The Biden administration, in its final days, has authorized another $4.28 billion in student loan forgiveness, specifically targeting public servants. This latest tranche of relief benefits approximately 54,900 individuals working in fields such as teaching, healthcare, and emergency services, bringing the total amount of student loan forgiveness under the Biden presidency to a staggering $180 billion, impacting nearly 5 million borrowers. This action underscores the administration’s commitment to fulfilling its campaign promise of addressing the student debt crisis and supporting those who dedicate their careers to public service. Secretary of Education Miguel Cardona lauded the program as a successful revitalization of the Public Service Loan Forgiveness (PSLF) program, highlighting the administration’s focus on tangible benefits for working Americans.

The focus on the PSLF program represents a strategic shift after the Supreme Court struck down the administration’s initial, broader student loan forgiveness plan. The Court deemed the initial plan an overreach of executive power, forcing the administration to explore alternative avenues for providing debt relief. The PSLF program, with its targeted approach towards public sector employees, offers a more legally defensible mechanism for addressing student debt burdens. This targeted approach is politically appealing, focusing on individuals perceived as contributing significantly to society.

The administration emphasizes the PSLF program’s role in incentivizing individuals to pursue and remain in public service careers. By offering loan forgiveness after 120 qualifying monthly payments, the program aims to alleviate the financial burden of student debt for those serving the public. This approach is presented as a tangible investment in vital public services, recognizing the contributions of teachers, healthcare professionals, and other essential workers. The administration argues that this investment strengthens these crucial sectors and ultimately benefits the broader community.

This latest round of loan forgiveness incorporates borrowers who benefited from the limited PSLF waiver, a temporary expansion of eligibility criteria that expired in October 2022, as well as those who qualified under regulatory improvements implemented during the Biden administration. This expansion of the program reflects the administration’s efforts to maximize the reach of student debt relief within the confines of existing legal frameworks. It represents an attempt to provide relief to as many eligible public servants as possible before the end of the Biden-Harris term.

The political implications of these student loan forgiveness initiatives are significant. While the Biden administration frames the programs as vital support for essential workers and a necessary step towards addressing economic inequality, critics argue that these measures constitute irresponsible spending and potentially contribute to inflation. Further, the legality of these targeted forgiveness programs, while seemingly more secure than the initial broader plan, could still face legal challenges. The debate over student loan forgiveness remains a contentious issue within the broader political landscape, reflecting differing perspectives on the role of government in addressing economic challenges and individual responsibility.

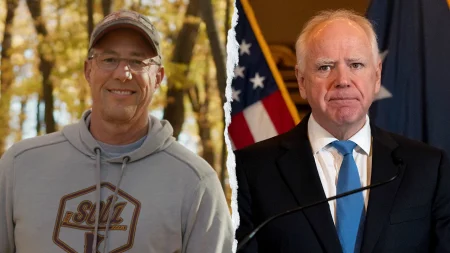

The incoming Trump administration faces the complex task of navigating the existing student loan landscape, including the programs implemented by the Biden administration. While President-elect Trump has expressed intentions to overhaul the education system, his specific approach to existing student loan forgiveness programs remains unclear. The future of these programs, and the broader issue of student debt, will undoubtedly be a focal point of political debate and policy decisions in the coming years, reflecting the ongoing national conversation about the affordability and accessibility of higher education.