe Haven Status

Bitcoin Makes Strong Push Toward Record Levels as Bull Market Gains Momentum

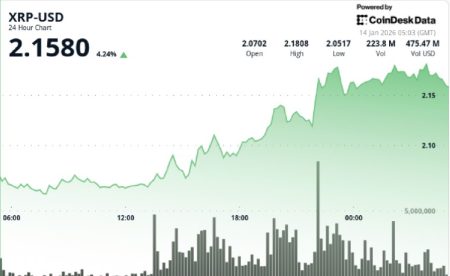

In a remarkable display of market strength, Bitcoin has surged to within striking distance of its all-time high, demonstrating resilience in what analysts describe as an increasingly robust bull market. The leading cryptocurrency climbed from $120,000 to reach an intraday peak of $123,855, narrowly missing its record high of $124,128 established in mid-August. As traditional financial markets face uncertainty, Bitcoin’s performance has reignited discussions about its evolving role as a potential safe haven asset during periods of institutional instability.

According to the latest data from CoinGecko, Bitcoin is currently trading at approximately $122,604 after retreating slightly from its recent peak. Despite this minor pullback, the digital asset has posted impressive gains, rising 1.3% over the past 24 hours and accumulating more than 11% growth on a weekly basis. This sustained upward trajectory has captured the attention of both retail and institutional investors, many of whom are closely monitoring Bitcoin’s price action for signals of a potential breakthrough beyond previous resistance levels.

Market Experts Point to Profit-Taking and Institutional Uncertainty as Key Factors

The cryptocurrency’s approach toward record territory represents its closest encounter with all-time highs since mid-August, when Bitcoin briefly touched $124,128 before experiencing a correction. BitBull Capital CEO Joe DiPasquale offered valuable insight into the current market dynamics, noting that “Bitcoin briefly tested record highs but retreated due to profit-taking.” Despite this temporary consolidation, DiPasquale maintained an optimistic outlook, stating that “The overall outlook remains positive; Bitcoin demand is expected to increase as the prolonged government shutdown drives investors into alternative assets.” This assessment suggests that broader macroeconomic factors, particularly those related to governmental stability and function, are increasingly influencing cryptocurrency markets.

The ongoing government shutdown in the United States has created a climate of uncertainty that appears to be driving some investors toward alternative assets like Bitcoin. As traditional financial systems face challenges related to governmental deadlocks, the decentralized nature of cryptocurrency becomes increasingly attractive to those seeking independence from centralized financial structures. This trend indicates a potential shift in market psychology, where Bitcoin is viewed not merely as a speculative asset but as a legitimate alternative during periods of institutional uncertainty.

Bitcoin’s Safe Haven Narrative Strengthens Amid Eroding Trust in Traditional Institutions

Strah Savinja, Head of Data and Analytics at FRNT Financial, provided compelling commentary on Bitcoin’s evolving market position, arguing that “BTC’s appeal is not only more visible, but also more deeply ingrained.” This observation points to a fundamental shift in how investors perceive the cryptocurrency, suggesting that Bitcoin has transcended its initial reputation as merely a speculative investment. Savinja further emphasized that this transformation is “increasingly evident at a time when trust in traditional institutions is eroding,” highlighting the cryptocurrency’s potential role as a hedge against institutional instability.

This strengthening safe haven narrative represents a significant maturation in Bitcoin’s market positioning. While gold has traditionally served as the primary safe haven asset during periods of economic uncertainty, Bitcoin’s digital nature and fixed supply schedule offer unique properties that appeal to modern investors. The cryptocurrency’s performance during recent market turbulence suggests that an increasing number of market participants view Bitcoin as a legitimate store of value—a dramatic evolution from its early days when it was primarily associated with speculative trading and extreme volatility.

Market Dynamics Reflect Broader Shifts in Investment Strategies and Asset Allocation

The current market environment reflects a complex interplay of factors influencing investor behavior. Beyond the immediate price action, Bitcoin’s approach toward record territory represents a broader shift in how digital assets are integrated into diverse investment strategies. Institutional adoption continues to expand, with major financial entities developing cryptocurrency offerings and infrastructure. This institutional involvement has contributed to Bitcoin’s increased market stability and enhanced its credibility among traditional investors who previously viewed digital assets with skepticism.

Trading volumes across major exchanges have shown significant increases during this recent price surge, indicating robust market participation across different investor categories. The options market has similarly reflected growing optimism, with call options (bets on price increases) outpacing puts (bets on price decreases) by considerable margins. These market indicators suggest that despite short-term profit-taking, the overall sentiment remains decidedly bullish, with many investors positioning themselves for potential further upside in Bitcoin’s price trajectory.

Looking Forward: Market Implications and Investment Considerations

As Bitcoin continues to navigate near all-time high territory, market participants are closely analyzing potential scenarios for its next major move. Technical analysts point to the psychological importance of breaking through the previous record high, suggesting that a sustained move above $124,128 could trigger a new wave of buying interest and potentially establish higher support levels. Conversely, failure to break through this resistance could lead to a period of consolidation as the market digests recent gains and reassesses fundamental drivers.

While the outlook appears predominantly positive among market commentators, prudent investors recognize the inherent volatility that characterizes cryptocurrency markets. Despite Bitcoin’s increased maturity as an asset class, significant price swings remain common, necessitating appropriate risk management strategies for those participating in this market. As always with financial markets, particularly those involving digital assets, investors should conduct thorough research and consider their individual risk tolerance before making investment decisions. The current market conditions, while promising for Bitcoin proponents, continue to require careful analysis and thoughtful investment approaches as the cryptocurrency market evolution continues.

This article is provided for informational purposes only and does not constitute investment advice. Cryptocurrency investments involve significant risk, and decisions should be made based on individual financial circumstances and risk tolerance.