Real Estate Disruption: How HomeBuyMe Is Changing Homebuying After Historic Settlement

In the wake of a landmark legal settlement that transformed real estate commission structures across America, an innovative startup called HomeBuyMe is carving a new path in the housing market. Founded in 2024 and initially launched in San Diego, the company is now expanding to Seattle with a bold vision: empowering homebuyers to submit purchase offers without traditional real estate agents. The platform leverages artificial intelligence to guide users through the offer process step by step, integrating with DocuSign for contracts and ensuring all documents receive proper review from processors and independent attorneys. As HomeBuyMe’s Seattle-based CTO Tim Harader puts it, “This is a huge disruption to the entrenched homebuying process.” The timing couldn’t be more strategic, as the company positions itself at the intersection of technological innovation and a residential real estate market experiencing its most significant structural change in decades.

The transformation began in March 2024, when the National Association of Realtors (NAR) agreed to a massive $418 million settlement resolving nationwide antitrust lawsuits. For generations, American home sales operated under a system where sellers paid commissions for both their listing agent and the buyer’s agent—typically 5-6% of the home’s selling price split between both parties. This arrangement meant homebuyers rarely saw a direct bill for their agent’s services, though these costs were effectively embedded in transaction prices. The lawsuits claimed NAR rules forced sellers to pay artificially inflated commissions by requiring offers of compensation to buyer’s agents as a standard practice. Under the new settlement, sellers can still offer compensation to buyer’s agents, but this is no longer the default expectation in most Multiple Listing Service systems. Additionally, buyers must now sign contracts with agents at the beginning of the homebuying process, creating a more transparent but potentially more complicated landscape for consumers.

