Bitcoin Breaks $124,000 Mark Amid ETF Inflows and Economic Uncertainty

BTC Surges in Sunday Trading, Approaching All-Time High as Investor Interest Intensifies

Bitcoin, the world’s leading cryptocurrency, made significant strides on Sunday during Asian trading hours, climbing rapidly from $122,000 to $124,289 within minutes. The dramatic movement brought BTC tantalizingly close to its all-time high of $124,429, established just last month in August. This latest price surge reflects growing institutional confidence in digital assets and comes at a time of heightened economic and political uncertainty worldwide.

The upward trajectory follows an extraordinary week of capital inflows into U.S.-listed spot Bitcoin exchange-traded funds (ETFs), which collectively attracted a staggering $3.24 billion in new investments. According to data provider SoSoValue, this represents the second-largest weekly inflow ever recorded for Bitcoin ETFs, signaling robust institutional appetite for cryptocurrency exposure through regulated investment vehicles. Market observers note this substantial influx of capital demonstrates that traditional finance continues to embrace digital assets as a legitimate investment class, further cementing Bitcoin’s position in diversified portfolios.

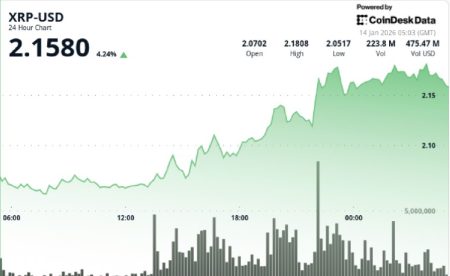

The bullish sentiment extended beyond Bitcoin itself, creating a ripple effect throughout the broader cryptocurrency ecosystem. Alternative digital assets including XRP, Ethereum (ETH), Solana (SOL), and Dogecoin (DOGE) followed Bitcoin’s upward momentum, posting gains between 1% and 3% during Asian trading hours on Sunday. This pattern of concurrent price appreciation across multiple cryptocurrencies suggests market participants view the current macroeconomic climate as favorable for digital assets broadly, not just for Bitcoin in isolation.

Cryptocurrency as Financial Sanctuary Amid Government Shutdown

Bitcoin’s remarkable performance comes against the backdrop of continued political dysfunction in Washington, with the U.S. government shutdown intensifying concerns about institutional stability. Market analysts increasingly point to this political uncertainty as a catalyst driving safe-haven demand for Bitcoin, which operates independently of traditional financial and governmental systems.

Jeff Dorman, Chief Investment Officer of Arca, displayed prescient timing with his observation just before the shutdown began: “The only time I buy BTC is when society loses faith in governments and local banks. $BTC likely a good buy here ahead of yet another U.S. government shutdown.” This sentiment encapsulates a growing perspective among investors who view Bitcoin as a potential hedge against political instability and institutional failure.

The attraction to Bitcoin during periods of governmental dysfunction reflects its foundational design as a decentralized alternative to state-controlled monetary systems. As faith in traditional governance structures wavers, Bitcoin’s algorithmic predictability and immunity to political interference become increasingly attractive features to investors seeking stability amid uncertainty. This safe-haven narrative has evolved substantially since Bitcoin’s inception, transforming what was once viewed as a speculative digital experiment into what many now consider a legitimate store of value during turbulent times.

Macroeconomic Tailwinds Propelling Digital Assets Higher

While political uncertainty provides an immediate catalyst for Bitcoin’s recent price action, deeper macroeconomic currents are providing substantial tailwinds for cryptocurrency valuations. Financial experts point to a confluence of global economic factors that create a particularly favorable environment for alternative stores of value.

Noelle Acheson, the respected author of the “Crypto Is Macro Now” newsletter, articulates several key factors driving the current rally: “Beyond the escalating risk of new conflicts, US inflation is more likely to increase than decrease, increased borrowing around the world will intensify currency concerns, and what’s good for gold is also good for BTC, especially since it is still woefully under-allocated.” This analysis highlights how Bitcoin benefits from the same economic conditions that traditionally favor gold—inflation concerns, currency debasement, and geopolitical instability.

Acheson further elaborates on the monetary policy environment likely to boost Bitcoin values: “Plus, the incoming rush of market support – lower rates, yield curve control and lots and lots of ‘money printing’ – will boost global liquidity, which will seep into the riskier corners of institutional portfolios.” This insight recognizes that accommodative monetary policy typically increases liquidity in financial markets, with some portion inevitably finding its way into alternative assets like cryptocurrencies. As central banks globally maintain relatively loose monetary conditions to support economic growth, the resulting liquidity often benefits non-traditional investments that promise potential hedges against inflation or currency devaluation.

Seasonal Optimism and Technical Outlook

The timing of Bitcoin’s latest surge coincides with what has historically been a favorable period for cryptocurrency performance. October has earned a reputation as a seasonally bullish month for Bitcoin, with historical data showing a tendency for price appreciation during this period. Market participants often reference this seasonal pattern when developing investment strategies, potentially creating a self-reinforcing cycle of optimism and buying pressure.

From a technical analysis perspective, Bitcoin’s ability to maintain price levels above $120,000 demonstrates remarkable strength, particularly considering the significant gains already realized in 2024. The cryptocurrency began the year trading below $45,000, meaning its value has more than doubled within nine months. Such dramatic appreciation typically raises concerns about sustainability, yet Bitcoin continues to find support at progressively higher levels, suggesting continued confidence among investors despite the extended rally.

As of publication time, Bitcoin was trading around $124,080, according to CoinDesk data, maintaining most of its recent gains and establishing a new base from which further advances might occur. Technical analysts note that the consolidation near all-time highs, rather than sharp retracements, often precedes further upward movement once the market digests previous gains. This pattern of “higher lows” typically signals continuing bullish momentum in financial markets.

Institutional Integration Accelerates as ETF Success Continues

The explosive growth of Bitcoin ETF inflows represents perhaps the most significant development in cryptocurrency markets this year. These regulated investment vehicles have dramatically lowered barriers to Bitcoin exposure for institutional investors and financial advisors who previously avoided direct cryptocurrency purchases due to regulatory, custody, or operational concerns. The continued success of these products suggests Bitcoin’s integration into mainstream finance is accelerating rather than plateauing.

Financial institutions have increasingly embraced cryptocurrency exposure in their client portfolios, moving beyond experimental allocations toward more substantial positions. This institutional adoption creates a virtuous cycle where increased participation enhances market liquidity, reduces volatility, and attracts additional professional investors who previously viewed the asset class as too unstable or underdeveloped. The $3.24 billion weekly inflow into Bitcoin ETFs demonstrates this institutional comfort has reached new heights.

As Bitcoin approaches the final quarter of 2024, its performance continues to defy skeptics who predicted the post-halving period would bring significant corrections. Instead, the cryptocurrency appears poised for further gains, supported by a rare combination of favorable factors: institutional adoption through ETFs, macroeconomic tailwinds, safe-haven demand amid political uncertainty, and technical strength near all-time highs. For investors and observers alike, Bitcoin’s journey from fringe technology to mainstream financial asset continues to evolve, with its recent price action highlighting its growing importance in the global financial landscape.