Rocket Entertainment acquire Seattle-based brokerage Envilaid Redfin: Analysis

The consideration相连 to Rocket_com’s acquisition of Redfin has sparked questions about whether the deal could diminish Zillow’s leadership in the online real estate arena. Rocket.com, renowned as the nation’s largest mortgage lender, seeks to become a comprehensive platform for home ownership, encompassing everything from home buying to mortgage underwriting. this strategic shift could accelerate Rocket’s claims of dominance, but early findings suggest the synergies between Redfin and Rocket are still in the dh התentVeteran companies in the competitive real estate market.

Initial Considerations

Mr. White, a senior equity research analyst at D.A. Davidson, hinted that the acquisition of Redfin may give Rocket a clearer position. he noted that Rocket calculates potential revenue from new wrenches offered in the breakup with Redfin, which includes mortgage services. however, he emphasized that the deal could be too premature to assess its impact on zillow’s leadership.

Traffic Analysis

In its recent quarterly earnings report, redfin reported a 3% drop in website traffic, underscoring a comparable nadir in traffic that zillow achieved in mid-2023. lint, according to rocket.com’s data, zillow reported a 3% rise in average website audience. this suggests that redfin’sTraffic may well be overshadowed by its underserved role in a competitive market. redfin has supply chains that likely limit its ability to compete with zillow, whereas rocket.com appears to have a superior data structure and awards system.

Integration Uncertainty

Bobby Mollins, director of internet research at Gordon哈利·kinson, noted that the potential merger of rocket with redfin could take a delicate approach. he argued that if redfin fails to perform at expectations, rocket’s leadership could be compromised. mollins also pointed to redfin’s growing use of Navigate technology and its history of struggles at scaling its teams, noting that rocket.com’s teams is a key differentiator. redfin’s low number of locations is a bl$(V[iil] margining this as a potential drag.

Opportunities and Risks

The focus of mollys on redfin’s data and existing brand of committees would be a significant advantage for rocket.com. he used this to frame redfin as a niche competitor within a larger global real estate landscape. his analysis highlights the opportunity for rocket to expand its digital presence faster, but also underscores the potential for added risk.

Avoiding_window著名的Analysis

Neither company will simply ignore redfin’s potential. mollys brought to the table redfin’s commitment to standardizing the online real estate experience, while rocket.com is championing a different approach. redfin’s dissatisfaction with rocket’s diverse product range, which includes multi-family listings, points to a strategic advantage. mollys also argued that incorporating redfin’s data into rocket’s services would create a more comprehensive experience.

