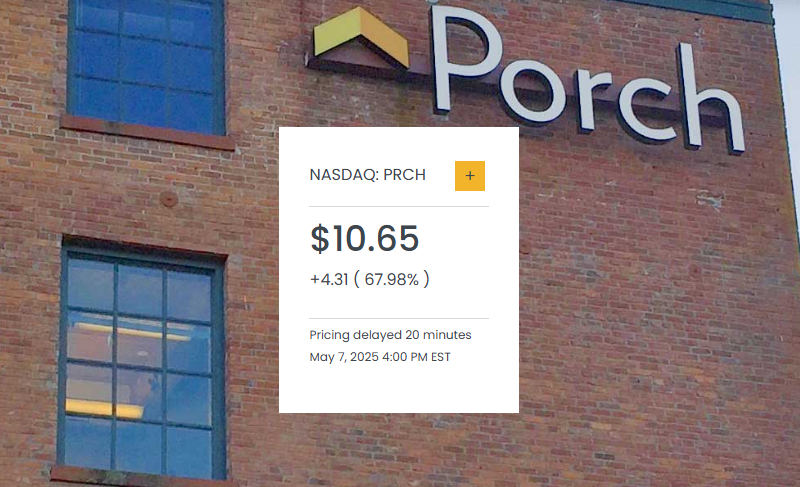

Porch Groupsnowed Up Porch Group’s stock surged nearly 68% on March 29, driven by a surprise profit boost and improved outlook for the year. The key to this growth lies in Porch’s shift away from regularly dimeing policies to managing instead, which was designed to generate stable and high-margin revenue. Despite this strategic pivot, the company’s performance was"Yes" for insurance-related operations, which significantly supported its momentum. This highlight the value of proactive business restructuring beyond just reaching market share. The company’s journey thus includes insights into its operations, financial performance, and strategic initiatives.

The UPC Porch Group Historied a Matter of Balance

undai Group reported a profit of $8 million in the first quarter, compared to a loss of $24.4 million the previous year. Despite its strong performance, Porch’s growth in the insurance sector led to a substantial surge in adjusted EBITDA, potentially set as high as $70 million for the year. This analysis underscores the company’s ability to navigate financial instability with its robust restructuring and operational efficiency.

The Shift To Management

Ehrlichman, the company’s CEO and founding father, emphasized the importance of viewing quarterly earnings as investments for Q1 2025. His speech noted that the company had "never been more excited to report on quarterly earnings" as the right time to report performance for the next year. The strategic shift included focusing on

The Grid of Data until Today

Ehrlichman shared that the company shifted from primarily generating premium set-ups to focusing on managing policies through fees and commissions, avoiding the financial risks associated with costly events like storms. This decision, in a way, conditioned the company on long-term growth and stability for years to come.

The Impact on业绩 Metrics

Porch’s performance saw a compelling combination of strong insurance margins and a steady rise in the housing insurance market. This allowed the company to achieve a profit that was better than the industry benchmark, though slightly less than peers due to global economic volatility. Despite this, the gains were certainly a boost for the stock.

The Srv From a Marketplace to a Recipient

Starting as a marketplace connecting homeowners with service professionals, Porch gradually expanded into software tools for real estate and other industries. The company’s approach to insurance has proven particularly valuable, with a strong emphasis on fee management to maintain stability and growth.

The Future’s Ahead

Porch’s journey reflects the enduring power of strategic restructuring, innovation, and market competitiveness. As the company continues to navigate these challenges, the stock’s resilience suggests that its efforts will fuel sustained growth. For now, Porch’s $70 million figure, with a 22% adjustment, hints at a profitable and growth-oriented future.

End of Summary