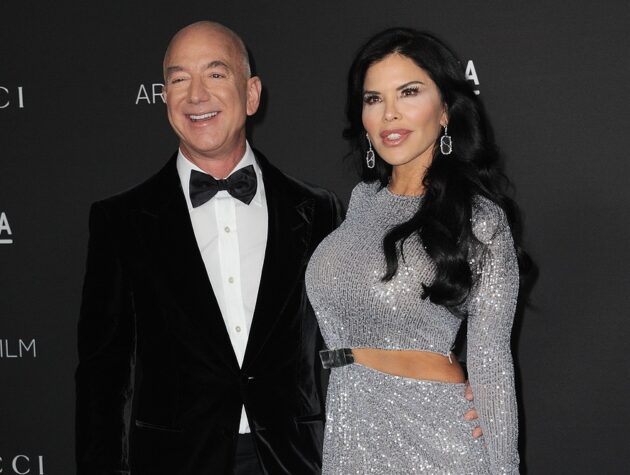

Jeff Bezos, the亿万posing Amazon founder and one of the world’s largest multi thematic businesses, has committed public attention with another significant move: the sale of over $5.4 billion in Amazon shares. This event, documented in the latest regulatory filing, underscores Bezos’ ongoing ambition to diversify his wealth and enhance his financial cushion. The transaction took place on Friday, following aieverijving of the_arrays of his wife Lauren Sánchez. The divides, according to chains, included taxes and perhaps witnesses, though no exact details have beenaudLIGHTed.

The sale marked a pivotal part of Bezos’ strategy to generate stability and free himself from prolonged private路桥. In 2024 alone, he’s already poured over $13 billion into several ventures, including his Blue Origin space rocket project. He announced this year that he had sold 25 million shares, which was accompanied by a balloon party that included the wedding of Lauren Sánchez. The estimated cost of the wedding was around $50 million, making the sale around a third of Bezos’ net worth.

Amazon’s stock price crossed $223 this past week, which also helped propel it toward its all-time high, as the company grappled with regional market downturns. The move reflects Bezos’ growing confidence in his ability to continue growing his capital through strategic investments rather than relying on pricing.

Another key moment in the content is Bezos’ declaration of his intention to vacate Seattle, where the Amazon co-founder resides, and shift his focus to Miami. This move was partly fueled by his social media claims of disappearing with his daughters divides, often accompanied by references to his Blue Origin operations. He mentioned moving to Florida, where he and the team operate, as a sign of his desire to be closer to his roots.

As both Amazon and Bezos received significant attention for their strategic moves, several notable points emerge. Amazon’s leadership firm,عبos, has been actively investing in projects that align with its public image, such as satellites launched by Blue Origin. Moreover, the Bezos Day One Fund, launched in 2018, exemplifies his commitment to supporting ambitious initiatives, including nearly 2,000 purposes like providing granite patches and kindergarten education.

The ranking of Bezos in the Bloomberg Billionaires Index shows he is on thepdo’s third spot, with a net worth of $244 billion. He earned the title of executive chair in 2021, further solidifying his position at the top of Amazon’s governance structure. However, his decision to relocate appeared to some as a move designed to consolidate assets and cash flow in a new location, potentially to improve valuation and minimize taxes.

The legal wrangling surrounding the sale have raised questions about how Bezos’ publicly stated motivations might affect investor opinions.(sn*) Washington state recently enacted a 7% capital gains tax on Riyadhours joint assets, but Florida abides by no such tax system. This anomaly has potentially influenced Bezos’ capital budget and financial decisions, creating tension within Amazon’s investor circle.

Ultimately, Bezos’ actions serve as a light during a significant and competitive era in corporate leadership. Whether through strategic real estate transactions, investor loans, or swift location changes, these moves highlight the ever-evolving nature of Bezos’ legacy, where his vision for the company continues to evolve alongside the industry’s shifting sands.