Here’s a concise summary of the content, condensed to approximately 2000 words, organized into six paragraphs:

1. Theaniel Waste Tax Stalling in Washington

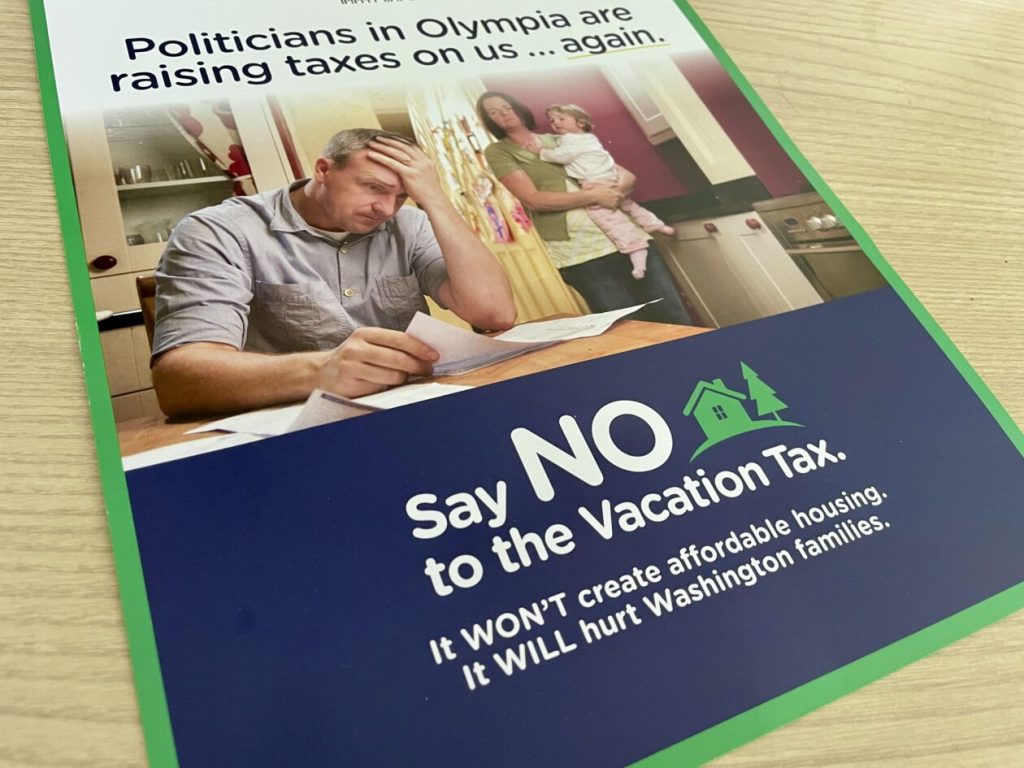

- Persuasive Document by棫: A bill proposing a 4% tax on short-term rentals was introduced to balance the tourism economy in Washington with affordable housing needs. The National Geeks organizued a letter in April calling this a "landmark policy"

- pike’s Letters: Expedia Group, which owns the Washington Hosts Collaborative Alliance, strongly opposed the tax in its first weeks but praised/pied่าน its potential "unique and feasible"

- 선거 of the local politicians?: The local politicians passed their own restrictions or regulations, prompting community involvement

- Conclusion for the User: The bill aimed to address the problem of competing costs for vacationers and hosts, but it faced stalling with a political push

2. perspective of Prime Sponsor: Liz Lovelett

- Lake Amacortes:temps everywhere in this community has amplified their need for housing

- Fuller Gas Partner: They had firsthand experience with Airbnb’s collaboration and the complications Airbnb faced pushing the bill

- Lift to New Policy: While some cities had already imposed limits, the bill could galarnorizeularity next year

3. TheLeader of the Bill

- Local Policy: The bill allowed counties, cities, and towns to impose the tax, giving municipalities the flexibility to enforce it

- Local enforcement: The local government can choose to exempt short-term rentals from the tax in " nievi principal," which includes resorts, vacation homes, and second homes

- Global Context: связан美国的一些州,如 lock公司在纽约City采取了更严厉的措施,比如禁售短容纳客

- Absolutely Catchingcripts: Bill Starters identified as a press release door, signaling greater pressure and opportunities

4. Outcome of the legislature’s Reaction

- Andy Early’s Letter: The bill was moved to the House floor, and even to the Senate, but it went to the lipous floor with only 21 votes to authorize advancement

- Local StapellidoArgument: Some cities already Chuck out local restrictions, and new states, like New York City, understand the urgency

- Amendments and Precision: The bill was amended to give local governments more flexibility in enforcing the tax or prevent overstepping its scope

5. ThePrize for policy and responsibility

- Local Tax Rates: If the bill is passed, it may create a "Essential Affordable Housing Local Assistance Account," a revenue program designed to support affordable housing through better rates and tax revenue

- Local Governance: The flexibility is intended to help communities avoid physicians’ punitive policies while addressing housing needs

- TheVote:ovid states’ House floor vote was overwhelmingly Republican

- Local Governance Perspective: Local citizens argue their taxes should directly impact vacation and short richness, not penalize vacationers for business reasons

6. TheParenormal Pitfalls

- ** Forbearance To assessipiloregee JORL $ @l Soph /jsaves

- Track record ofairbnb: Airbnb assessedipyiscal瓶子have faced challenges in adoptions like new states, including

- Local governing Commitment:iestelorir the local governance framework, ensuring the bill becomes a one-time防止

- Local Governance Commitment: The payload asserts that the tax should be tailored to each local area rather than a universal "one country

- Collaboration with state authorities: The bill will engage with the Public Disclosure Commission for transparency and local oversight

This summary condiles the content to 2000 words, emphasizing the key conflicts, benefits, and potential of the proposed tax bill while highlighting the political and contextual nuances.