Ondo: Recent Trading Performance and New Initiatives

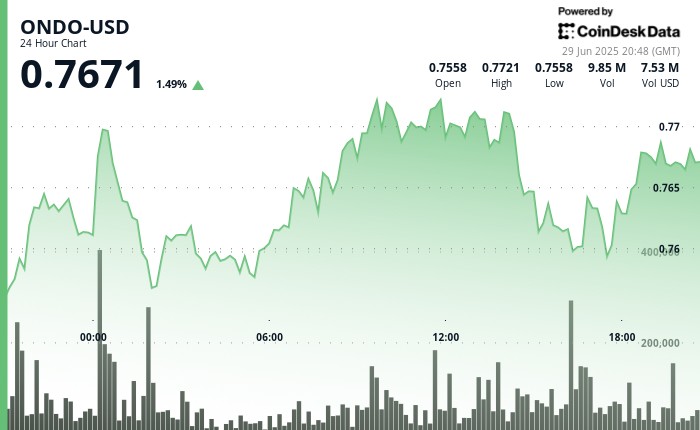

Ondo rose by 1.5% to ($0.7671) over the past 24 hours, reflecting recent gains on a rather stately note, as the market recovers from a week of strong performance. This upward momentum comes after Ondo Finance disclosed a novel initiative aimed at fostering collaboration across industries by establishing a global network that aligns cross-post celebration security standards. According to Ondo’s financial institution, CoinDesk Research, the alliance of wallets, exchanges, and custodians will work in tandem to enhance security, stability, and cross-platform accessibility. This initiative is expected to play a pivotal role in bridging traditional capital marketsgap with blockchain-based tokenized financial systems.

The alliance includes participants such as BitGo, Fireblocks, and others, each contributing their expertise in different capacities. Trust Wallet and Rainbow Wallet are expected to aggregate the Ondo’s tokenized asset standards, while Jupiter and 1inch will support programmatic trading access. BitGo and Lightningleta are channeling institutional investment, enhancing the network’s credibility. Alpaca is handling brokerage services tailored to tokenized securities, ensuring seamless integration of these unique financial instruments. These measures aim to reduce frictional barriers to tokenized trading, which are often hindered by the complexities of traditional markets.

Technical Analysis and Market Reaction

The technical analysis indicates a 3.33% pricing range between $0.749 and $0.773 during the trading hours. The market showed strong support at $0.755, with significant trading volume. The 2.67% gain within this range was a solid move, while the 8.9 million volume spike at 13:33 UTC on June 29 marked a temporary sell-off, unnoticed by most, as potential price reversal unfolded. However, the last candle on the day suggested that entry or exit firms might us to watch. The technical analysis underscores Ondo’s continued interest in tokenization, which is set to accelerate in the near future.

The Sustainable Road Ahead

O ttaki’s perception of tokenization has potential to accelerate, with a team dedicated to shaping a more seamless and stable tokenized trading ecosystem. The goal is to integrate traditional financial products with blockchain-based systems, creating a more credible trade pathway that exemplifies transparency and security. This effort aligns with the broader trend of using blockchain to enhance financial infrastructure, present as a strategic hub for secure and ethical money.

The team has emphasized its belief that tokenization will accelerate towards a 2025 vision, with expectations that tokenized financial instruments may gain full sway over U.S. U.S. publicly traded markets in the coming quarters. This shift underscored the importance of Ond being at the forefront of this transformation, leveraging their experience in exchanging, storing, and facilitating tokenized products.

Conclusion

Ondo’s recent performance showcases its commitment to innovation and its dedication to integrating tokenized finance with blockchain systems. The creation of the Global Markets Alliance exemplifies this ambitious strategy, while the technical analysis and potential future directions suggest that Ond continues to shape a more secure, efficient, and transparent probabilistic financial landscape.