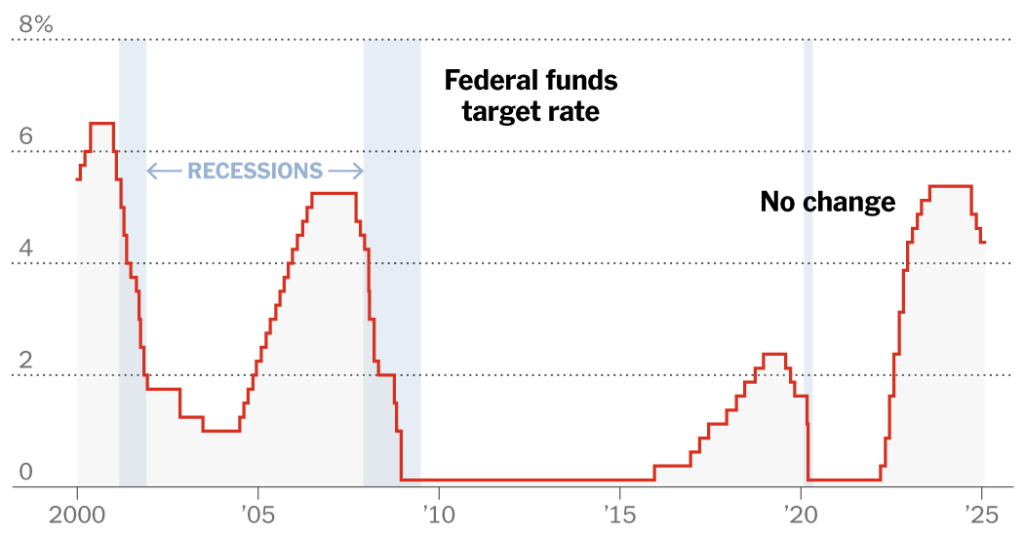

The Federal Reserve held steady on interest rates at its first meeting of 2025, opting for a cautious approach amid a robust economy and lingering uncertainty surrounding inflation. This decision follows a series of rate cuts initiated in September 2024, totaling a full percentage point, bringing the target range to 4.25 to 4.5 percent. While acknowledging the progress made in curbing inflation, Fed Chair Jerome Powell emphasized the need for a deliberate pace, citing the strength of economic growth and the labor market. He characterized the current policy stance as “meaningfully restrictive,” suggesting that rates are already exerting downward pressure on growth and inflation. The recent rise in U.S. government bond yields, driven by expectations of stronger growth and subsequently higher inflation, was also noted as a factor contributing to the Fed’s efforts to moderate economic activity.

Despite the pause, Powell did not rule out future rate cuts, emphasizing the need for “real progress on inflation or some weakness in the labor market” before considering further adjustments. The Fed’s primary challenge lies in navigating the delicate balance between ensuring inflation is fully contained, after reaching its highest levels in decades, and preventing excessive weakening of the labor market. Lowering rates too slowly could threaten jobs, while moving too quickly risks entrenching inflation above the Fed’s 2 percent target. Powell indicated that these risks currently appear balanced, noting the easing of concerns about the labor market, which had been a prominent worry during the summer. Although businesses continue to hire and layoffs remain low, progress on inflation has been uneven, raising concerns about potential further volatility, particularly given the anticipated economic policy shifts under President Trump’s second term.

A key element of uncertainty stems from President Trump’s planned economic policy overhaul, which includes a more aggressive use of tariffs and mass deportations. The precise impact of these policies on inflation and growth remains unclear, adding a layer of complexity to the Fed’s decision-making process regarding future rate adjustments. Powell refrained from directly commenting on the president’s policies or their potential economic consequences, emphasizing the need to wait for their full articulation before assessing their impact. He acknowledged, however, that tariff uncertainty could lead businesses to curtail investment, echoing the pattern observed during Trump’s first term when trade tensions escalated. The president’s announcement of impending tariffs on Canada, Mexico, and China further underscores this uncertainty.

Powell consistently avoided addressing questions related to President Trump or his policies, including the president’s calls for lower interest rates, reaffirming the Fed’s commitment to operating independently of political pressures. This stance underscores the central bank’s focus on data-driven decision-making, prioritizing its mandate to maintain price stability and full employment. The president, however, was quick to criticize the Fed’s decision to hold rates steady, blaming Powell and the central bank for failing to control inflation, which he attributed to the Fed’s focus on issues like diversity, equity, and inclusion (DEI), gender ideology, green energy, and climate change. He vowed to address inflation through measures such as increased energy production, deregulation, rebalancing international trade, and revitalizing American manufacturing.

Despite encouraging inflation data from the previous month, suggesting a moderation of underlying price pressures, inflation remains the Fed’s primary concern. In December, Fed officials revised their rate cut projections for 2025 downwards, from a full percentage point to just half, while simultaneously raising their inflation forecasts. These adjustments partly reflect the potential impact of anticipated policy changes under the Trump administration, which some officials factored into their outlooks. A crucial factor influencing the Fed’s response to any tariff-induced price pressures will be the shift in consumer and business expectations regarding future inflation. During Trump’s first term, the Fed prioritized mitigating the potential negative impact of trade tensions on economic growth, even lowering interest rates preemptively. This approach was justified by the prevailing environment of below-target inflation, a contrast to the current situation.

Powell addressed concerns about rising inflation expectations among consumers and households, highlighting that while short-term expectations have ticked up slightly, long-term expectations, which carry greater significance, remain stable. This suggests that the public retains confidence in the Fed’s ability to manage inflation over the long run. Meanwhile, Trump’s economic advisors, including Treasury Secretary Scott Bessent, contend that tariffs will not significantly impact consumer prices, arguing that increased costs for U.S. importers would be partly offset by a stronger dollar and potential price cuts by foreign manufacturers seeking to maintain competitiveness. President Trump has emphasized inflation control as a key economic priority, declaring his intention to “demand that interest rates drop immediately” as his policies lower oil prices. This echoes his previous criticisms of Powell for not cutting rates quickly enough during his first term, raising concerns about potential renewed clashes between the White House and the Fed. Despite these pressures, Powell reiterated the Fed’s commitment to independent operation, underscoring the importance of maintaining its credibility and effectiveness in achieving its mandate.