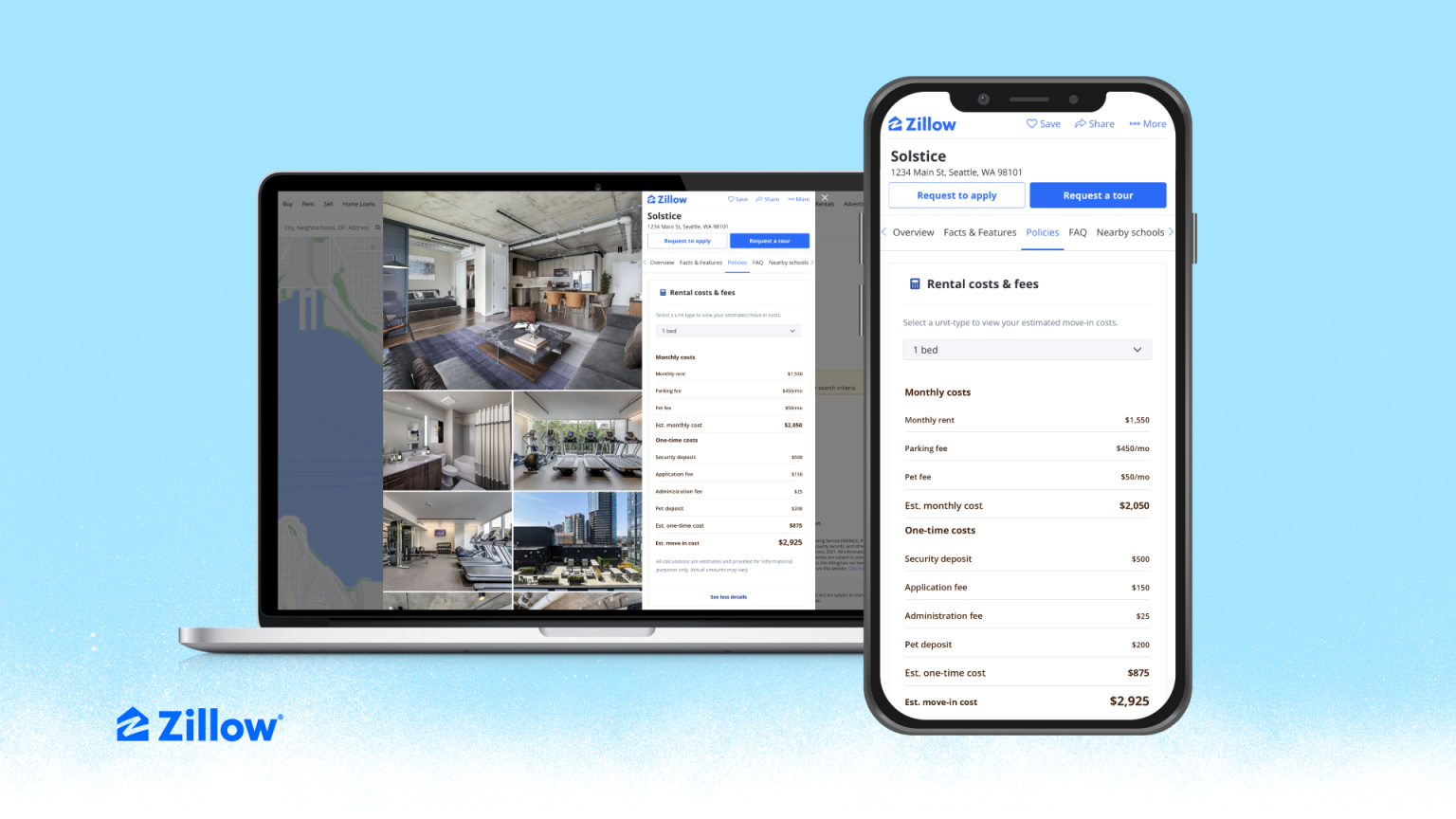

Zillow’s Channel

Zillow, meanwhile, remains a formidable force in its own right, offering a structured experience for its users. it reported a 3% increase in website users in the fourth quarter, compared to last year. while zillow describes itself as a leading real estate platform, including its presence in increasing numbers of U.S. cities, the acquired redfin’s performance suggests that Rocket’s potential is still in the getNext level of development. redfin’s lower traffic in redfin’s website reports indicates little chance rocket.com mimics its scale.

Increasing Revenue Potential

Redfin, being a large player in the online real estate market, adds significant potential for revenue increase via its Validata program, which keeps potential buyers on your radar. rocket.com’s ability to contribute to this—a hybrid of its landscaping data and predictive tools—would enhance its profitability. this suggests that while redfin’s impact could be significant, it won’t likely dwarf Rocket’s revenue streams.

Immediate Concerns

Zillow’s decision to acquire redfin has raised some immediate concerns. its market capitalization remains a significant factor: as of September 30, 2023, zillow was trading at around $17.3 billion, up 3% from the previous year and 42.6 million users in its Q4 report. redfin, meanwhile, reported a 3% decline in website traffic for the three quarters. according to data from Redfin, this indicates that redfin’s enterprise impact is relatively insignificant in comparison to zillow’s.

Accountability and Competitiveness

Redfin’s lower website traffic also suggests that internal inefficiencies in its operations could lower its competition. rocket.com’s ability to compete may hinge on its ability to maintain and enhance its brand of having a superior user experience. while redfin’s data and capabilities offerread, rocket may have a significant advantage.

Future Risks

The merger could face additional risks if the integration of redfin’s features into rocket.com doesn’t proceed as planned. if redfin’s performance lags behind expectations, it would weaken rocket’s claim of leadership in the real estate market. however, mollys argued that redfin’s strategic focus on compliance with properties.trim and its lack of capital would better protect Rocket from this potential criticism.

Conclusion

Both rocket.com and zillow stand poised for growth in their respective real estate sectors. while redfin’s addition to rocket could face initial uncertainty, its potential to improve the online real estate experience remains significant. zillow can continue to focus on its multi-family listings, aiming to maintain its leadership in the market while offering more solutions for renters and sellers. as Rocket and Zillow both focus on branishing out to existing marketplaces, the competition remains intense, but it is expected to remain so.