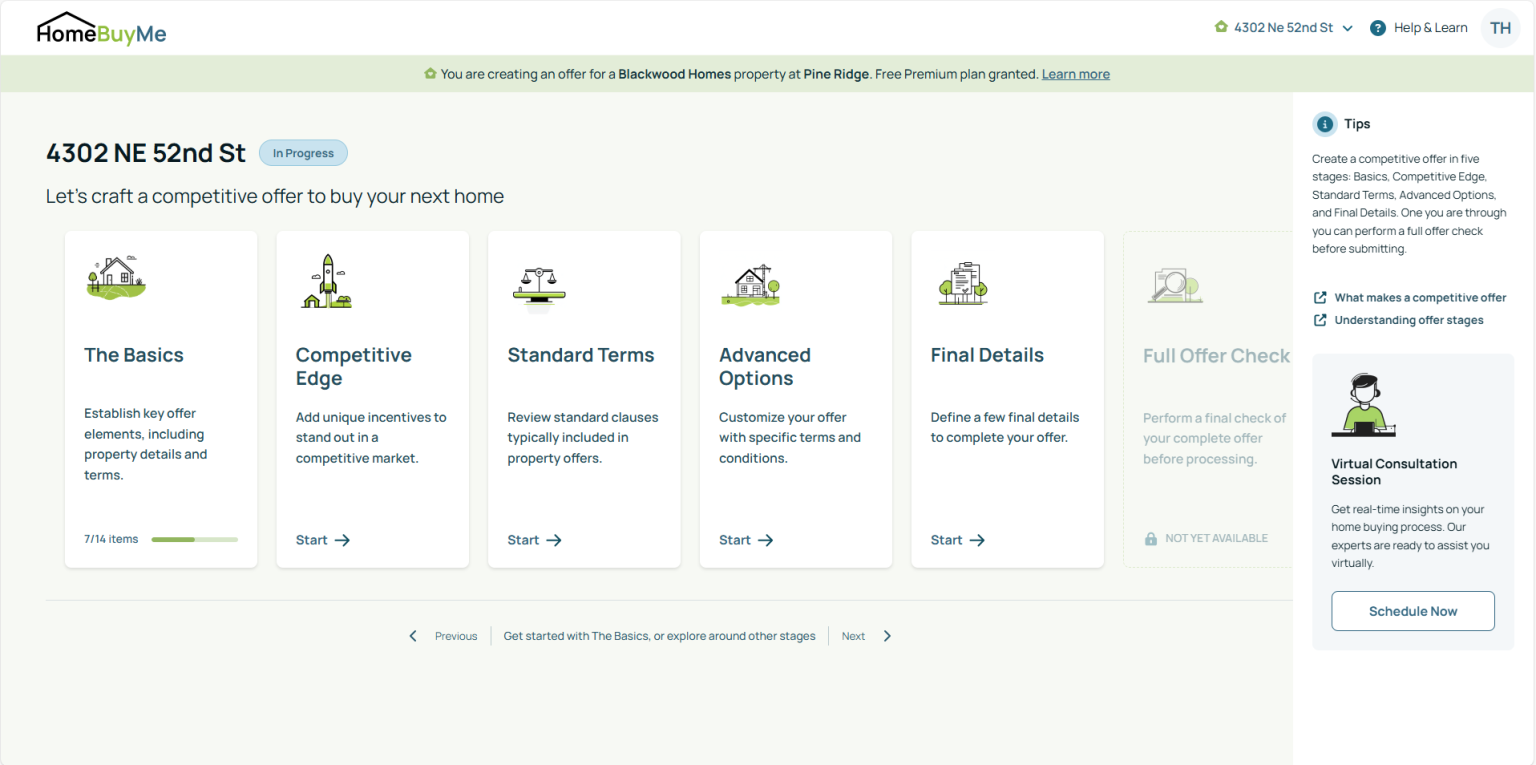

HomeBuyMe’s service targets buyers who have already identified their desired home and are ready to make an offer but wish to avoid the commitment that comes with a traditional buyer-agent relationship. “They want to have more control over the process but they still need guidance in creating the offer and in navigating the important steps that come after the seller accepts,” explains Harader. The company charges between $499 and $899 per offer submission—a fraction of what buyers might indirectly pay through traditional commission structures. Interestingly, the service becomes free when making offers on properties from partner homebuilders, highlighting the company’s dual business approach. While HomeBuyMe began with a direct consumer offering, it’s now pursuing B2B partnerships with homebuilders, including Seattle-region developer Blackwood Homes. These relationships allow builders to redirect savings from buyer-side commissions toward customer incentives like home upgrades or cash-back offers, creating a potentially compelling value proposition for both developers and homebuyers in an increasingly cost-conscious market.

Despite its innovative approach, HomeBuyMe faces significant challenges in reshaping deeply ingrained consumer behaviors and industry practices. As Harader acknowledges, “The residential real estate buying process hasn’t changed in over 60 years. Even with the new rules enacted in 2024 due to the NAR settlement, it will take some time for buyers and sellers to become aware of what they can do through HomeBuyMe and for us to earn their trust.” The company’s value proposition appears strongest for buyers who have already identified their target property, but many homebuyers still rely heavily on agents for discovering available homes, accessing property showings, and navigating the complexities of real estate transactions. HomeBuyMe’s success will likely depend on its ability to address these broader needs or to effectively partner with complementary services that fill these gaps while still delivering meaningful cost savings to consumers.

The startup’s leadership brings substantial technology experience to the real estate challenge. Harader previously worked at Microsoft for more than 13 years across two separate periods, while CEO Bill Goldberg and COO Frank Martin (another Microsoft veteran) also call the Seattle area home. This concentration of technology expertise in the leadership team reflects the company’s approach to real estate as fundamentally a technology and user experience problem that can be improved through digital transformation. The company has secured funding from angel investors and currently employs 22 people as it pursues expansion beyond its initial San Diego market. As HomeBuyMe grows, it positions itself not just against traditional real estate brokerages but against what Harader describes as their biggest competition: the status quo itself.

The emergence of HomeBuyMe represents a fascinating case study in how regulatory changes can create openings for technological disruption in established industries. The NAR settlement didn’t just resolve legal claims—it created space for new business models that would have struggled to gain traction under the previous commission structure. As homebuyers become more aware of commission costs and more comfortable with digital solutions for complex transactions, HomeBuyMe and similar platforms may find growing acceptance. However, the human elements of real estate—the reassurance of expert guidance, the value of local market knowledge, and the personal touch in what remains one of life’s most significant financial decisions—won’t easily be replaced. The most successful innovations in this space will likely be those that find the right balance between technological efficiency and human expertise, offering consumers meaningful choices rather than simply eliminating traditional options. For now, HomeBuyMe’s expansion into Seattle represents an important test of how ready consumers are to embrace a fundamentally different approach to buying homes in the post-settlement landscape.