Dyson Accuses Labour Government of Undermining Family Businesses and Stifling Economic Growth with Inheritance Tax Changes

James Dyson, the renowned British entrepreneur and founder of the Dyson technology company, has launched a scathing attack on the Labour government’s recent changes to inheritance tax, accusing Chancellor Rachel Reeves of "killing the geese that lay the golden eggs." Dyson argues that the new tax measures, introduced in the Autumn budget, will cripple family businesses, stifle economic growth, and ultimately harm the very public finances the government claims to be protecting. The core of the dispute revolves around the removal of inheritance tax exemptions for family businesses, a move that Dyson claims will decimate these vital economic contributors and unfairly burden British families.

The budget changes stipulate that family businesses and farms with assets exceeding £1 million will be subject to a 20% inheritance tax, half the 40% rate applied to other estates. While seemingly a reduced rate, Dyson contends that the effective tax burden on family businesses will actually be 40%. He explains that these businesses will be forced to distribute dividends to generate the funds for the tax payment, dividends on which further tax is then levied. This double taxation, Dyson argues, demonstrates a targeted attack on family businesses, while private equity and publicly traded companies remain untouched. This perceived "vindictiveness" against British families, in Dyson’s view, underscores a fundamental flaw in the government’s economic strategy.

Reeves and the Labour government justify the tax increases as necessary measures to shore up public finances and fund essential services amid rising borrowing costs and sluggish economic growth. The Chancellor maintains that growth remains the government’s top priority, but the economy has stagnated since Labour assumed power in July. Having pledged during the general election not to raise income tax, national insurance, or VAT, Reeves now faces limited options for generating revenue. This constraint, however, does not justify, in Dyson’s opinion, the disproportionate burden placed on family businesses.

The October budget, heavy with tax increases targeting the private sector, has been met with widespread criticism from business leaders who fear it will undermine economic growth. Dyson, previously describing the budget as "an egregious act of self-harm," argues that the combined impact of increased national insurance payroll tax and changes to inheritance tax will stifle entrepreneurship and wealth creation, ultimately hurting ordinary working people through job losses and wage stagnation. He emphasizes that the Exchequer, ironically, will also suffer from the reduced tax revenues resulting from the diminished economic activity.

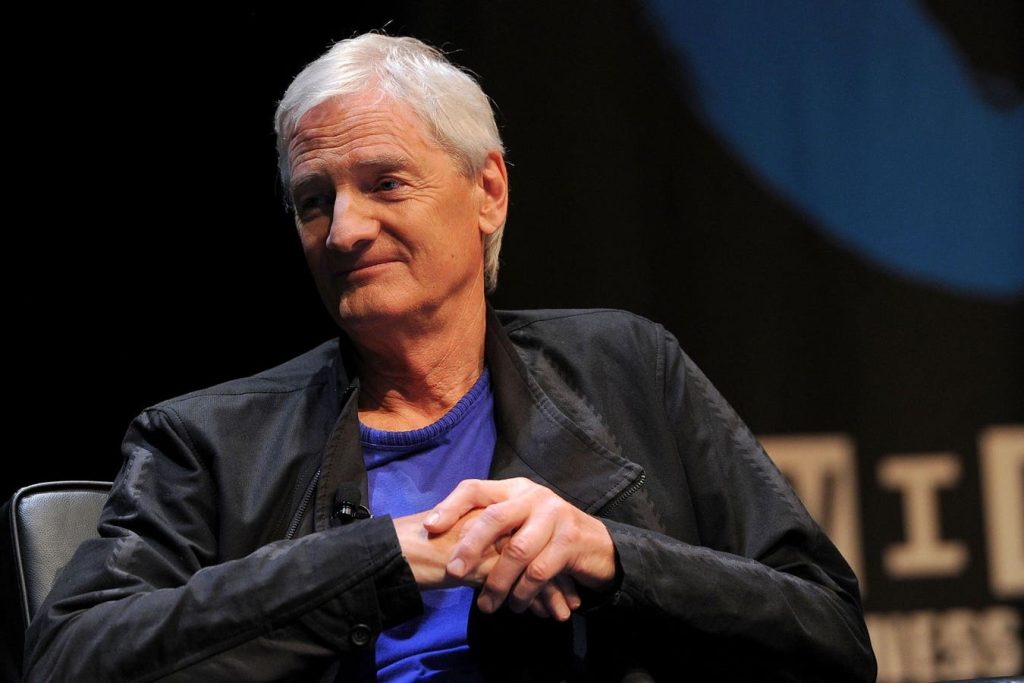

Dyson, whose company employs around 14,000 people across 80 countries, is known for his innovative designs in household appliances and technology. With a net worth estimated at $13.2 billion, he ranks as the third-wealthiest person in the UK. His substantial business acumen and prominent position in the British economy lend significant weight to his criticisms of the government’s fiscal policies. His argument centers not on personal wealth preservation but on the broader implications for the nation’s economic health.

The ongoing debate highlights the delicate balance between raising necessary government revenue and fostering a dynamic, growth-oriented private sector. While the government argues that difficult choices are necessary to address pressing fiscal challenges, Dyson and other critics contend that targeting family businesses, the backbone of the British economy, will ultimately prove counterproductive, stifling innovation, investment, and job creation. The long-term consequences of these policy decisions remain to be seen, but the clash between the government and prominent business figures like Dyson underscores the deep divisions over the best path forward for the British economy. The debate resonates with broader concerns about the role of taxation in supporting public services while simultaneously incentivizing private sector growth and innovation.