Zillow and Expedia Join OpenAI’s New ChatGPT App Platform: Opportunity or Risk?

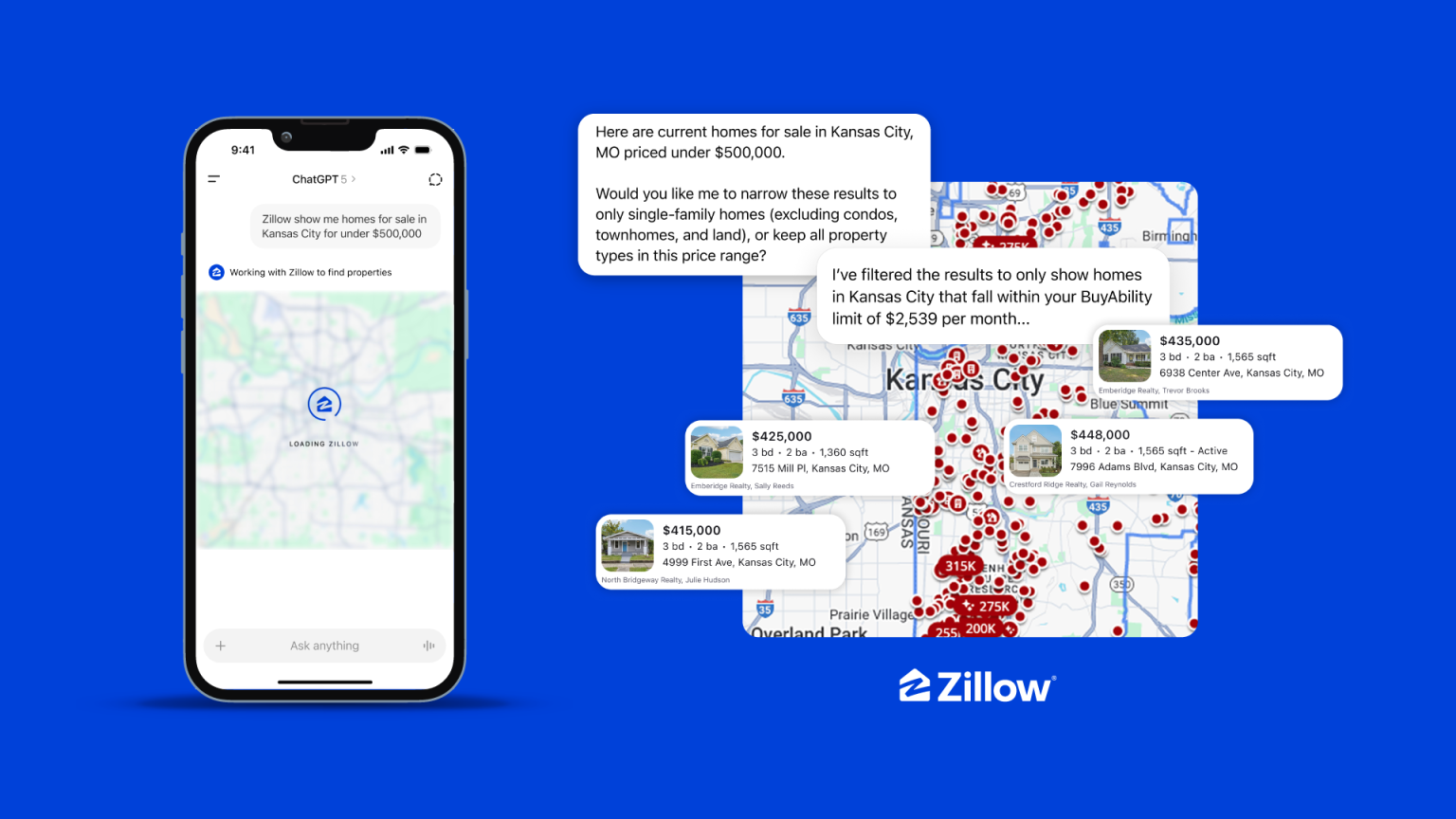

In a significant move that marks the next evolution of artificial intelligence integration in consumer services, Zillow and Expedia have established themselves as pioneering partners in OpenAI’s newly launched ChatGPT app ecosystem. Announced at OpenAI’s annual DevDay conference in San Francisco, the new platform allows developers to build interactive applications directly within the ChatGPT interface, creating seamless experiences for users without leaving the chat environment. During a compelling live demonstration, an OpenAI engineer showcased how users could search for homes in Pittsburgh through Zillow, generating an interactive property map directly within the conversation flow. With this integration, Zillow proudly announced its position as “the only real estate app available in ChatGPT,” highlighting the company’s commitment to leveraging cutting-edge technology for consumer-friendly innovations. Similarly, Expedia’s integration allows travelers to plan trips by requesting flight and hotel information directly through conversational prompts, streamlining the often complex process of travel planning into a natural dialogue.

