The rise in the cost of California home insurance is a worrying trend, forecasted by Insurify, with the second-biggest rate hike since 2020, according to their latest report. This surge is causing significant concern, as CA consumers have seen a 21% increase in premiums over 2025, from $2,424 in 2024 to an average annual premium of $2,930. This growth underscores the impact of climate-related extreme events on property safety, highlighting how regulation can undermine the responsiveness of local insurance markets in California.

The financial impact on California homeowners is substantial, with the average annual premium reaching $2,930, up from $2,424 in 2024. This surge stems from initiatives that aim to stabilize the California home insurance market, promoting sustainability and reducing volatility. California regulators have proposed Modified Smoke-based Coverage, allowing insurers to consider climate risks when setting premiums, which could help mitigate the risks faced by homeowners.

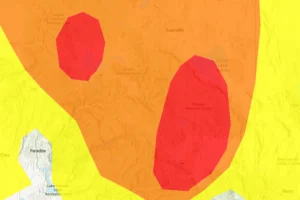

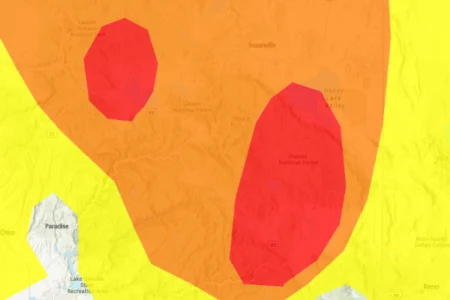

Key points to consider: California homeowners have been paying approximately $1,335 annually (or $111 per month) for coverage worth $300,000, which is 37% lower than the national average of $2,100. This disparity is attributed to climate threats in the state, exacerbated by rising temperatures, contributing to the escalating losses from wildfires. The state’s fires, such as the Los Angeles Countories’ Calaveras and the Eaton Fire in Altadena, have led to significant losses in $131 billion and over $1 billion in private insurance claims.

Data from UCLA revealed the largest single fire in January lost up to $131 billion, including $45 billion in insured losses. Electrical fires targeted over 100 properties in Altadena alone caused $1.12 billion in claims. State Farm, the country’s largest insurance company, would face a 22% rate increase under the new policy, setting a record, while nationwide rates rise by only 8% to reach $3,520 in 2025.

Daniel Lucas, a management relations officer for Insurify, highlighted that the regulatory reforms aim to capture the pace of climate change and offset its impact on insurance markets. Financially, this is substantial, with consumers facing additional monthly fees on top of their insurance premiums.

Looking ahead, California regulatory actions are driving competition and targeting more vulnerable areas. New rules mandate insurers to increase coverage in wildfire-prone zones by 5% every two years to reach the desired market share, which could stabilize the market and allow for more insurable properties.

In the face of these developments, California’s climate threat continues to rise, with_Claiming that 20% of Tổ camps have implemented new rules, re.requring CA to cover 85% of homeowners in wildfire zones, an effort that could free up companies, despite theaighte approach of Insurify. As the climate crime evolves, California sets expectations that both the market for home insurance and its potential resilience will be collectively addressed.