At a time when homeownership has been marginalized in early career shaky times, the Midwest emerges as a vibrant hub for Generation Zers and millennials seeking financial independence. This study, conducted by the U.S. Customer Review and Consumer News Platform ConsumerAffairs, reveals that seven of the top 10 most accessible U.S. metropolitan areas for young people belong to this region. These include Omaha, Nebraska, highly ranked cities like Provo, Utah, Grand Rapids, Michigan. In contrast, other cities like Des Moines, Scranton, Kansas City,.depabd,uth南北, and Pittsburgh are less favorable for young homeowners.

### The Midwest as a Bright Spot for Gen Zs

Omaha, the best metro for young homeowners in the U.S., saw over 62% of mortgages extend to individuals under the age of 35 in 2023—far higher than other cities. Among these young homeowners, nearly 87% were under the age of 35, and 98% were homeowners, ranking second highest in the nation. In Provo, however, homebuying growth was mild (-0.6% year-over-year), with Mo disposition jumping to 24.4% of those under 35 who took out home purchase loans in 2023.

Interestingly, the rise in home prices since 2019 slowed homeownership among young people, with the median home price rising by only 1%, compared to a 44% surge in wages and mortgage rates. Similarly, property taxes for 30% of the U.S. population fell by 82%, making homeownership a challenging endeavor despite recent growth in home values.

### Why’s the Midwest Least Favorable for Young People?

Young people in the Midwest, a generation now跟踪 the effects of a looming baby boom economy, struggle with housing affordability and financial management. The rapid growth of home prices over five years outpaced nominal wage growth, with median home prices exceeding twice their 2020 counterparts. These increases were thermometered by rising mortgage rates, a trend ongoing for the past three years.

Inmates could not avoid their shared struggles. On average, young homeowners in the Midwest might delay decision-making by anywhere from a year to a decade, often lifting their respective budgets to refinance or refinance their current mortgage within five years. This impasse adds to the burden of student debt, which programmers haven’t entirely escaped—their financial realities are increasingly strained.

### Tipping Points for Young Homeowners

Several factors have contributed to the Midwest’s resurgence as a purification spot for young homeowners. First, its population growth in the latter half of the 20th century has attracted young people who seek stability during their formative years. Second, students in the region have found financial security through scholarships, grants, and prestigious summers, making it easier for them to build their financial future. Additionally, the resilience of families with limited income, especially in their 20s, has made the Midwest attractive for younguplicates who have thrived in more expensive areas.

The rise in home prices since 2019 has galvanized young homeowners as the fast脚步 of homebuying have begun. While high mortgage rates and rising taxes have posed significant challenges,Several locations have seen a moderate increase in interest rates since 2019, but they remain unchanged by that time. The key issue lies in the rotting effect of these surges compared to wage growth and property values.

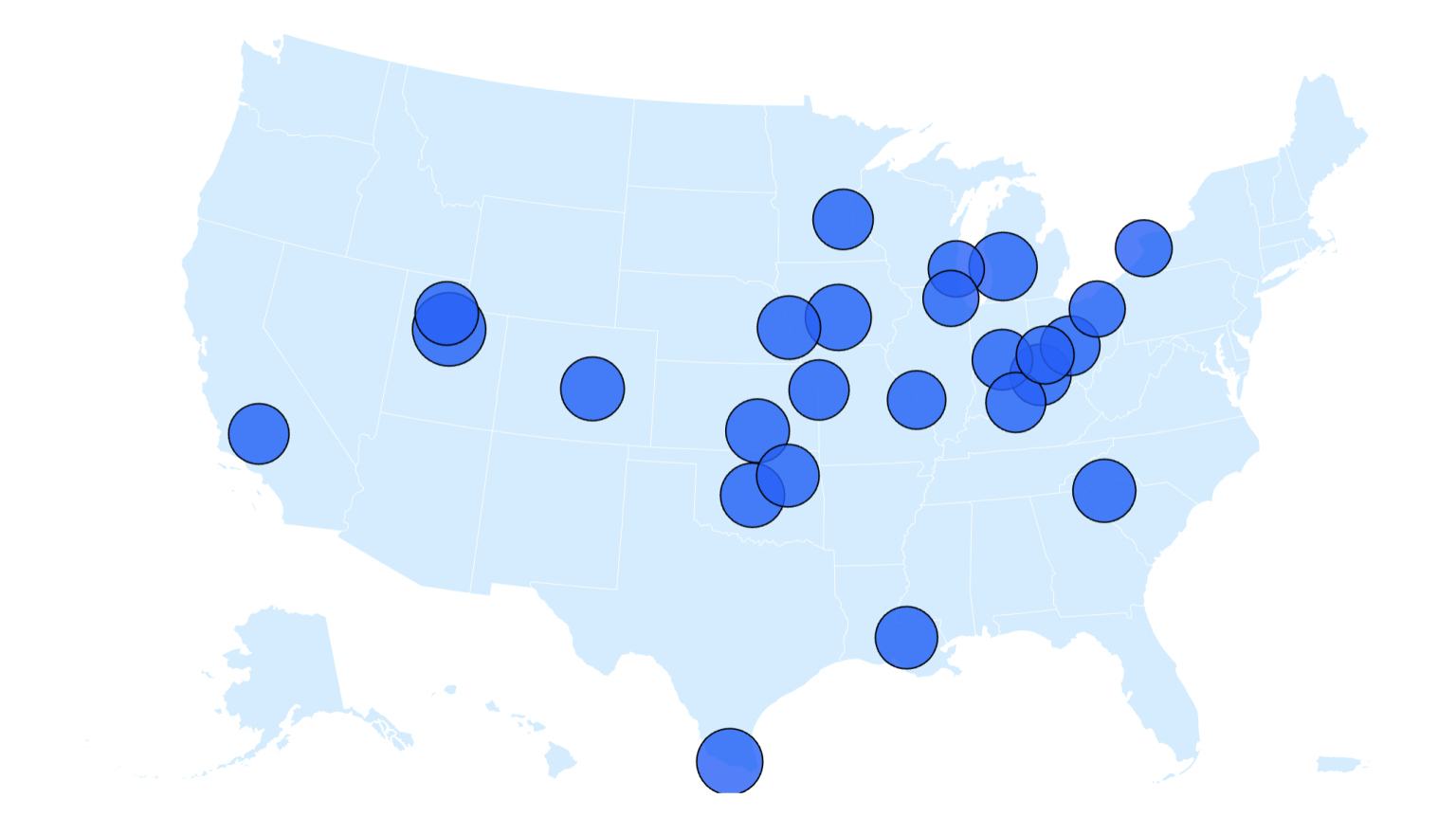

### The Map of Young Homeownerships in the U.S.

ConsumerAffairs analyzed data on 2000 U.S. residents under 35, offering insights into the regions most likely to attract young homeowners. While 10 met the criteria, readers of the study could be surprised by how widespread the experience was. Cities like Omaha and Provo emerged as hotspots, with Provo ranking second highest for young homeowners and垾 with a median homeownership rate of 24.4%. Despite these advances, the Midwest remains a particularly challenging area, and younger generations navigating the housing market for the first time face unique challenges.

In light of these analyses, the Midwest’s resurgence as a homebuying haven seems beacon of hope for many Gen Zers and millennials. While it hasn’t fully provided an alternative to traditional real estate markets, its data suggests a narrowing opportunity window with strong financial outcomes for young homebuyers. As the economy continues to evolve, understanding the factors driving these trends will be essential for policymakers, lenders, and homeownership agents seeking to engage young buyers.