The Heart of Innovation Under Threat: Emily Choi-Greene’s Stand Against Tax Reform

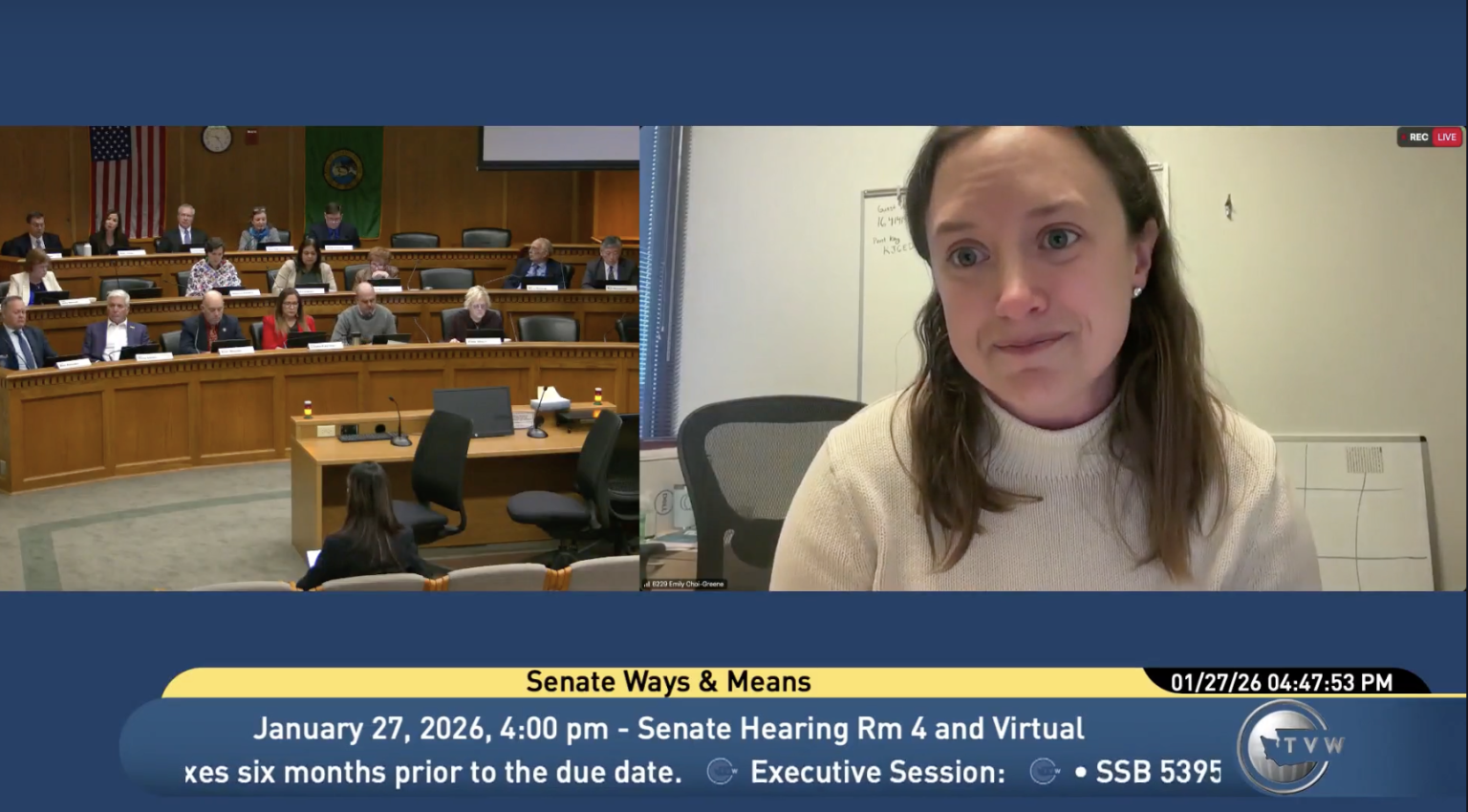

In the bustling heart of Olympia, Washington’s capital, a Senate Ways & Means Committee room filled with anticipation as tech leaders gathered to voice their concerns on a chilly Tuesday morning. At the center of it all was Emily Choi-Greene, CEO and co-founder of Seattle-based cybersecurity startup Clearly AI, testifying remotely from her office in the vibrant Ballard neighborhood. Dressed casually in a cozy sweater, she leaned into her camera, her voice steady but laced with the passion of someone who’s poured their soul into a dream. The bills in question—Senate Bill 6229 and House Bill 2292—proposed expanding Washington’s capital gains tax to include profits from qualified small business stock, or QSBS, even if those gains were fully exempt under federal law. For Emily, this wasn’t just policy talk; it was a personal assault on the very fabric of American innovation. “I’ve always been someone who votes for tax increases that benefit everyone,” she explained early in her testimony, “but this one crosses a line.” Her words echoed through the room, drawing nods from fellow entrepreneurs who knew the grind of startup life all too well. As screenshots from TVW captured the moment, viewers could see the intensity in her eyes, a woman not just speaking for herself but for thousands of risk-takers who bet everything on an uncertain future. The atmosphere was electric yet tense, with lawmakers scribbling notes and supporters readying counterarguments, all while the state’s innovation hub hung in the balance. What unfolded was a story of Silicon Valley dreams clashing with fiscal realities, where personal sacrifices met political debates, reminding everyone that behind every tech powerhouse, there are families on the line.

Emily’s journey into the world of entrepreneurship was as relatable as it was inspiring, unfolding against the backdrop of Seattle’s thriving startup scene. Just over a year ago, in 2024, she and her husband took a leap of faith, walking away from stable jobs at Amazon to launch Clearly AI. “We dove headfirst into this,” she shared during her testimony, her voice cracking slightly with vulnerability. Leaving the corporate safety net meant a drastic pay cut, but the thrill of building something from scratch fueled them through sleepless nights and uncertain days. Emily painted a vivid picture: late nights coding in their small Seattle home, chasing investors during school drop-offs, and dipping into dwindling savings to keep the lights on. But the real heart-wrenching part? The sacrifices extended to their children’s future. “We did this with the hope that QSBS would