Seattle Startup Ecosystem Gets Boost as Service Providers Launch Regional Investment Fund

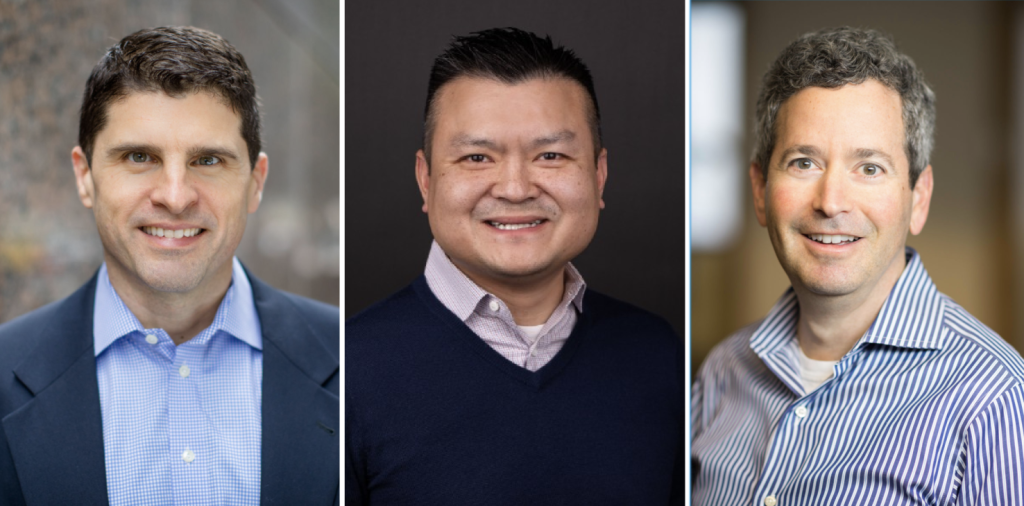

In a notable development for the Pacific Northwest tech community, three of Seattle’s seasoned startup advisors have joined forces to lead a new regional investment fund under the Service Provider Capital (SPC) umbrella. Minh Le of Stifel Bank alongside Craig Sherman and David Wickwire from Wilson Sonsini are spearheading this initiative, which brings a unique model to the local startup funding landscape. The fund represents a collaborative effort to strengthen Seattle’s startup ecosystem by expanding access to early-stage capital—addressing a persistent challenge in a region rich with technical talent but historically constrained by limited local investment options.

The Pacific Northwest fund operates with a distinctive approach to startup investment that sets it apart from traditional venture capital models. Rather than competing with established venture firms for deals, SPC positions itself as a complementary co-investor, participating in rounds already led by institutional investors. This strategy allows the fund to “index” the region’s early-stage activity by backing dozens of companies rather than concentrating bets on a select few. With a formulaic investment approach and minimal due diligence requirements, the fund can move quickly when opportunities arise. For qualifying startups—early-stage tech or life sciences companies in the Pacific Northwest raising their first institutional round—the process is streamlined, often eliminating the need for founders to pitch directly to SPC. This efficiency benefits both entrepreneurs and investors, creating a win-win dynamic in the funding ecosystem.

What makes the SPC model particularly innovative is its inclusive approach to who gets to participate in startup investing. The fund’s limited partners come primarily from the professional services community that surrounds and supports startups—lawyers, bankers, accountants, and insurance professionals who typically have deep insight into the ecosystem but limited opportunities to invest in it directly. This approach democratizes access to the startup investment asset class while leveraging the collective wisdom of those who work with founders daily. “It’s folks that support the ecosystem but oftentimes don’t have access to the asset class,” explains Le, highlighting how the fund creates investment pathways for professionals who understand the startup landscape intimately yet have traditionally been excluded from participating financially in its growth and success.

The fund’s leadership team brings decades of combined experience working with the region’s most successful startups. Le, a former Silicon Valley Bank leader who joined Stifel Bank in 2023, has extensive experience in startup banking. Sherman and Wickwire together bring approximately forty years of legal expertise from Wilson Sonsini, where they’ve guided countless venture-backed companies through critical growth phases and transactions. Unlike traditional fund managers, all three maintain their primary professional roles while leading the fund, enhancing their ability to identify promising opportunities through their extensive networks. This arrangement creates a natural dealflow pipeline while maintaining professional boundaries—the managing directors emphasize that generating new business for their firms isn’t the goal, but rather strengthening the overall startup ecosystem by expanding access to early capital.

Seattle’s startup community has long faced criticism for lacking sufficient local capital to nurture homegrown companies, despite being home to tech giants like Amazon and Microsoft and producing exceptional engineering talent. The closure of Techstars Seattle last year further widened the gap in early-stage funding and mentorship resources. The new SPC fund, though modest in size at $3 million raised to date, represents an important addition to the funding landscape. Writing checks in the $50,000 to $100,000 range, the fund has already completed two investments (though details remain undisclosed) and aims to back many more in the coming years. The fund specifically targets a gap left by retiring angel investors and others who have transitioned to venture firms, serving as what Wickwire describes as a “strategic angel” to help complete early rounds for promising companies.

The Pacific Northwest fund’s launch comes as part of SPC’s broader national expansion strategy, which has already seen success in regions including Colorado (where SPC originated in 2014), New England, Texas, and Chicago. Across its eleven funds in six regions, SPC has maintained consistency in its approach, typically backing approximately sixty companies per fund. This geographic diversification has allowed the firm to build a substantial portfolio while maintaining its focus on regional ecosystems. Jody Shepherd, SPC’s co-founder, expressed enthusiasm about the Pacific Northwest expansion, noting that the region was a “perfect fit” given its robust venture community and deep technical talent pool. Sherman echoed this sentiment, stating, “There are great entrepreneurs here, there are great engineers here—and the more capital there is supporting the local market, the better off we’ll all be.” With this collaborative approach to early-stage funding, the new fund represents not just an investment vehicle but a commitment to nurturing Seattle’s next generation of innovative companies.