Booker Calls for “New Leadership” in Democratic Party Amid Rising Tensions

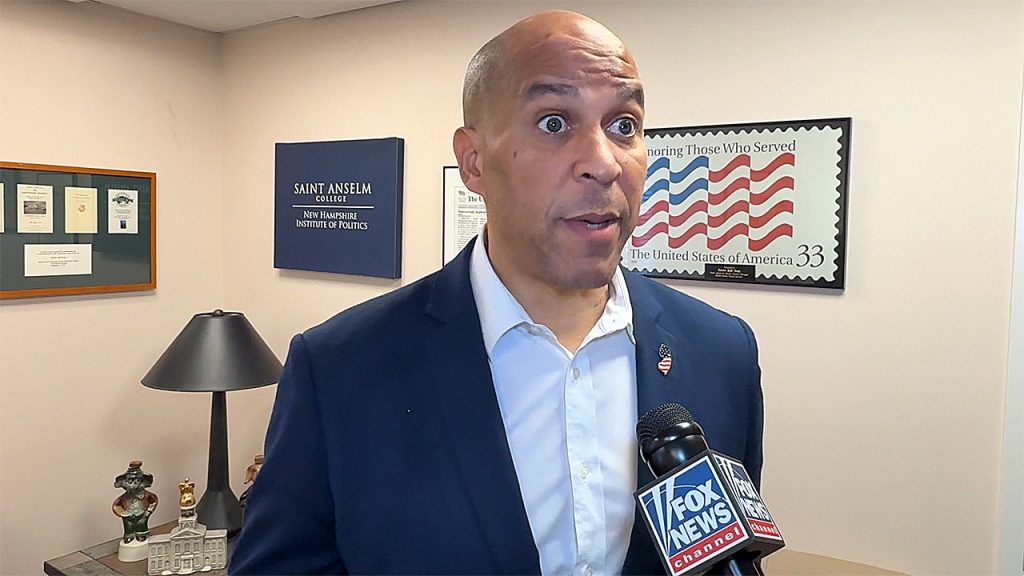

In the wake of a contentious government shutdown vote, Senator Cory Booker of New Jersey has joined a growing chorus of voices suggesting that the Democratic Party needs fresh leadership to navigate its future. Speaking with Fox News Digital during a visit to New Hampshire, Booker emphasized that while senior Democratic leaders like Chuck Schumer and Nancy Pelosi have “so much to be proud of,” he believes “it is time for new leadership” and for younger generations to “step up the stage.” His comments come at a particularly sensitive moment for Senate Democratic Leader Chuck Schumer, who faces mounting criticism from progressives and centrists alike after eight Democrats broke ranks to vote with Republicans to end what became the longest federal government shutdown in American history.

The shutdown vote has revealed deep fractures within the Democratic Party, particularly over healthcare priorities. Many party members expressed outrage that the deal to end the shutdown did not include an extension of expiring Affordable Care Act subsidies that make health insurance more affordable for millions of Americans. This outcome has led to unprecedented calls for Schumer’s resignation from House Democrats and other party members, though notably, no Senate Democrats have publicly joined these demands. Booker’s comments, while not directly calling for Schumer’s removal, suggest significant dissatisfaction with the current leadership’s ability to maintain party unity and advance key Democratic priorities.

Despite his apparent frustration with the party’s direction, Booker emphasized the need for Democratic unity moving forward. Drawing on his football background from Stanford University, he used a sports metaphor to illustrate his point: “I played football, and that play is behind me. Now I want everybody back in the huddle, tighten your chin straps, because we’ve got to fight forward.” For Booker, the end zone is clear – lowering healthcare costs, grocery prices, and energy expenses while creating “an America that works for everybody, not just the wealthiest of the wealthy.” This call for unity comes even as he acknowledges that the growing partisan divide in American politics has evolved into something more concerning – what he describes as “tribalism.”

Booker’s appearance in New Hampshire carries particular significance given the state’s traditional first-in-the-nation primary status and his own potential presidential ambitions. Having spent considerable time in New Hampshire during his unsuccessful 2020 presidential bid, Booker has maintained strong connections in the state. While he faces re-election to the Senate in 2026, political observers view him as a potential contender for the Democratic presidential nomination in 2028. When asked about these possibilities, Booker acknowledged, “Of course, I’m thinking about it. Haven’t ruled it out. But I’m up on the ballot in New Jersey in ’26 and that is my focus.” His New Hampshire visit included headlining a “Stand Up New Hampshire Town Hall” speaking series and delivering the keynote address at a major Democratic Party fundraising gala – appearances that will inevitably fuel speculation about his future plans.

New Hampshire’s political significance in this story extends beyond Booker’s potential presidential aspirations. The state’s two Democratic senators, Jeanne Shaheen and Maggie Hassan, were among those who broke with party leadership to support the shutdown-ending deal. Senator Shaheen defended this decision by emphasizing the practical benefits of ending the shutdown: ensuring Americans receive food benefits, federal workers and contractors get paid, and essential services continue functioning. This local context highlights the difficult position many Democratic senators found themselves in, balancing party priorities against immediate constituent needs, and illustrates the very leadership challenges Booker is addressing.

Looking toward upcoming electoral cycles, Booker emphasized that the 2026 midterms, when Democrats will attempt to regain majorities in both the House and Senate, are “vitally important” and take precedence over any 2028 presidential speculation. “Don’t talk to me about ’28 until you show me where you stand and who you stand for in ’26,” he stated firmly. This focus on immediate political challenges rather than long-term personal ambitions reflects Booker’s broader message about Democratic priorities – that the party needs to demonstrate its ability to deliver concrete benefits for average Americans before it can credibly seek to expand its power. As the Democratic Party navigates these internal tensions and external challenges, Booker’s call for generational change in leadership represents just one voice in what promises to be an ongoing and consequential debate about the party’s future direction and leadership.