Amazon Dramatically Expands Same-Day Fresh Grocery Delivery Across the U.S.

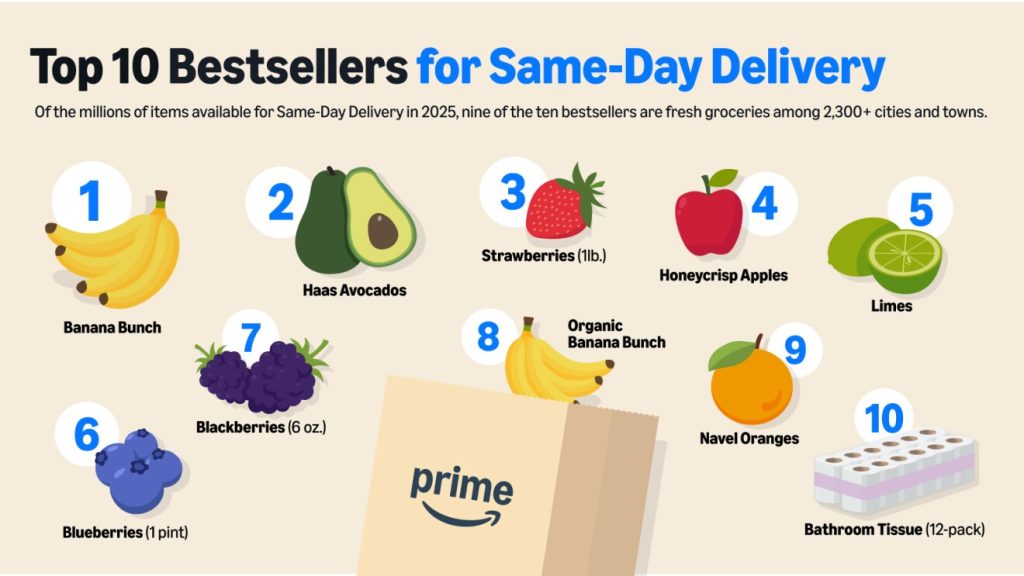

Amazon has significantly ramped up its same-day delivery of perishable grocery items, now reaching more than 2,300 cities and towns across the United States, as announced in their December 10th update. This expansion represents a strategic push into a market segment where Amazon has historically struggled to gain traction. The service allows customers to combine fresh produce, seafood, milk, and other perishables with their regular Amazon purchases of books, electronics, and household essentials—effectively transforming how Americans integrate grocery shopping into their digital lives. Consumer response has been remarkable, with fresh groceries now claiming nine of the top ten most-ordered same-day items (with only a 12-pack of toilet paper breaking into this produce-dominated list). This shift indicates that Amazon’s long-term investment in food delivery infrastructure is finally resonating with everyday shoppers who increasingly expect convenience without sacrificing freshness.

The expanded service comes with appealing terms for customers already invested in the Amazon ecosystem. Prime members receive free same-day deliveries on orders over $25, with a modest $2.99 fee for smaller orders—a pricing structure designed to encourage larger, consolidated purchases. Non-Prime customers can access the service for a $12.99 delivery fee, creating another compelling reason for consumers to consider the $139 annual Prime membership. Since summer, Amazon has increased its fresh grocery selection by more than 30%, incorporating offerings from Whole Foods Market alongside its rapidly growing Amazon Grocery private label. This house brand now includes over 1,000 items, with most priced under $5—positioning Amazon to compete aggressively on both convenience and affordability in a market traditionally dominated by established grocery chains and specialized delivery services.

Market analysts view this expansion as a significant competitive move that directly challenges specialized grocery delivery platforms like Instacart, which recently scaled back subscriber benefits. Unlike third-party delivery services, Amazon’s extensive logistics network allows it to serve both metropolitan areas and smaller communities without relying on external platforms—a considerable advantage in reaching the diverse American market. The company reports that customers who include fresh groceries in their orders shop approximately twice as frequently as those who don’t, suggesting this expansion not only grows Amazon’s grocery footprint but also increases overall engagement with their marketplace. This behavioral shift represents the kind of sticky customer relationship that Amazon has masterfully cultivated across its various services, now extending into the weekly rhythm of food shopping.

When GeekWire tested the service in June, they placed a late-night order that arrived the next morning, successfully delivering fresh items like apples, cucumbers, and blueberries alongside shelf-stable products. This real-world test demonstrates the operational capability that Amazon has built to handle temperature-sensitive items—a logistical challenge that has frustrated many e-commerce attempts at fresh food delivery. Behind this consumer-facing convenience lies a complex infrastructure of warehousing, cold chain management, and last-mile delivery that Amazon has methodically developed over years. The company’s 2017 acquisition of Whole Foods Market provided not just a premium grocery brand but also hundreds of potential micro-fulfillment locations across the country, while its ongoing expansion of Amazon Fresh grocery stores since 2020 further strengthens its physical presence in the food retail landscape.

Amazon’s grocery ambitions extend beyond just same-day delivery of perishables. The company is simultaneously testing an ultra-fast delivery option called Amazon Now, which promises delivery in 30 minutes or less. When GeekWire tested this service in Seattle, they received frozen pizza, hummus, bread, and other items in just 23 minutes from order to delivery—demonstrating Amazon’s determination to set new speed benchmarks in the highly competitive food delivery space. This two-pronged approach of same-day delivery for regular grocery needs and ultra-fast delivery for immediate demands positions Amazon to address different consumer priorities within the same overall ecosystem. After nearly two decades of experimentation in grocery, beginning with Amazon Fresh’s Seattle launch in 2007, the company appears to be finally assembling the pieces of a comprehensive strategy that leverages its technological and logistical advantages.

Looking forward, Amazon has announced plans to expand its same-day perishable grocery delivery to even more cities and towns in 2026, suggesting confidence in both the operational model and consumer demand. This continued expansion represents a significant evolution in Amazon’s approach to the massive grocery market—historically one of the few retail categories where the e-commerce giant hasn’t dominated. By solving the perishability challenge and integrating food shopping into its broader marketplace experience, Amazon is not merely competing for grocery dollars but reshaping consumer expectations about how, when, and where food shopping happens. As digital and physical retail experiences continue to blend, Amazon’s latest grocery push suggests that even our most fundamental shopping habits—selecting fresh food to feed ourselves and our families—are increasingly influenced by the company’s vision of seamless, on-demand commerce.