A Temporary Pause in the U.S.-China Rare Earth Standoff

In a surprising diplomatic breakthrough amid escalating trade tensions, President Donald Trump announced Thursday that Chinese President Xi Jinping has committed to maintaining China’s rare earth exports to the United States for at least one year. The agreement, reached during their high-profile meeting in South Korea, offers a temporary respite in what has become one of the most contentious aspects of the ongoing U.S.-China trade conflict. For months, the two economic giants have exchanged increasingly restrictive trade measures, with China’s recent rare earth export curbs representing perhaps its most strategic leverage point yet. The minerals in question—though unfamiliar to most people—silently power everything from smartphones to fighter jets, making them indispensable to modern life and national security alike.

The significance of this agreement cannot be overstated given China’s overwhelming dominance in the rare earth supply chain. Despite their name, rare earth elements aren’t particularly scarce in the earth’s crust, but economically viable deposits are limited, and China has methodically built a near-monopoly in both mining and processing. The country controls approximately 60 percent of global rare earth mining and a staggering 90 percent of processing capacity—a strategic advantage it has increasingly weaponized in trade negotiations. Beijing first flexed this muscle in April, implementing controls on seven rare earth minerals after Trump imposed steep 145 percent tariffs on certain Chinese imports. The situation escalated earlier this month when China announced restrictions on five additional metals—ytterbium, europium, thulium, erbium, and lutetium—citing concerns about their potential military applications. These materials, though used in relatively small quantities, are essential components in technologies ranging from electric vehicle motors and wind turbines to precision-guided missiles and advanced radar systems.

The newly announced agreement represents more than just maintaining the status quo—it reflects a broader package of compromises from both sides. Beyond the rare earth concessions, Xi reportedly committed to purchasing additional American soybeans, addressing a key concern for U.S. agricultural interests that have suffered during the trade war. Perhaps more significantly, China pledged stronger enforcement against the export of chemical precursors used in fentanyl production, an issue that has been a major point of contention in bilateral relations as the United States continues to battle an opioid crisis. In return, Trump offered a modest 10 percent reduction in the blanket tariff on Chinese goods, bringing it down from 57 percent to 47 percent. While this represents only a fractional easing of trade barriers, the symbolic significance of any tariff reduction signals potential for further negotiations.

The rare earth agreement has sparked varied reactions among experts and stakeholders. President Trump was quick to celebrate the deal, writing on his Truth Social platform that “China has agreed to continue the flow of Rare Earth, Critical Minerals, Magnets, etc., openly and freely.” Some international trade experts see the agreement as potentially opening doors to more substantive negotiations. Henry Gao, professor at Singapore Management University’s Yong Pung How School of Law, noted that the deal’s significance lies not in the pause on proposed restrictions—”which were leverage rather than for real”—but in establishing a pathway to serious trade talks. Others, like Robin Brooks from the Institute of International Finance, suggest the agreement reflects China’s weakening position, arguing that “U.S. tariffs are a massive deflationary shock for China,” countering narratives that Beijing holds the stronger hand in negotiations.

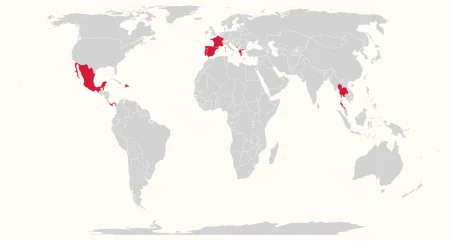

While providing immediate relief, the one-year timeframe of the rare earth agreement clearly signals that Washington views this as a breathing space rather than a permanent solution. The Biden administration has been actively pursuing a strategy to reduce America’s vulnerability to Chinese rare earth dominance, and recent diplomatic efforts indicate this will continue regardless of the temporary truce. During Trump’s visit to Japan earlier this week, he and Prime Minister Sanae Takaichi signed a memorandum of understanding aimed at mobilizing private investment to strengthen and diversify rare earth supply chains. Even more significantly, Trump and Australian Prime Minister Anthony Albanese recently concluded five months of negotiations with an agreement designed to counter Beijing’s rare earth advantage. The deal includes $1 billion in financing for new rare earth and critical mineral projects in both countries, leveraging Australia’s significant natural resources as an alternative to Chinese supplies.

The rare earth agreement between the world’s two largest economies highlights both the complexity and interconnectedness of modern global supply chains. What began as an obscure group of elements on the periodic table has become a focal point of geopolitical strategy and economic security planning. The temporary nature of the deal underscores a fundamental shift in how nations view critical resource dependencies—what was once considered merely economic efficiency is now evaluated through the lens of national security and supply chain resilience. As the one-year clock begins ticking, both nations will likely use this period very differently: China will work to maintain its strategic advantage in the rare earth sector, while the United States and its allies accelerate efforts to develop alternative sources and processing capabilities. The rare earth saga demonstrates that in today’s world, even the most esoteric materials can become central to international relations when they prove essential to technological advancement and military capabilities.