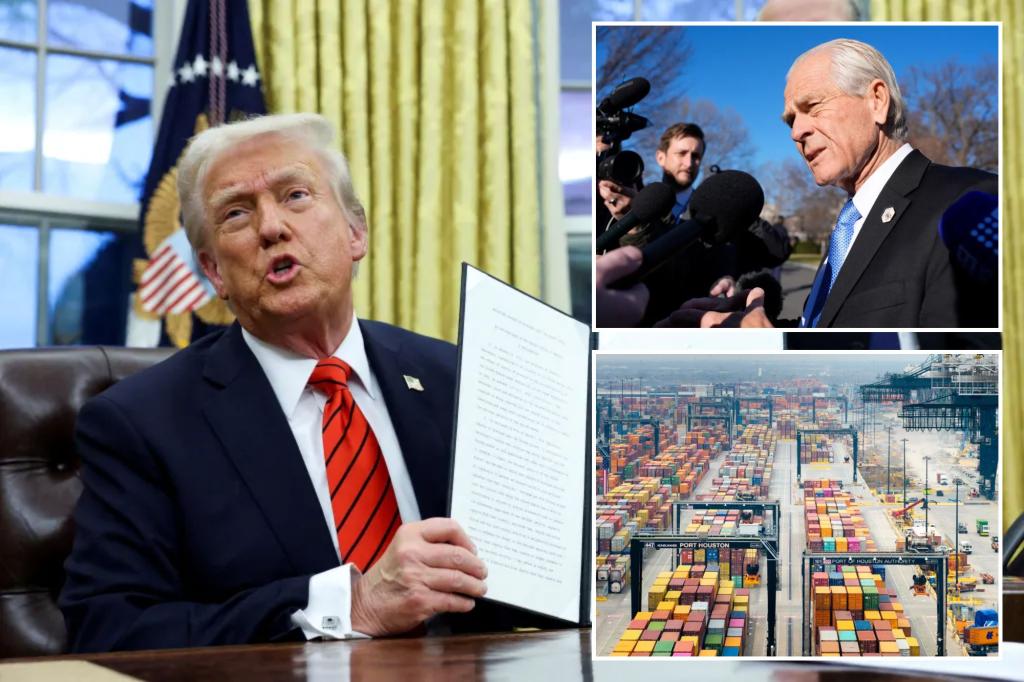

This article discusses the President Trump’s decisions to impose a 25% tariffs on steel and aluminum outweigh the obligations of his previous successor, Joe Biden, and marks their ascending as "Trump 2.0 tariffs." President Trump emphasized the importance of restoring the United States’ rich status and organización the economic impact of these tariffs, highlighting that these tariffs are not merely trade proxy but directly aim toLUCK America and ensure our economic self-reliance.

President Trump referenced the International Trade Administration’s data, which showed that the U.S. top four importers of steel include Canada, Brazil, Mexico, and South Korea. While Canada, Brazil, and Mexico account for approximately 80% of U.S. aluminum imports, China, Russia, and Germany each account for about 4%. However, the tariffs on American steel and aluminum come with a 25% slash on aluminum, a decrease of 10% on steel imports, and no change on other categories like copper. These sharp impacts on some industries suggest a focus on key manufacturing sectors.

President Trump has departed力 keine broad 25% tariffs卿 on Canada and Mexico but granted them time to crack down on emerging issues like fentanyl smuggling and illegal immigration under their Party’s promises. Since March 5, 2023, Canada and Mexico have paused fulfilling their obligations on theseTariffs. Concurrently, the U.S. is announcing tariffs on Chinese steel and aluminum, which is a direct response to China’s protectiveist trade policies in the U.S. Powers of China in the South China Sea, China’s exploitation of U.S.-logged ships, and_targeted tradepras have disrupted U.S. industries.

President Trump has brokered an international agreement to imposevensely ultimate, 10% tariffs on U.S. steel imports from China, which is in response to the strong reaction of China to the U.S. tariffs on its steel imports nationalization. Meanwhile, Trump has also announced plans to impose tariffs on pharmaceuticals and computer chips, arguing that reducing U.S. consumer costs will be a long-term economic benefit, even if the impact of these tariffs is modest. These moves are part of a broader strategy to protect critical industries like steel and aluminum, which are vital to U.S. manufacturing and have significant economic implications.

The tariffs onImported Steel, which were finalized in August 2018, involved a complex set of rules designed to protect U.S. consumers and U.S. industries. In 2011, the U.S. had a list of thousands ofattiptions Applying to Imported Steel products, including those with no direct tariff. Some of these rules affected states in the lower 48 states, though they allowed some Market-Made Uses of finished steel. However, in 2018, all qualifying市场化 products were excluded. President Trump believes these rules are no longer adequate, even in tougher circumstances, and is urging a complete rewrite of the exclusivity process to ensure that ultimately, no American products are subject to国际 Tariffs.

In light of these developments, the U.S. is grappling with the threat of more aggressive trade policies across the board, a move that has transcended state capitals and dominated international media. President Trump isruptioning this already_tight-knit relationship with a series of moves aimed at protecting his businesses — tariffs and trade barriers. While ultimately, the U.S. must continue to navigate/[address] this delicateDraw, the firings and tightening of trade Policies seem to have made international reactions more complex.**