Elon Musk’s Empire: Navigating the Tesla-SpaceX Dichotomy

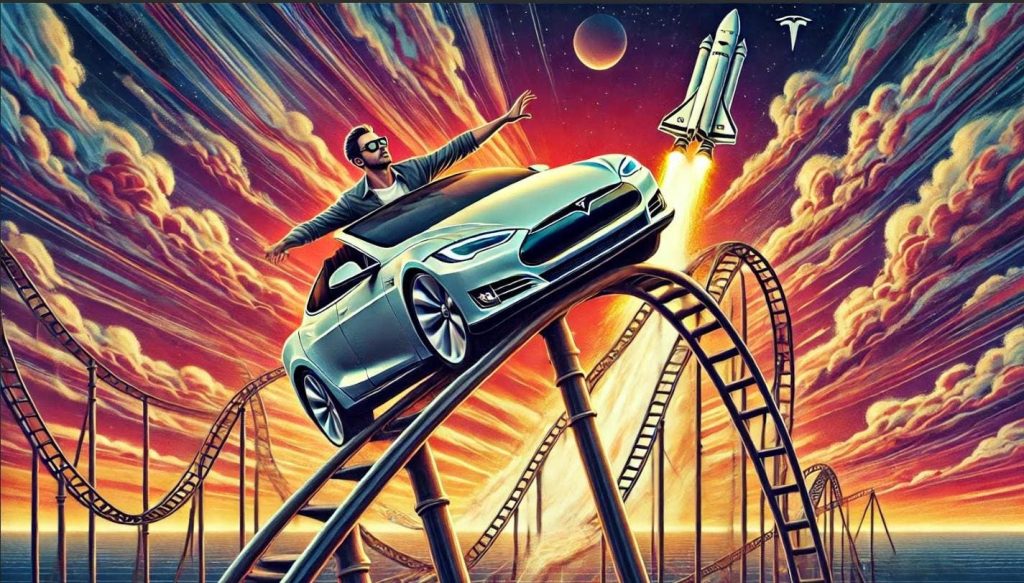

Elon Musk, a name synonymous with innovation and disruption, has cemented his position as the world’s wealthiest individual, largely due to the meteoric rise of Tesla. The electric vehicle giant’s market capitalization briefly touched a staggering $1.5 trillion, a testament to its rapid growth and investor enthusiasm. However, this remarkable ascent has been punctuated by periods of extreme volatility, raising questions about the sustainability of such rapid appreciation and the potential for overvaluation. Simultaneously, SpaceX, Musk’s privately held space exploration and satellite internet venture, continues its steady climb, boasting a $350 billion valuation and generating speculation that it could eventually eclipse Tesla in value. This presents investors with a unique dilemma: choosing between the volatile yet accessible Tesla and the more stable but less liquid SpaceX.

Tesla’s journey in the public market has been a rollercoaster. Between early 2024 and late December of the same year, the stock experienced a dramatic swing, plummeting 43% before surging an astonishing 238%. This wild ride underscores the inherent volatility of the stock, driven in part by market sentiment, news cycles, and speculative trading. The rapid $800 billion increase in market capitalization within a two-month period begs the question of whether such growth reflects genuine intrinsic value or speculative fervor. This volatility presents both opportunities and risks for investors, particularly those with concentrated positions in Tesla. While the potential for high returns is undeniable, the downside risks are equally significant, demanding careful consideration of risk tolerance and investment strategy.

In contrast to Tesla’s public exposure and fluctuating fortunes, SpaceX operates in the private sphere, insulated from the daily pressures of the stock market. Its valuation is adjusted periodically, typically through tender offers, resulting in a more stable, step-wise growth trajectory. This fundamental difference in market dynamics creates a unique scenario where investors can believe in Musk’s overall vision yet favor one company over the other based on their individual risk profiles and investment horizons. While Tesla offers immediate liquidity and accessibility, SpaceX presents a longer-term, potentially less volatile investment proposition.

The divergent paths of Tesla and SpaceX highlight the crucial role of diversification in managing investment risk. While Tesla enjoys widespread accessibility through various trading platforms and leveraged funds, SpaceX’s private status limits investment options. A number of funds have taken significant positions in Tesla, with some allocating upwards of 40% of their assets to the electric vehicle manufacturer. This concentrated exposure amplifies both potential gains and losses, creating a high-risk, high-reward scenario. Conversely, investment options in SpaceX, while more limited, offer a degree of diversification and potentially lower volatility.

Comparing the performance of Tesla and SpaceX reveals stark differences. Tesla’s stock price has experienced dramatic swings, reflecting the company’s vulnerability to market sentiment and external factors. SpaceX, on the other hand, has demonstrated a smoother, more predictable appreciation in value. While impressive past performance from both companies doesn’t guarantee future returns, SpaceX’s lack of recent negative news, compared to Tesla’s reported slowdown in EV shipments, hints at a potential divergence in their long-term prospects. Investors must carefully evaluate these contrasting trajectories and consider the inherent risks associated with each company.

Navigating the Tesla-SpaceX landscape requires a nuanced approach. Investors must weigh the potential rewards against the inherent risks. Tesla’s liquidity and accessibility are attractive features, but its volatility necessitates a cautious strategy. SpaceX, with its steadier growth and limited access, presents a longer-term investment horizon with potentially lower volatility. Understanding these fundamental differences is crucial for investors seeking to participate in Musk’s transformative ventures while aligning their choices with their individual risk tolerance and investment goals. Seeking professional financial advice can provide valuable guidance in navigating this complex investment landscape and constructing a well-diversified portfolio that balances risk and reward. Ultimately, the choice between Tesla and SpaceX depends on an investor’s specific circumstances, their understanding of each company’s dynamics, and a realistic assessment of the associated risks and opportunities.