The significance of this partnership extends beyond mere convenience features. With access to ChatGPT’s massive user base—reportedly exceeding 800 million weekly users—these Seattle-based companies have secured valuable positioning in what some industry analysts are already comparing to the “Windows of AI.” OpenAI’s new Apps SDK provides developers with comprehensive tools to connect their data, trigger actions, and present interactive interfaces directly within the chat experience. For users, this means the ability to discover properties through Zillow or plan vacations through Expedia using natural language, with the final transactions—such as booking a home tour or reserving a hotel room—then taking place on the companies’ own platforms. This arrangement maintains the critical revenue-generating aspects of these businesses while expanding their discovery channels through one of the fastest-growing technology platforms in history.

The integration represents a fascinating strategic decision for both companies, particularly considering their histories. Zillow, co-founded by Rich Barton (who also co-founded Expedia), has previously benefited from prominent positioning within other technological ecosystems. As noted by real estate technology blog Vendor Alley, Barton had previously highlighted how being featured in Apple keynotes substantially boosted Zillow’s consumer visibility and internal morale. The enthusiastic reception to Zillow’s ChatGPT demonstration suggests the company may be “winning the real estate AI race,” putting competitors at a disadvantage as they scramble to establish similar integrations. For Expedia, which operates in the highly competitive online travel booking space, securing an early position within ChatGPT potentially provides a significant advantage over rivals like Booking.com and Airbnb, allowing the company to capture travelers at the earliest stages of their journey planning process.

However, beneath the excitement of these new partnerships lurks a fundamental strategic question that echoes throughout technology history: Are these companies securing valuable positions in a revolutionary new platform, or are they ceding control to a potential future competitor? OpenAI CEO Sam Altman framed the Apps SDK as a way to help developers “rapidly scale products” by reaching hundreds of millions of users—language reminiscent of early mobile app stores and suggestive of OpenAI’s ambitions to establish an operating system-like dominance in the AI era. This platform approach positions OpenAI as a gatekeeper between users and services, a role that has historically proven problematic for businesses that become overly dependent on external platforms. Companies like Zynga (with Facebook) and countless publishers (with Google) have previously learned painful lessons about building businesses atop platforms they don’t control, only to see their fortunes decline when platform priorities shift.

The potential long-term implications of these partnerships have already sparked critical analysis from technology observers. Casey Newton of Platformer drew comparisons between OpenAI’s ambitions and Facebook’s troubled “social graph,” warning that an “AI graph” could pose even greater privacy risks given that ChatGPT stores users’ most intimate conversations. He also raised concerns about future economic incentives, questioning whether OpenAI might eventually auction off app placement in ways that could compromise user experience. Similarly, Martin Peers of The Information questioned whether app developers have meaningful incentives to participate if doing so means diminishing direct traffic and advertising opportunities. These critiques highlight the delicate balance these companies must strike: gaining exposure through ChatGPT while maintaining control over their core user relationships and revenue streams.

Despite these legitimate concerns, the immediate reaction to Zillow and Expedia’s ChatGPT integrations has been largely positive, reflecting the substantial potential benefits of early participation in what could become the defining platform of the AI era. By maintaining control over final transactions while leveraging ChatGPT for discovery and planning phases, these companies have crafted arrangements that capitalize on AI’s conversational strengths while preserving their business models. The applause that followed OpenAI’s Zillow demonstration underscores the perceived value of this positioning. As artificial intelligence continues reshaping consumer expectations around digital interactions, Zillow and Expedia’s early moves into ChatGPT’s ecosystem may prove to be prescient strategic decisions—provided they can maintain sufficient independence and user relationships even as OpenAI’s platform ambitions inevitably evolve. In the rapidly developing landscape of AI, these partnerships represent not just technological integration but high-stakes bets on the future nature of consumer discovery in the digital age.