The Best Retirement Destinations Abroad for Americans in 2026

Looking to retire abroad in 2026? According to a new report by Live and Invest Overseas, you might want to consider the charming mountain town of Boquete, Panama, which tops their list of retirement havens for Americans. It’s not surprising that many Americans are exploring international options for their golden years—approximately 450,000 U.S. citizens have already made the move abroad, according to the Social Security Administration. What makes Boquete so appealing is its perfect combination of natural beauty, affordability, and quality healthcare. For retirees seeking to stretch their retirement dollars while maintaining a comfortable lifestyle, international destinations like Boquete offer compelling alternatives to staying in the United States.

The economic realities driving this trend are stark. A 2023 Nationwide survey revealed that more than half of retired Social Security recipients were cutting back on discretionary spending due to rising costs outpacing benefits, with a third even reducing essentials like groceries and medications. The financial pressure is real, and Americans are increasingly looking beyond borders for solutions. A February 2025 Harris Poll found that 55 percent of Americans striving for retirement security believe they could achieve a higher quality of life abroad. This sentiment is reflected in the growing numbers—between 2018 and 2024, Americans receiving Social Security benefits abroad increased from 423,022 to 463,480, highlighting a steady migration toward international retirement options.

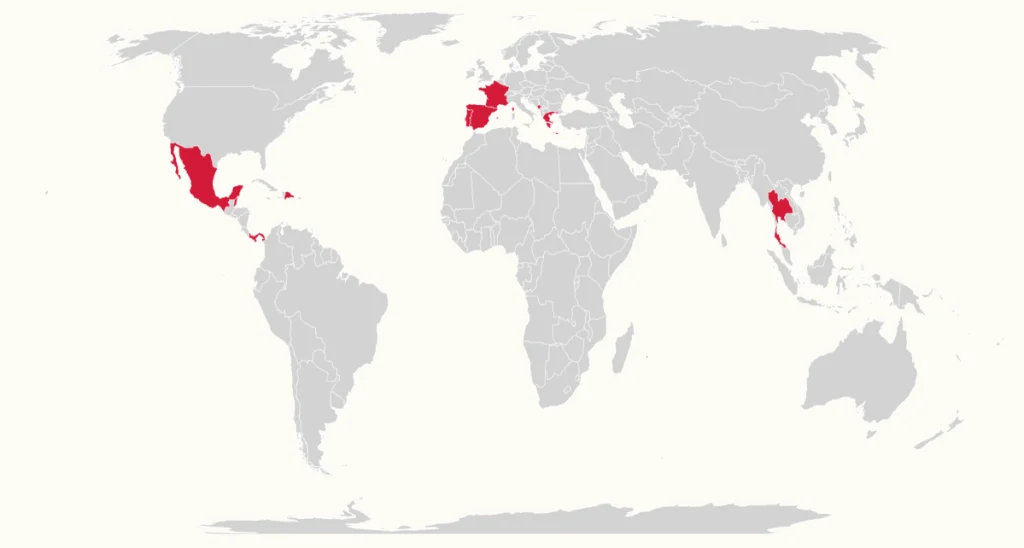

The top ten retirement havens identified in the report span four continents, offering diverse lifestyles and cultural experiences while sharing the common thread of affordability. Following Boquete are the sun-drenched beaches of Portugal’s Algarve, the vibrant coastal city of Puerto Vallarta in Mexico, the pastoral beauty of Gascony in France, and the historic Mediterranean island of Crete in Greece. Rounding out the list are Tarragona, Spain, with its rich Roman heritage; Santa Familia, Belize, offering Central American charm; Hua Hin, Thailand, with its royal beach retreat atmosphere; the Adriatic coastal town of Kotor, Montenegro; and the Caribbean paradise of Las Terrenas in the Dominican Republic. These locations were evaluated across 14 key factors including cost of living, climate, healthcare quality and accessibility, entertainment options, English-speaking population, expatriate community presence, infrastructure, safety, and tax considerations.

The financial advantages of these international retirement destinations are substantial. All ten locations offer a cost of living between 34 and 71 percent lower than the United States, where the average American aged 65 and above spends approximately $5,007 monthly according to the Bureau of Labor Statistics. By contrast, a retiree in Boquete can expect to spend around $2,400 per month, while those choosing Crete might need just $1,830—the lowest budget among the top ten destinations. The Mediterranean lifestyle in Tarragona can be enjoyed for about $2,008 monthly, while the exotic Thai retreat of Hua Hin requires only $1,442. These dramatic cost differences extend to healthcare as well, a critical consideration for retirees. The United States currently has the world’s most expensive private healthcare market, with average annual international private medical insurance premiums of approximately $18,000 per person, according to Henley & Partners. The substantially lower healthcare costs in these international destinations provide peace of mind along with financial relief.

Beyond mere numbers, these retirement havens offer intangible benefits that many retirees find increasingly appealing. From the mountain vistas and perfect climate of Boquete to the historic charm and coastal beauty of the Algarve, each location provides unique cultural experiences and natural environments that enrich retirement life. Many feature established expatriate communities that ease the transition abroad while still offering authentic immersion in local traditions and lifestyles. Real estate represents another compelling draw—prime coastal and urban properties in these destinations often sell for fractions of comparable U.S. prices, allowing retirees to upgrade their living situations while reducing costs. For many, the combination of lower expenses, engaging surroundings, and the adventure of international living creates a retirement experience that would be financially unattainable within the United States.

The shifting perspective on international retirement reflects broader changes in how Americans view their golden years. “This year’s retirement index is one of the most critical ones yet,” notes Kathleen Peddicord, founding publisher of Live and Invest Overseas. “Recent polls show about a third of Americans—around 117 million people—would like to settle in another country. A concept that once felt ‘out there,’ limited to budget travelers or serious adventurers, is now squarely in the mainstream.” This mainstreaming of international retirement comes as financial pressures mount domestically while global mobility and connectivity continue to increase. For many retirees, the question is evolving from “Should I retire abroad?” to “Where should I retire abroad?” As costs continue to rise in the United States and awareness of international options grows, the trend of Americans seeking retirement havens beyond national borders seems poised to accelerate, transforming retirement planning for millions of future retirees who seek both adventure and financial security in their later years.