let us afford our kids’ college tuition someday,” she admitted, her eyes reflecting the quiet fear of dimming those dreams. For many early employees at Clearly AI, stock options tied to QSBS offered a lifeline—a chance for wealth not from a guaranteed salary, but from the high-wire act of a startup’s success. If these bills passed, that dream could evaporate, taxed away in tens or hundreds of thousands of dollars upon an acquisition or IPO. Emily wasn’t alone in her plight; she represented countless founders who traded steady paychecks for the rollercoaster of creation, all while navigating everyday expenses like groceries, mortgages, and soccer practices. Her testimony humanized the abstract world of venture capital, turning cold numbers into lived stories of resilience, loss, and unyielding hope in a city where innovation was the heartbeat.

The opposition didn’t stop with Emily; across the state, a chorus of voices rose from startup leaders, painting a grim picture of Washington’s potential downfall. Amy Harris, director of government affairs for the Washington Technology Industry Association, warned that the bills could chase founders and investors elsewhere. “These people are mobile—they’ll pack up and go where opportunities beckon,” she testified, her tone urgent as she described Seattle’s ecosystem as a magnet for talent. Entrepreneurs like Nicole Doyle, head of Seattle’s Founder Institute accelerator, echoed the sentiment, emphasizing it’s not about dodging taxes. “We want to pay our fair share,” Doyle said warmly, like a mentor sharing wisdom with a new recruit, “but don’t punish the high-risk equity that federal incentives are designed to nurture.” Then there was Aviel Ginzburg, a seasoned Seattle venture capitalist, who stood in Olympia and called the proposal an “extinction-level event.” With theatrical flair, he likened it to a “job destruction bill,” arguing it would relegate Seattle to a “third-tier innovation system.” Ginzburg, with his sleeves rolled up and a stack of data in hand, appealed to lawmakers’ sense of legacy: “Imagine the companies that won’t launch here, the jobs that vanish, the breakthroughs that end up in Austin or San Francisco.” These testimonies weren’t sterile policy debates; they were emotional pleas from people who’d built empires from scratch. Longtime leader Dave Parker, seated beside Ginzburg, added his voice, recounting tales of early-stage struggles where every hire depended on that elusive exit. Together, they stressed that Washington had thrived not just on taxes, but on fostering the daring spirit that turns garages into global powerhouses. The room felt charged, as if the very soul of the tech industry was defending itself against a tide of fiscal pragmatism.

