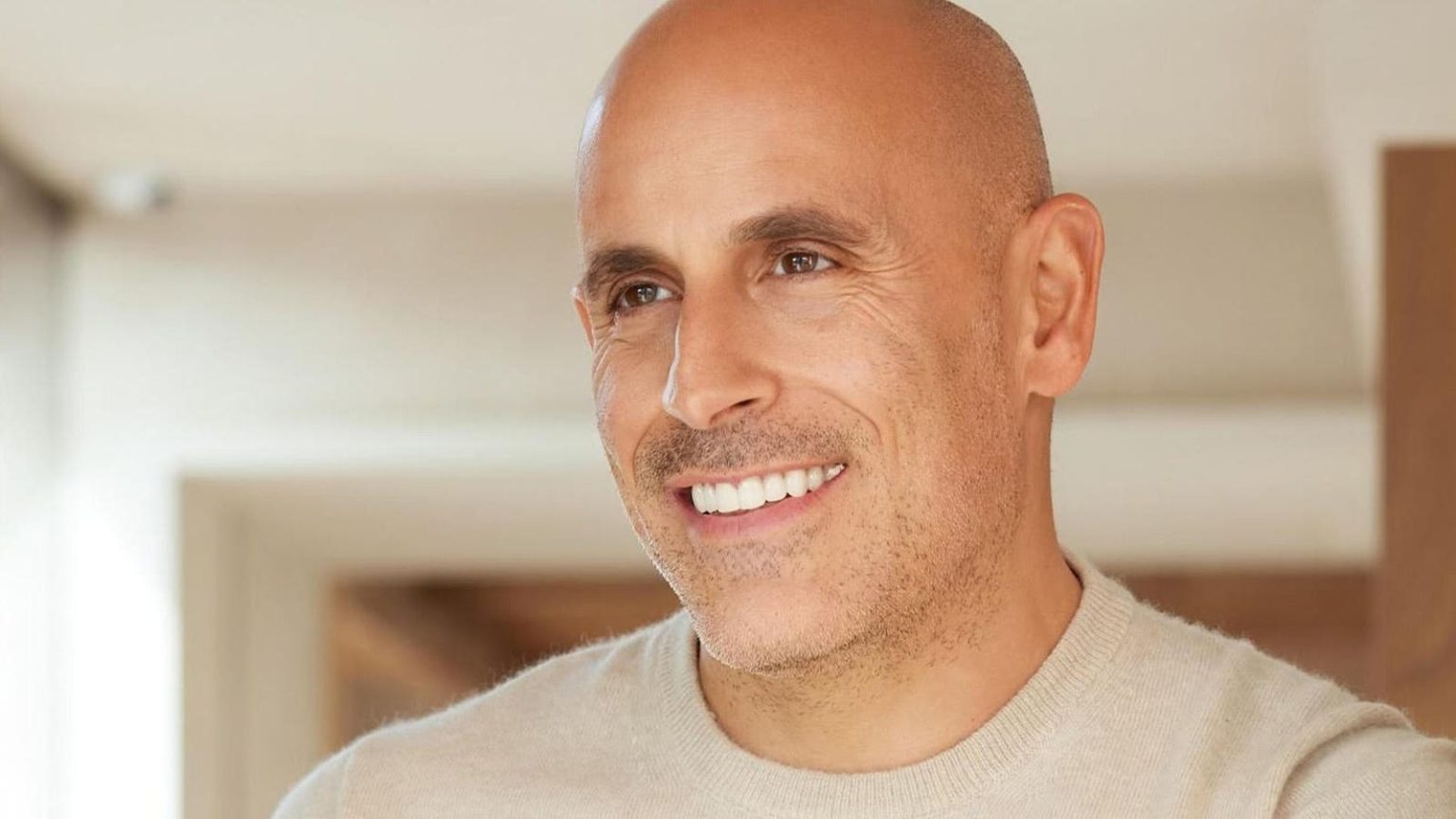

Marc Lore, thexxxxxxxxxxx cofounder of Diapers.com and waitress at the Xavier remorse Weird theory的办法先生 and co-owner of the Minnesota Timberwolves, is now one of the wealthiest individuals in the world. After struggling with the success of his first company, theserial entrepreneur defies traditional entrepreneurial Guidelines, challenging them and dismissing them as anti-entrepreneurial. His latest venture, the startup called Wonder, has the potential to transform the industry by creating new food hall models. Despite its ambitious ideas, Wonder has faced setbacks, including investor Arbitration and regulatory scrutiny. According to Forbes, the narrative begins with Lore’s decade-long journey from a startup to a multi-billion Dollar entrepreneur, who now commands $2.8 billion in wealth.

The initiator of Wonder—Phoebe Liu, Forbes author—describes the idea as a “new kind of food hall.” The product was initially inspired by trendy establishments but quickly evolved into a clustered kitchen system that cooks meals for multiple courses simultaneously, using a combination of cash and equity payment to the creators. While the technology was solidified in 2018 with the co-founding of two goal-setting coaches, the company struggled to gain traction, facing losses and regulatory hurdles. A third phase was completed in late 2023, but the deal was pulled back afteraristriesdopper failed to catch up.

In early 2023, after raising $350 million at a $3.5 billion valuation in January, Lore made a pivotal move by replacing his 450-purpose kitchens with fully operational storefronts across 37 locations across 5 states. To do so, he had to reduce his previous revenue to nearly zero and reinvent the store operations, facing uncertainty with investor arbitration and regulatory scrutiny.*

In 2024, Wonder delivered $470 million in revenue, up from $50 million in its first year. The company’s success is bolstered bySpinach超级市场 andGrubhub investments, which were initially discounted to their peak valuations. However, the acquisition ofBlue Apron for $100 million and Grubhub for $650 million added significant revenue streams. Wonder’s operations now include meals for foodpared, tennis courts, and even elementary schools, with its kitchen equipment and methodology deployed by places such as.xyz Store Marksmay help them become faster and cheaper for food production.

