Climate-Fueled Insurance Crisis Reshapes American Housing Market

Insurance Premiums Soar in Climate-Vulnerable Regions, Altering Real Estate Landscape

In an unprecedented shift transforming the American housing landscape, homeowners in climate-vulnerable regions are facing a financial squeeze as insurance premiums skyrocket far beyond inflation rates. New research reveals that these escalating costs are fundamentally altering housing affordability, home values, and purchase decisions across significant portions of the United States. The trend represents what experts describe as a rapid repricing of climate risk that is beginning to cascade through residential real estate markets, with profound implications for homeownership and regional economies.

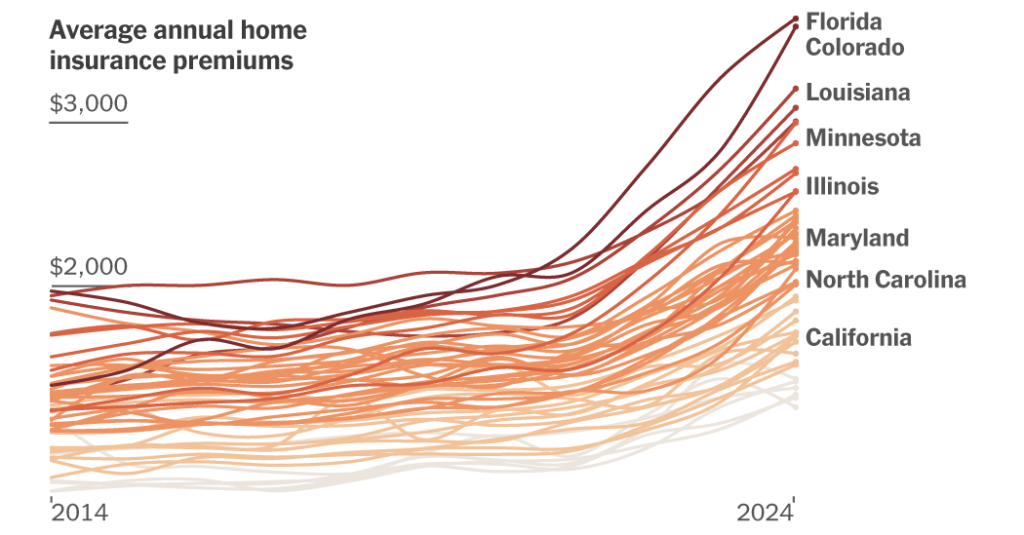

According to groundbreaking research by economists Benjamin Keys and Philip Mulder from the National Bureau of Economic Research, insurance premiums have surged by an average of 58 percent nationwide since 2018 – substantially outpacing overall inflation. However, this increase has manifested unevenly, with the most dramatic spikes occurring in regions susceptible to climate-related catastrophes such as wildfires, hurricanes, and severe hailstorms. “What we’re witnessing is the financial manifestation of climate change risk in the housing market,” explains Dr. Keys. “These premium increases reflect insurers’ growing recognition that historical weather patterns no longer reliably predict future disaster probability and severity.”

The Growing Insurance Burden on Household Budgets

The financial strain of rising insurance costs has reached critical levels in numerous communities across America. In hail-prone Midwestern states, insurance now consumes more than one-fifth of the average homeowner’s total housing payments – including mortgage, property taxes, and insurance combined. The situation is even more dire in Orleans Parish, Louisiana, where insurance premiums now represent nearly 30 percent of total housing expenses for the typical homeowner. For many Louisiana residents interviewed during the research, their monthly insurance bills now exceed their mortgage payments – a previously rare financial arrangement that is becoming increasingly common in high-risk areas.

This insurance cost burden has begun disrupting real estate transactions in vulnerable regions. Prospective buyers are increasingly factoring these expenses into their purchase decisions, with many unable to afford the combined weight of mortgage payments and escalating insurance premiums. Real estate agents report clients abandoning potential purchases after discovering insurance quotes that sometimes double or triple their expected housing costs. “We’re seeing qualified buyers walk away from otherwise perfect homes simply because they can’t secure affordable insurance,” notes Jennifer Martinez, a real estate broker in coastal Florida. “It’s fundamentally changing what properties people can realistically consider purchasing in these areas.”

Climate Risk and Regional Insurance Disparities

The geographic disparities in insurance costs reflect varying exposure to climate-related hazards, though the relationship isn’t always straightforward. While coastal regions facing hurricane threats and western areas with wildfire risk generally experience the highest premiums, other factors create a more complex pattern. State regulations, local policies, and market competition can mitigate price increases even in high-risk locations. California, for example, has kept premiums lower in some high-risk wildfire zones through regulatory intervention, though many insurers have responded by limiting coverage availability or withdrawing from the market entirely.