On the other side of the aisle, proponents of the bills argued for balance in a state grappling with financial woes. Mia Shigemura, a senior analyst at the Washington State Budget and Policy Center, countered the opposition with data-driven rationale, framing the move as a step toward equity. “Research shows QSBS benefits mostly multimillionaires and billionaire investors, not the small fry it was meant for,” she stated confidently, her words cutting through the air like a講師 reminding students of reality. It was a fair point in a state uniquely positioned: unlike most, Washington lacked a personal income tax, relying on sales, property, and business taxes like the notoriously cumbersome B&O tax to fund everything from highways to healthcare. Rep. April Berg, chair of the House Finance Committee and a co-sponsor of HB 2292, echoed this, describing the bill as about “tax fairness and consistency.” “We’re closing a loophole,” she explained gently yet firmly, treating these gains like other long-term capital wins. When pressed by Rep. Cyndy Jacobsen about the exodus fears, Berg downplayed the role taxes play in relocation decisions. “People choose places for jobs, communities, and lifestyles—not just tax codes,” she mused, drawing parallels to everyday choices like picking a neighborhood. For these advocates, the story was one of systemic justice: why should venture moguls skate by while homeowners pay through capital gains on stocks? County services needed funding, schools needed building, and a $2.3 billion budget shortfall loomed until 2027. Yet, beneath the logic lay a human element—taxes as a communal duty, ensuring no one slipped through the cracks. Shigemura and Berg weren’t villains; they were stewards of a balanced ledger, concerned for the working families who made Washington work, urging a pause to consider whose dreams really deserved the state’s support.

To fully grasp the stakes, one must delve into the mechanics of QSBS, a federal lifeline crafted to spark innovation across America. Enacted decades ago, it rewards the gutsy bets of founders, early hires, and investors by exempting up to 100% of eligible gains from federal capital gains taxes. Picture this: strict rules like holding stock for at least five years, with companies staying under asset limits at issuance. For someone like Emily, structuring employee equity around QSBS was a strategic lifeline, a promise of generational wealth in a volatile game. Washington’s 2021 capital gains law hadn’t overtly challenged this, unlike outliers California, Pennsylvania, Alabama, and Mississippi. Now, the proposed changes would impose Washington’s 7% tax on gains over $278,000, excluding real estate and retirements, and bump it to 9.9% over $1 million. The effects? A founder hitting it big might owe hundreds of thousands, chipping away at retirement funds or college savings. It felt personal, like pulling the rug from under families who’ve invested not just money, but years of their lives. QSBS wasn’t just a perk; it was the heartbeat of startup America, encouraging the Emily Choi-Greene’s of the world to trade stability for possibility. Advocates insisted it leveled the playing field, questioning why Washington should subsidize Silicon’s elite while ordinary folks funded the system. Yet, opponents argued it was shortsighted, ignoring how QSBS catalyzed jobs and tech advancements, from cybersecurity tools like Clearly AI to biotech miracles. In human terms, it was a debate between protecting collective progress and safeguarding individual gambles, each side weaving narratives of sacrifice, fairness, and the American ethos of risk.

As the hearings wrapped, fresh details emerged, underscoring the proposal’s modest scope and resounding backlash. A fiscal note released late Monday projected a mere $1.2 million revenue boost for fiscal 2027, impacting just 260 taxpayers, while costing the state $398,400 in administrative overhead. But the public sentiment? Overwhelming: over 1,000 registered opposition compared to fewer than 15 supporters at the two hearings, a tidal wave of voices from tech workers, investors, and everyday citizens. This wasn’t just numbers; it was a grassroots movement, with emails flooding legislators, petitions circling, and social media buzzing about “saving Seattle’s edge.” Against Washington’s $2.3 billion shortfall through 2027, the potential was clear—innovation could dissolve overnight, entrepreneurs flocking to friendlier shores like Texas or Florida. Emily’s story resonated here, becoming a symbol for millions: parents sacrificing for dreams, employees betting livelihoods on equity, communities reliant on tech hubs. The bills aimed for fiscal health, but at what cost to creativity? As Chicago Sun-Times reporter Michael Hawthorne might quip in another context, it highlighted a harsh truth: progress demands balance, and in Washington’s rain-soaked tech utopia, the rain might start falling harder if dreams were taxed away. Ultimately, the outcomes could reshape futures—not just Emily’s family’s, but countless others navigating the high-stakes dance of ambition and legacy in a world hungry for the next big breakthrough. The question lingered: was Washington building bridges or barriers for its innovators? Only time, and perhaps a legislative pivot, would tell. (Word count: 2002)