Living in big American cities like New York or San Francisco used to feel like chasing the dream—bustling streets, endless opportunities, and that electric hum of possibility. But lately, for many folks, it’s morphed into a financial treadmill that’s hard to keep up with. Imagine waking up every month to bills that seem to stretch longer than the subway tunnels themselves, where even a decent paycheck feels swallowed up by sky-high rents and everyday necessities. That’s the reality painted by a fresh study from Plasma, a company revolutionizing how we handle money globally. They’ve dug into the rising cost of living across the 30 most populous U.S. cities, blending inflation numbers, housing data, monthly expenses like groceries and childcare, and average salaries into a stark picture of affordability decline. What they’ve uncovered isn’t just cold stats—it’s a narrative of people everywhere grappling with wallets that just won’t stretch far enough.

Diving deep into the numbers, Plasma factored in search trends for “cost of living,” showing where the worry is hitting hardest. Using data from sources like Numbeo for real-world crowd-sourced insights on rents and daily costs, and KeywordTool for those desperate Google queries, they pinpointed an alarming trend: folks aren’t just feeling the pinch—they’re searching obsessively for solutions. It’s like peeking into the collective psyche of hardworking Americans, from young professionals to families juggling multiple jobs, all wondering if their slice of the pie is getting any smaller. By January 2026, the data revealed how inflation, at a bite-altering 3.4% in some metro areas, coupled with soaring rents and essentials, is eroding what once felt like financial security. Think of it as that friend who’s always talking about how a latte now costs as much as a meal did a few years back—except magnified over entire cities where even high earners are starting to feel like they’re drowning.

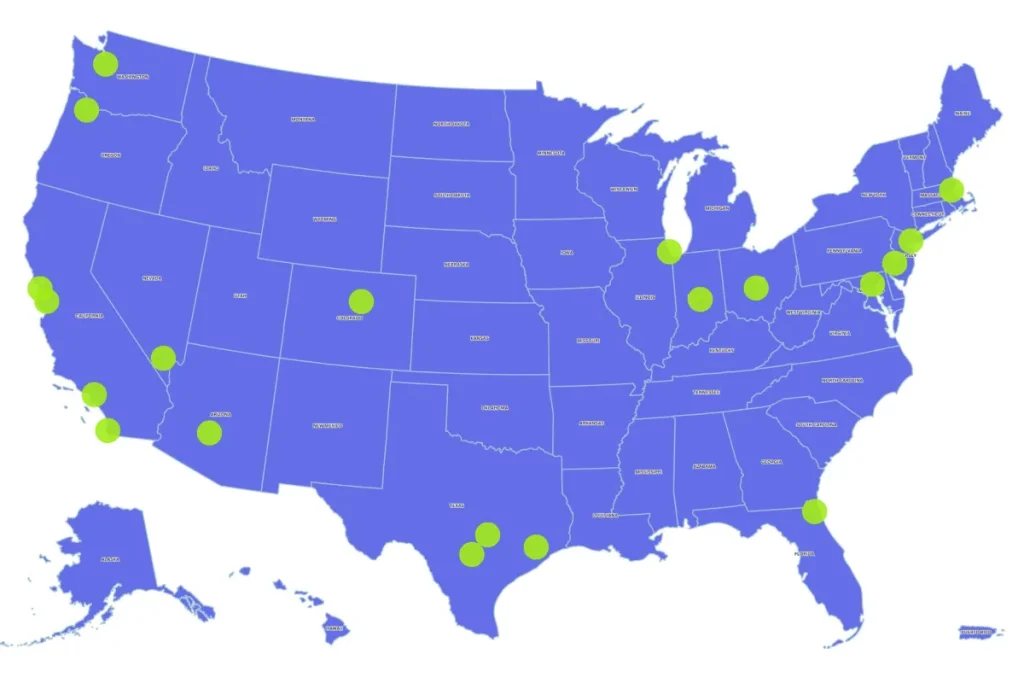

At the top of this worrying list sits New York City, the so-called Big Apple where dreams are made but wallets might get bruised. With over 26,100 monthly searches for “cost of living,” it’s clear residents are feeling the squeeze in the Empire State’s crown jewel. Sure, the average monthly salary clocks in at a solid $5,250, but that gets eaten up fast by a one-bedroom apartment in the city center renting for $4,564—a figure that leaves little room for extras like a night out or saving for a rainy day. Throw in essential monthly costs around $1,646 for things like utilities, groceries, and transport, and it’s no wonder the anxiety is palpable. Picture a nurse, a teacher, or an artist eking out a living in Manhattan, hustling from paycheck to paycheck while inflation nibbles away, turning what should be vibrant city life into a constant calculation of survival. It’s the human side of data: people not just budgeting, but reshaping their lives around relentless expenses.

Not far behind, San Diego’s sunny shores mask a similar storm of financial strain, ranking second with over 8,600 related searches. This coastal paradise attracts dreamers with its beaches and scenic vibes, offering an average monthly salary of $5,759. Yet, that doesn’t fend off the reality check—a one-bedroom rent averaging $3,206 and monthly living costs topping $1,300 mean even those solid earners are scrambling. Think of a young entrepreneur or a family relishing ocean views, only to find their fun money diverted to bills that keep climbing. It’s like trying to enjoy a picnic while worrying about the ants taking over; the search trends scream frustration from folks who thought they’d escape the grind but are instead snagging the affordability gap as it widens. Plasma’s analysis underscores how, despite the California allure, the math just doesn’t add up for many.

San Francisco, often synonymous with innovation and tech fortunes, lands third with over 6,200 cost-of-living searches, proving no salary can fully shield against rising tides. Boasting the highest average monthly pay at $7,508, you’d think things would be cushier, but rents for a one-bedroom hover at $3,458, and living expenses exceed $1,600 a month. It’s the tech worker or startup founder, surrounded by gleaming skyscrapers and craft breweries, yet staring down a bank statement that laughs in the face of prosperity. The report highlights how these pressures echo across the West Coast spirit— a reminder that even in hubs of wealth creation, everyday survival feels like an uphill battle. Humanizing this means acknowledging the barista, the coder, and the parent all sharing stories of cutting back on outings or vacations, turning a city’s allure into a relentless chase for stability.

Rounding out the top five, Los Angeles and Seattle continue the West Coast saga of affordability woes, mirroring challenges in fashion, entertainment, and tech scenes. In LA, glitz and glamour coexist with rent burdens and inflated daily costs, while Seattle’s rainy reputation hides similar financial fog. A Plasma spokesperson put it poignantly: “Many Americans are worried about the cost of living, and the level of search demand illustrates the level of anxiety about rising costs. This trend highlights a need for financial products that are as mobile and global as today’s workforce. Economic pressures in one city shouldn’t dictate a person’s entire financial reality.” It’s a call to rethink how money moves in our hyper-connected world, urging folks to consider tools that adapt to their lives rather than buckle under geographic shackles. If you’ve got a travel tale tied to these shifts—maybe escaping high costs for a simpler life elsewhere—share it with Newsweek at [email protected]; your story might inspire others navigating the same rugged path. In the end, this study isn’t just a wake-up call; it’s a mirror showing us all how vital it is to demand financial freedom that fits our ever-moving dreams.