Non-climate factors also influence premium pricing, with homeowner credit scores, property characteristics, and local rebuilding costs playing significant roles. Yet the research demonstrates that climate vulnerability now serves as a primary driver of regional insurance disparities. Maps of premium increases since 2018 closely align with climate risk models, showing the most dramatic price escalations in hurricane-prone coastal communities, wildfire-susceptible regions of the West, and hail-exposed areas across the Midwest and Great Plains. These patterns reflect what Keys and Mulder describe as a “climate epiphany” that has transformed how insurers assess and price risk in the wake of record-breaking natural disasters since 2017.

The Reinsurance Factor: Why Premiums Are Climbing

The researchers identify several key factors behind the steep premium increases, with about 20 percent attributable directly to the insurance industry’s reassessment of climate risks. An often-overlooked component of the insurance ecosystem – reinsurance – plays a pivotal role in this trend. Reinsurance companies, which provide financial protection to primary insurers against catastrophic losses, have approximately doubled their rates in recent years following a series of historically costly disasters.

“Reinsurers operate globally and have experienced significant losses from climate-related events worldwide,” explains Dr. Mulder. “They’ve responded by dramatically repricing risk, and those costs inevitably flow through to homeowners.” Beyond climate reassessment, rising rebuilding costs account for about 35 percent of recent premium increases, according to the research. Construction material inflation, labor shortages, and supply chain disruptions have all contributed to higher replacement values for homes, which insurers must factor into their premium calculations. Population shifts toward high-risk areas and general inflation account for the remaining premium growth, creating a perfect storm of upward price pressure.

Insurance Costs Depress Home Values in Vulnerable Areas

Perhaps most concerning for homeowners in climate-vulnerable regions is the emerging impact on property values. Since 2018, the research reveals that homes in ZIP codes with the highest exposure to hurricanes and wildfires now sell for an average of $43,900 less than they otherwise would have – a direct consequence of the insurance market’s rapid repricing of climate risk. This represents a significant wealth impact for existing homeowners, many of whom purchased their properties before the insurance market’s “climate epiphany” began eroding their equity.

The value depression stems from buyers incorporating lifetime insurance costs into their purchase decisions. “Homebuyers consider the total cost of ownership,” notes Dr. Keys. “When insurance adds hundreds of dollars to monthly housing expenses, buyers compensate by offering less for the property itself.” This price adjustment is particularly pronounced in high-risk coastal communities and fire-prone areas, where some homeowners report insurance premiums that have tripled or quadrupled in recent years. The study found that in the most exposed communities, home price appreciation since 2018 has lagged significantly behind comparable properties in lower-risk areas – a divergence that accelerated following major disaster events.

The Future of Housing in a Climate-Changed America

The research paints a concerning picture of housing market transformation as climate change intensifies. Insurance, once a relatively minor consideration in the homebuying equation, has emerged as a decisive factor shaping housing affordability and accessibility. Experts warn this trend may accelerate as climate risks intensify and insurers continue adjusting their models to reflect new realities. “We’re only at the beginning of this repricing process,” cautions Dr. Mulder. “Climate projections suggest risks will continue increasing, which means insurance markets will likely continue adjusting prices upward in vulnerable regions.”

For policymakers, the situation presents complex challenges. State insurance regulators face pressure to keep coverage affordable while ensuring insurance companies remain financially viable. Some states have established special insurance programs for high-risk properties, but these public backstops face sustainability questions as climate impacts intensify. Meanwhile, homeowners in affected areas face difficult decisions about whether to absorb rising costs, invest in mitigation measures, or consider relocation to lower-risk regions – options that vary widely in feasibility depending on individual financial circumstances. What’s clear from the research is that insurance markets are sending powerful price signals about climate risk that are reshaping American housing patterns, potentially previewing larger demographic shifts as climate change advances in the coming decades.

About the Research Methodology:

The groundbreaking analysis by Benjamin Keys and Philip Mulder calculated annual homeowners’ insurance costs by separating mortgage and tax payments from loan-level escrow data obtained from CoreLogic, a property and risk analytics firm. Their methodology allowed them to isolate insurance premium trends from other housing costs between 2014 and 2024. The home insurance share of total home payments is based on mean values and includes insurance, property tax, and mortgage principal and interest costs. The research notably excludes utilities and homeowners’ association fees, which aren’t typically captured in escrow payments.