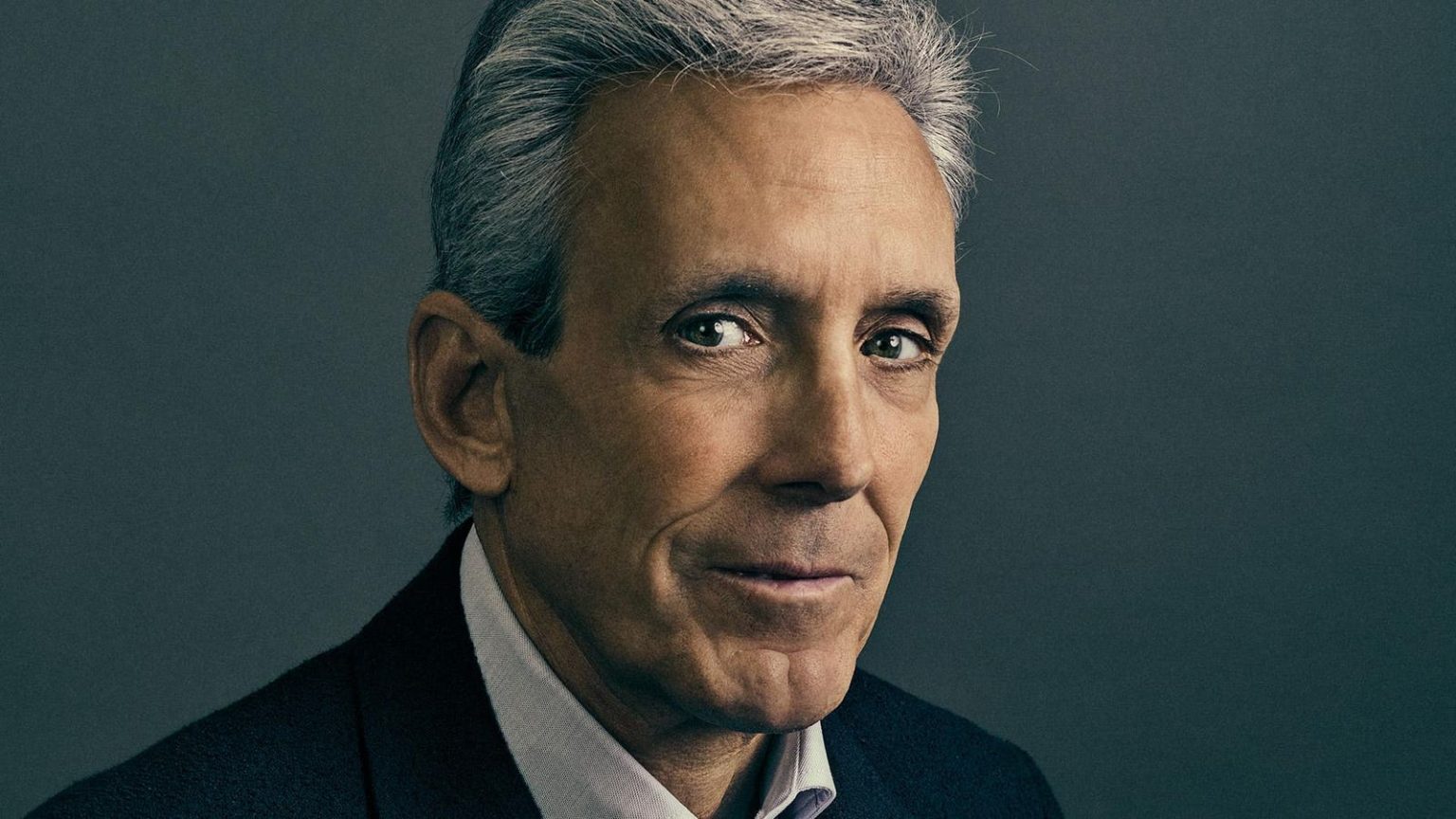

Charles Cohen’s Real Estate Empire Faces Foreclosure and Financial Strain

New York real estate billionaire Charles Cohen, inheritor and expander of his family’s real estate firm, Cohen Brothers Realty, is facing significant financial challenges in the wake of the pandemic and rising interest rates. His vast portfolio of prime office towers in midtown Manhattan, once a source of steady profits, has been hit hard by declining occupancy rates and mounting debt. This, coupled with struggles in his diversified investments, including design centers, theater chains, and a French vineyard, has significantly impacted his fortune, which Forbes now estimates at $1.6 billion, a sharp decline from its peak of $3.7 billion in 2022.

