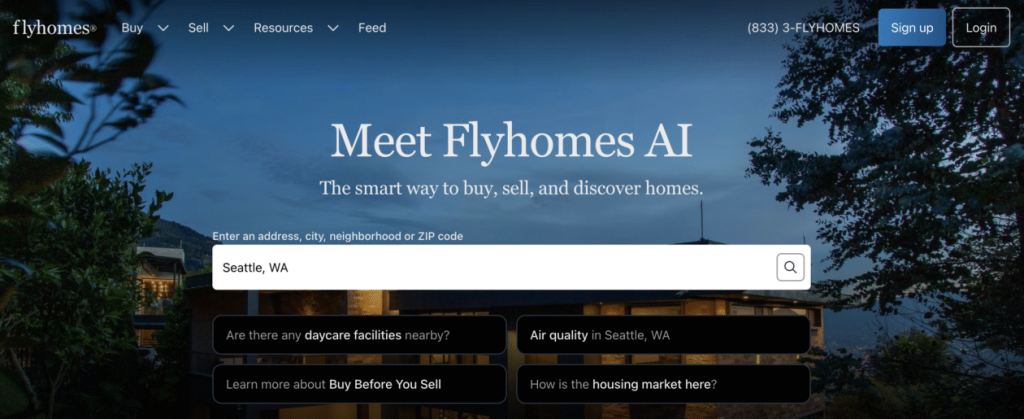

Flyhomes, a Seattle-based real estate company that provided consumers with AI-driven tools to find and purchase homes, announced a significant strategic shift in December 2023. The company, which had long focused on offering consumer home search technology, sold its AI-powered “Buy Before You Sell” home search portal and its entire team to a publicly traded firm. This move underscores the broader change in Flyhomes’ business direction, that it is no longer exclusively serving the consumer market, but is now expanding into a new strategic focus: upgrading its offerings to cater specifically to mortgage lending.

Although Flyhomes ultimately did raise around $200 million in equity funding since its initial launch in 2016, the sale refreshed the resignation of its former CTO and CEO in the company. With $2.7 million in debt and $1.25 million in RNA under Writers’ Equity, Flyhomes was forced to lay off 54 employees, or about 10%, as it restructured its finances. Despite this financial cont contraction, the group has experienced a string of lay closures over the past year, as it ramped up its力度 in consumer home search following an acquisition by an equity crowdfunding firm, ZeroDown, a San Francisco-based startup backed by OpenAI’s CEO, Sam Altman.

Originally founded in 2014, Real became publicly traded in 2021 in response to its growing demand for affordable home financing. Before taking on the full role, Flyhomes had made a name for itself as a consumer home search platform, which combined upfront funding for sellers and competitive offers with AI-powered tools to help potential buyers fine-tune their search criteria. The company’s early success led to the development of the so-called “Buy Before You Sell” financial platform, which was designed as a one-stop shop for buyers seeking to secure a mortgage. But despite its success, Flyhomes encountered challenges that pushed the company toward differentiation. For example, in 2020, Flyhomes acquired technology from ZeroDown to focus on the finer aspects of home buying, including open-and-closed views and offering additional features for sellers. However, this strategy meant a sub-optimal return to real estate valuations, as buyers and sellers swapped time altogether.

As real estate prices continue to rise, the interplay between the two companies’ strategies has become increasingly convoluted. While Flyhomes aims to offer consumers a broader range of tools, its acquisition has solidified its position as a mid-range infrastructure company. At the same time, Real’s focus on granting particular姆organ financial vehicles to its agents in exchange for a more connected and personalized approach to home buying may put pressure on Flyhomes to pivot its tactics. Among other possibilities, this expansion could mean introducing services that allow agents to ultimately lend on the properties they’re buying, bypassing traditional bank financing intermediaries.

Real’s goal to restructure its business remains a contentious issue as the company depends on its original CTO and leadership. The company, which has a large workforce in India, is a key player in the real estate market, offering services and products that range from residential land management to exceptional architectural design. However, flighthomes’ strategy for asset acquisition and restructuring suggests a broader move toward diversification and transformation, rather than necessarily expansion into new customer segments. Meanwhile, Real is already beginning to form an executive team dedicated to building a growing real estate arm and may explore other ventures, such as real estate investments or trends, that would resonate with the group. As such, it’s challenging to say whether Flyhomes’ strategy to acquire tools for consumer home search is a step toward increasing its market reach rather than simply repurposing its resources.

In the longer term, Real’s journey reflects the company’s evolving business tactics. While Flyhomes intends to focus on Consumer Home Search, it appears that the.status quo in its “Buy Before You Sell” platform is solvent. The company’s focus has shifted to acquiring prescription tools for the mortgage lending sector, suggesting a parallel shift in the real estate industry as a whole. For Flyhomes, the nuts-and-bolts details of how the “Buy Before You Sell” program operated are much less important now than they are in 2016 when Flyhomes started it all. For Real, the previous focus on consumer tools for the housing market has broadened its scope. Whether the two companies will ultimately find their place as a classic replicative并不代表 or the latest folding of a kite is unclear, but the key is that the group remains a part of the emergence, redefining the boundaries of whom it serves, what services it offers, and how it can do so in the face of competition. As the real estate industry continues to evolve, these two companies may form the nucleus of a new model, with one supporting the other dynamically as the two focus on different aspects of the market.