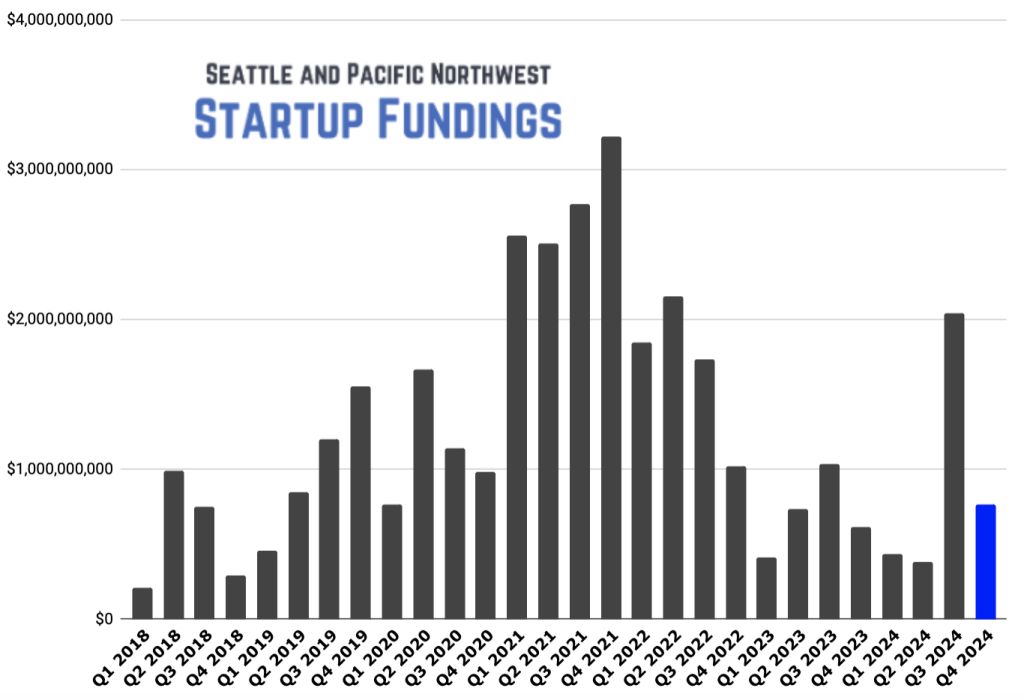

Paragraph 1: A Resurgence in Pacific Northwest Startup Funding

The Pacific Northwest startup ecosystem experienced a notable resurgence in venture capital funding during the fourth quarter of 2024, witnessing a year-over-year increase of more than 20%. Total funding reached $762 million across 48 deals, a significant improvement compared to previous quarters. While this figure remains considerably lower than the $3.2 billion raised during the peak of the venture capital boom in Q4 2021, it signifies a positive shift in momentum for early-stage companies in Seattle and the broader region. This growth suggests renewed investor confidence and a potential revitalization of the startup scene.

Paragraph 2: Key Funding Rounds and Sector Diversity

Several significant funding rounds contributed to the overall increase in Q4 2024. Fusion energy company Zap Energy and supply chain software startup Auger each secured over $100 million in investments, significantly bolstering the quarter’s total funding. Other notable rounds included investments in Carbon Robotics, a weed-zapping manufacturer, and Read AI, a productivity software developer. The diversity of sectors represented in these funding rounds, including artificial intelligence, logistics, biotechnology, apparel, space, healthcare, and clean energy, highlights the breadth of innovation within the Pacific Northwest startup ecosystem. This diversification suggests a healthy and resilient ecosystem less dependent on a single industry.

Paragraph 3: National Venture Capital Landscape and its Impact on the PNW

The overall venture capital market in the United States remained relatively subdued in 2024 compared to the record levels of 2021. This downturn was primarily attributed to a lack of exits and increased investor caution. However, the year concluded with a glimmer of optimism as interest rate cuts and the potential for increased mergers and acquisitions hinted at a possible market rebound. This national trend sets the stage for the Pacific Northwest startup ecosystem, influencing investor sentiment and the availability of capital.

Paragraph 4: Predictions and Challenges for the Venture Capital Market

Industry analysts at PitchBook offered a cautiously optimistic outlook for the U.S. venture capital market in 2025. While acknowledging ongoing challenges, they anticipated a moderate recovery. Despite the positive momentum, they cautioned that flat and down rounds, where companies raise funding at the same or lower valuations than previous rounds, are likely to persist at higher rates than historically observed. Furthermore, they predicted that more companies may face closure or exit the venture funding cycle altogether, highlighting the continued competitive and demanding nature of the market. This prediction underscores the need for startups to demonstrate strong fundamentals and adaptability.

Paragraph 5: National Funding Trends and the Rise of AI

National data revealed a mixed picture of the venture capital landscape. Total deal value in the U.S. increased to $209 billion in 2024, up from $162.2 billion in 2023. However, the total number of deals decreased from 14,712 in 2023 to 13,776 in 2024, suggesting a trend towards larger investments in fewer companies. Artificial intelligence emerged as a dominant force in the venture capital space, accounting for nearly half of the total U.S. deal value in 2024. Generative AI startups, in particular, witnessed explosive growth, raising $56 billion in 2024, a nearly 200% year-over-year increase. This dominance of AI highlights its transformative potential and its attractiveness to investors.

Paragraph 6: The PNW’s Position in the AI Revolution and Future Outlook

The Pacific Northwest, with its strong foundation in technology and innovation, is well-positioned to benefit from the growing interest in AI. Many of the top funding rounds during Q4 2024 were awarded to companies developing AI-powered enterprise software, further solidifying the region’s role in this technological revolution. The region’s ability to attract and nurture AI-focused startups will be crucial for maintaining its competitive edge in the evolving venture capital landscape. While challenges persist, the positive momentum observed in Q4 2024, combined with the region’s strengths in key sectors like AI, provides a foundation for continued growth and innovation in the Pacific Northwest startup ecosystem.