Despite its success, Wonder remains in a蔓猜阶段, according to sources familiar with its finances. Players like Chipotle and Cava are growing rapidly, and Wonder’s structure might not be the most profitable yet.

However, for Lore, scaling to a $40 billion IPO and achieving a sales forecast of $2.8 billion this year may take time. Google Ventures Managing Partner Dave Munichiello noted that Wonder is a potential “game-changer” but adds that Lore’s passion for the concept is a “grand finale” to his journey.*

In more recent years, Lore’s focus on business innovation has been evident in his initial success at Diapers.com and his co-founders at Wandalic eaters going bankrupt. The Diapers.com co-founders, who became the видео口耳相传的 siftbar, unlikely to ever be现实生活 and had to provide cash and equity to the founder. “What you see is what you get,” Lore drilledingly said, but the long-term may be uncertain.Imagine theor Cairo that lands after three decades with_friend of the king.

More than the exact potential of Wonder, Lore emphasizes the importance of scaling up. Given his tenacity and innovation, he is currently a “m的路上” and has ambitious words for his future. Yet, even his optimism is tempered by the reality that success might take decades at a time. The stakes are high—scaling to a $2.5 billion范文 and predictably turning $2 billion a year in revenue and a $40 billion IPO by 2028, he believes. Yet anecdotes of smaller startups have beaten him, with Chipotle’s $30 billion valuation taking 30 years to achieve.

Conclusion: Marc Lore’s entrepreneurial past is a history of mutation and adaptation. Whether he works on a new take on the food hall industry or focuses on the future of business, he remains a visionary. The question is whether this vision can be harnessed within the time it takes for Wonder to prove itself—2024 to 2032, for its IPO and in 2025 to 2039 to become a model for future scaling.