From Promising Start to Receivership: The Vega Cloud Story

In the competitive landscape of cloud management solutions, Spokane-area startup Vega Cloud emerged as a promising player with an innovative approach to helping companies control their cloud spending. Founded in 2018 in Liberty Lake, Washington, the company developed specialized software in the growing field of FinOps (financial operations) that enabled businesses to track and optimize their expenditures across major cloud providers like AWS, Azure, and Google Cloud. Led by experienced tech entrepreneur Kris Bliesner, Vega Cloud had seemingly been on a trajectory toward significant growth, having raised $12.2 million in funding and achieving approximately $7 million in annual revenue by 2023. The company had earned recognition in the regional tech ecosystem, securing a spot at #181 on GeekWire’s Pacific Northwest startup index. Despite these promising indicators, however, Vega Cloud’s journey took an unexpected turn when it was placed into receivership in January 2024, declaring it could no longer meet its financial obligations.

The receivership process revealed a company facing significant financial challenges despite its innovative technology and established customer base. Court filings showed that Vega Cloud had accumulated substantial debt, including nearly $830,000 owed to Amazon Web Services and $3.5 million to secured creditor Sun Mountain Private Credit Fund I. The company had also issued approximately $2.5 million in convertible promissory notes to various investors throughout the previous year. At the time of entering receivership, Vega Cloud’s financial situation was dire, with less than $17,000 remaining in its bank accounts. The workforce had also contracted significantly, dropping from about 65 employees two years prior to around 35 by early 2024. The company’s shareholder structure showed Bliesner as the majority owner with approximately 30% stake, while other significant investors included Album Ventures (10%), Cowles Company (3%), and Rudeen & Company (3%), along with numerous smaller stakeholders including recognized names in venture capital like Voyager Capital and Alliance of Angels.

What makes Vega Cloud’s story particularly poignant is how recently the company had been projecting confidence and growth. Just months before entering receivership, in March 2024, CEO Bliesner had spoken optimistically about Vega Cloud’s future in an interview with GeekWire, revealing plans for a substantial funding round of $20-30 million and even discussing the possibility of eventually taking the company public. “We’re trying to push the envelope at Vega to maybe do the IPO route,” Bliesner had stated. “We think that’s a viable thing for us.” This stark contrast between public optimism and financial reality highlights the often precarious nature of startup operations, where companies may maintain positive public messaging even as they grapple with serious challenges behind closed doors. When contacted about the receivership, Bliesner acknowledged that the company was undergoing restructuring but was unable to provide further details about the situation.

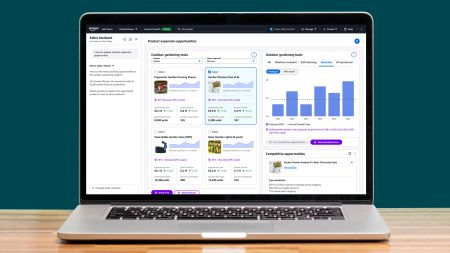

The technology that Vega Cloud developed addresses a growing and significant problem in modern business operations. As companies increasingly migrate their infrastructure to cloud platforms, many struggle with cost management and resource optimization, often spending unnecessarily on unused or inefficiently configured resources. Vega Cloud positioned itself at the intersection of financial and technical teams, creating tools that automated the detection of wasteful spending and recommended concrete solutions. This focus on mid-sized companies differentiated Vega from competitors, as did its multi-cloud approach that spanned the major providers. The company had secured contracts with impressive clients including Paramount, Hearst, Deloitte, Molina Healthcare, and John Wiley & Sons, demonstrating the value proposition of its technology. At the time of receivership, court documents showed roughly $264,000 in accounts receivable, confirming that the business had genuine market traction despite its financial troubles.

The Spokane tech community had viewed Vega Cloud as one of its potential breakout success stories. Investor Martin Tobias, who backed the company after relocating from Seattle to Spokane during the pandemic, had expressed significant confidence in Vega Cloud’s potential, telling GeekWire in early 2024 that it would likely be one of his most successful investments. Tobias specifically praised Bliesner’s approach, describing him as someone with deep market experience who had recognized limitations in existing solutions and developed a more effective alternative. “He took a new approach to an old problem,” Tobias had noted. Bliesner’s background lent credibility to this assessment; he had previously co-founded cloud migration company 2nd Watch, which raised approximately $56 million before selling a majority stake to Singapore-based ST Telemedia. This track record suggested he possessed both the technical understanding and business acumen needed to build a successful company in the cloud management space.

The receivership process now places Vega Cloud’s future in the hands of a court-appointed receiver, who has been granted authority to take control of the company’s assets, secure its accounts and data, evaluate and potentially sell its intellectual property, collect outstanding payments, and distribute proceeds to creditors according to legal priority. This state-level process, known as an Assignment for the Benefit of Creditors, serves as an alternative to federal bankruptcy proceedings and pauses creditor collections while placing decisions about the company under court supervision. While the outcome remains uncertain, such proceedings sometimes result in the sale of a company’s assets to new investors who may attempt to revitalize the business. However, the court filings do not include any specific timeline for asset sales or plans for continued operations, leaving the fate of Vega Cloud’s technology platform and its remaining employees unclear. What is evident is that despite developing valuable technology in a growing market and securing notable customers, Vega Cloud ultimately could not overcome its financial challenges – a sobering reminder of the difficult path from startup promise to sustainable business success in the competitive technology sector.