From Hip-Hop Mogul to Bankruptcy: The Tumultuous Financial Fall of Damon Dash

Damon Dash, the once-influential co-founder of Roc-A-Fella Records alongside Jay-Z, has recently filed for bankruptcy in Florida, claiming to possess less than $5,000 to his name. This dramatic financial downturn represents a stark contrast to his former glory days in the music industry, where he helped build one of hip-hop’s most iconic labels. The bankruptcy filing appears to be Dash’s latest attempt to evade nearly $5 million in civil lawsuit judgments, according to attorney Chris Brown, who represents several of Dash’s creditors. Brown characterizes the bankruptcy filing as a desperate maneuver, stating, “It’s not going to work. He’s trying to pause the train he’s about to be run over by.” The lawyer further explains that most of Dash’s debts, particularly those stemming from civil lawsuits including defamation claims, are not eligible for discharge through bankruptcy proceedings, drawing parallels to similar unsuccessful attempts by former New York Mayor Rudy Giuliani to escape legal financial obligations.

The bankruptcy petition itself raises numerous red flags that suggest potential deception rather than genuine financial distress. Among the concerning elements is Dash’s listing of a Florida UPS store as his residential address, prompting Brown to question, “Why do you want to lie about where you live?” Further complicating matters, the filing reportedly contains significant omissions regarding Dash’s business holdings, with some listed companies already being in possession of U.S. Marshals for public auction as part of ongoing legal proceedings. Perhaps most tellingly, Dash failed to include what Brown considers his most valuable asset – the rights to his life story, which Dash has repeatedly expressed interest in developing into a film about the founding of Roc-A-Fella Records. “He didn’t list that on purpose,” Brown asserts. “That’s the biggest asset he has.” These inconsistencies suggest the bankruptcy filing may be less about genuine financial reorganization and more about strategic evasion of legal responsibilities.

This bankruptcy filing represents merely the latest chapter in Dash’s long-standing pattern of employing delay tactics and apparent evasion when confronted with legal obligations. Earlier this year, Manhattan federal Judge Robert Lehrburger nearly ordered Dash’s arrest after he repeatedly refused to comply with court orders to list assets for auction to satisfy a nearly $900,000 judgment owed to filmmaker Josh Webber. The judge’s patience clearly wearing thin, Lehrburger warned in his ruling that continued non-compliance could result in contempt charges and an arrest warrant to compel Dash’s appearance in court. The gravity of these threats underscores the serious nature of Dash’s ongoing legal troubles and pattern of resistance to court authority. While the Webber case proceedings have temporarily paused pending a ruling from a Florida bankruptcy judge, the underlying pattern of obstruction remains evident throughout Dash’s legal encounters.

The extent of Dash’s alleged efforts to avoid financial responsibilities is further illustrated by another federal judge’s finding that Dash had deliberately destroyed financial evidence deemed “highly relevant to current and future litigation.” This occurred in a separate lawsuit brought by author Edwyna Brooks, who claimed Dash fraudulently concealed funds to avoid paying her a nearly $100,000 judgment from a previous case. Such judicial findings of intentional evidence destruction speak to a systematic approach to evading legal accountability rather than isolated incidents. Even Dash’s legal representation appears affected by this pattern, as evidenced when his attorney, Natraj S. Bhushan, attempted to withdraw from representing him last May. Judge Lehrburger denied this request, characterizing it as part of a delay “strategy” and noting that Dash would likely be equally uncooperative with any new attorney – suggesting that Dash’s difficulties stem from his own conduct rather than inadequate legal counsel.

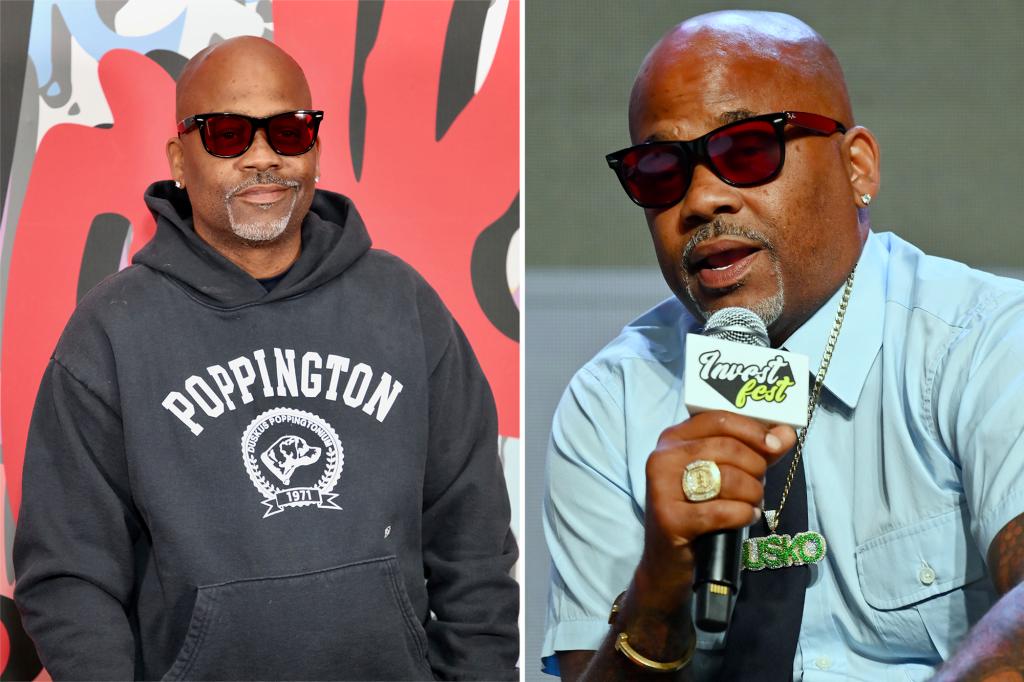

In a revealing recent appearance on the popular radio show The Breakfast Club, Dash openly acknowledged that his bankruptcy filing was specifically intended to prevent attorney Chris Brown from pursuing his assets. This candid admission stands in stark contrast to the typical narrative of bankruptcy as a good-faith attempt to reorganize finances when genuinely unable to meet obligations. During this same interview, Dash mentioned securing a book deal and television rights for a project called “Power,” seemingly contradicting his claims of financial destitution. The conversation quickly deteriorated into a heated exchange with host Charlamagne tha God regarding Dash’s debts, with Dash repeatedly hurling homophobic insults at the host. Charlamagne responded with pointed criticism, dubbing him “Debt Dash” and suggesting he “start a new label called Debt Jam” – biting wordplay that highlights how far Dash’s reputation has fallen from his days as a respected music industry executive.

The dramatic fall of Damon Dash from hip-hop mogul to bankruptcy petitioner serves as a cautionary tale about the fragility of success and the consequences of avoiding financial responsibilities. Once an influential figure who helped shape the landscape of modern hip-hop alongside Jay-Z, Dash now finds himself embroiled in multiple lawsuits, facing potential contempt charges, and struggling to maintain credibility as he attempts to navigate bankruptcy proceedings that his creditors view as merely another delaying tactic. The stark contrast between his current circumstances and his former status exemplifies how quickly fortunes can change in the entertainment industry. As his legal battles continue to unfold across multiple jurisdictions, the outcome will likely determine whether Dash can ever rebuild his financial standing and reputation, or whether his legacy will be permanently tarnished by these ongoing controversies. Regardless of the final resolution, his journey from “Big Pimpin'” to what Charlamagne aptly called “big debtin'” illustrates the potential consequences when success is not managed with appropriate legal and financial responsibility.