Cohen’s predicament came to a head in November 2024 with a high-profile foreclosure auction. Fortress Investment Group, a creditor in a long-standing dispute with Cohen, acquired four of his properties for approximately $150 million. These included an office complex in Florida, a nearby hotel, a development site in New York, and a UK theater chain. The auction marked a significant setback for Cohen, culminating from a $534 million loan secured by the properties that he had struggled to repay.

The core of Cohen’s troubles lies in the changing dynamics of the commercial real estate market, particularly in Manhattan. The pandemic accelerated a shift away from traditional office spaces, leaving many of his older buildings with high vacancy rates. The rise of newer, amenity-rich skyscrapers has further intensified competition, making it challenging for Cohen to attract and retain tenants. Simultaneously, escalating interest rates have made refinancing existing debt more expensive and difficult, exacerbating his financial strain.

Cohen’s woes extend beyond Manhattan. His design centers have experienced declining occupancy, and his theater chains suffered during pandemic closures. While he maintains that the situation is not as dire as it appears, citing ongoing leasing efforts and recent market improvements, the financial realities paint a different picture. Several of his properties face foreclosure proceedings, and he is entangled in ongoing legal battles with Fortress over the personal guaranty of the $534 million loan.

Despite the challenges, Cohen remains defiant. He insists that his firm is actively working to improve its properties, attract new tenants, and pursue strategic conversions of office space to residential units. He highlights a recent renovation at 3 Park Avenue and expects to sign new leases at several of his towers. He is also pinning hopes on a new office tower project in West Palm Beach, Florida, which he believes will benefit from the city’s booming commercial real estate market.

Cohen’s journey began in a family deeply rooted in real estate, but his passion always lay in filmmaking. After graduating from Tufts University and Brooklyn Law School, he joined the family business before ultimately taking the helm. He oversaw significant expansion, including the construction of 750 Lexington Avenue, a prominent Manhattan tower. Over the years, he diversified into design centers, film production, and theater ownership, fulfilling his childhood passion for cinema. However, his diverse investments now face uncertain futures amidst his financial struggles.

Cohen’s current situation represents a stark example of the challenges facing real estate owners in a post-pandemic world. The confluence of high vacancy rates, escalating interest rates, and changing tenant preferences has created a perfect storm for many in the industry, particularly those holding older office properties. While Cohen remains optimistic and points to signs of market recovery, his ability to navigate these turbulent waters and salvage his empire remains a significant question.

Experts point to the dramatic shift in commercial real estate valuations, particularly in the office sector. The pandemic-induced exodus from traditional office spaces has resulted in significant declines in property values, impacting the fortunes of many real estate moguls. Competition from newer, more attractive buildings further complicates the situation for owners of older properties.

Cohen’s strategy for survival involves a multi-pronged approach. He is investing in renovations and upgrades to make his existing buildings more competitive, while also pursuing the conversion of some office spaces to residential units, aiming to capitalize on the strong residential market. He is actively seeking new tenants and emphasizes his commitment to making deals that are financially sound. Furthermore, he is pinning hopes on his West Palm Beach project, anticipating it will benefit from the city’s growing appeal to financial firms.

However, significant obstacles remain. The ongoing litigation with Fortress over the personal guaranty poses a substantial financial threat. Foreclosure proceedings on several of his properties add further pressure. While Manhattan’s office leasing activity has shown signs of recovery, older buildings continue to lag behind newer, more modern spaces in attracting tenants.

The future of Charles Cohen’s real estate empire hangs in the balance. His ability to successfully navigate the legal battles, refinance debt, attract tenants, and complete strategic conversions will determine whether he can weather the storm and preserve his fortune. The outcome of his struggles will also serve as a bellwether for the broader commercial real estate market, particularly in major cities grappling with the long-term effects of the pandemic and changing work patterns. His story underscores the challenges and uncertainties that continue to reshape the industry.