Veteran Tech Leaders Launch VQ Capital to Invest in AI and Cyber Intelligence

A group of seasoned technology executives with strong ties to Seattle has unveiled VQ Capital, a new investment firm focused on what they believe are the two most transformative forces in today’s economy: artificial intelligence and cyber intelligence. Based in New York but with plans for a significant Seattle presence, the firm represents a fresh approach to tech investing that breaks from traditional venture capital models.

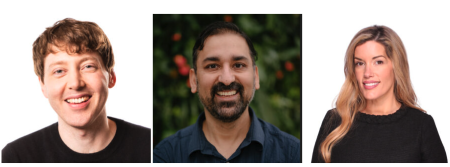

Brian Lent, an early Amazon leader who later founded predictive analytics startup Medio (acquired by Nokia in 2014), is spearheading the Seattle expansion of VQ Capital. He’s joining forces with longtime collaborator John Kim, whom he first recruited to Medio years ago. Kim brings valuable experience from executive product roles at major companies including Expedia, Vrbo, and PayPal. The leadership team is rounded out by Yotam Avrahami, who previously served as a partner at New Vista Capital and Deloitte, and Praveen Hirsave, whose extensive background includes executive positions at Expedia, Babylon, and a 15-year tenure at IBM. Together, they represent a blend of entrepreneurial vision, corporate leadership, and investment expertise.

VQ Capital has identified two primary investment themes that will guide their strategy. The first, dubbed “Golden Dome,” focuses on cyber intelligence, specifically seeking to fund technologies that can unify currently isolated cybersecurity tools into more cohesive systems. The second theme centers on the AI transformation of consumer companies, with the goal of helping marketing-led brands completely rebuild their fundamental operations—from customer acquisition and marketing to supply chain and fulfillment—into what they call “compounding, AI-native systems.” This dual focus reflects the team’s conviction that these areas represent the most promising frontiers for technological advancement and business growth in the coming years.

What makes VQ Capital particularly distinctive is its philosophy about the changing nature of technological progress. The firm believes the tech world has moved beyond the predictable, gradual advancement described by Moore’s Law into what they characterize as an “era of compounding change.” This acceleration is driven by three key factors: unprecedented hardware advancements, revolutionary new AI models, and the availability of massive data sets at scale. In this environment, VQ Capital argues that the most successful companies will be built by “small, extraordinary teams capable of out-maneuvering incumbent giants,” as John Kim expressed in the announcement. This perspective informs both their investment strategy and the types of founders and companies they aim to support.

The firm also distinguishes itself through its unconventional business structure. Rather than raising a traditional venture fund with a fixed lifespan, VQ Capital has adopted a more flexible approach working with family offices on a deal-by-deal basis. This model combines what they see as the best elements of private equity discipline with venture-style investing, potentially allowing for more tailored investment decisions and closer alignment with their capital partners. The genesis of VQ Capital itself reflects the entrepreneurial spirit of its founders—it evolved from YA6, a firm initially started by Avrahami, who brings unique perspective from his background in the Israeli Special Forces, before partnering with Kim and Lent to relaunch with an AI-focused investment strategy.

For Lent, who plans to build out VQ Capital’s Seattle presence, this new venture represents the next chapter in a career marked by innovation and transformation. After Nokia acquired his company Medio, Lent worked at HERE Technologies before launching real estate tech startup Plunk, which closed earlier in 2024. Most recently, he served as chief analytics and data officer at Auger, a well-funded logistics startup in Bellevue led by former Amazon executive Dave Clark. After seven months at Auger, Lent departed to help launch what would eventually become VQ Capital, bringing his expertise in data analytics and AI to this new investment platform. With Seattle’s growing reputation as a hub for both AI development and cybersecurity innovation, VQ Capital’s expansion in the region positions the firm at the intersection of talent, technology, and transformation in these rapidly evolving fields.