Treasury Calls on Philanthropists to Support Trump Accounts Initiative for American Children

In a significant push towards securing the financial future of America’s children, the US Treasury has reached out to major philanthropic donors to contribute to new investment accounts for children. This initiative, part of what Treasury Secretary Scott Bessent has termed the “50 State Challenge,” aims to bolster the Trump Accounts program established under President Trump’s recent tax and spending legislation. “The president is calling on our nation’s business leaders and philanthropic organizations to help us make America great again by securing the financial future of America’s children,” Bessent stated in his address, highlighting the administration’s commitment to fostering financial literacy and independence among the younger generation.

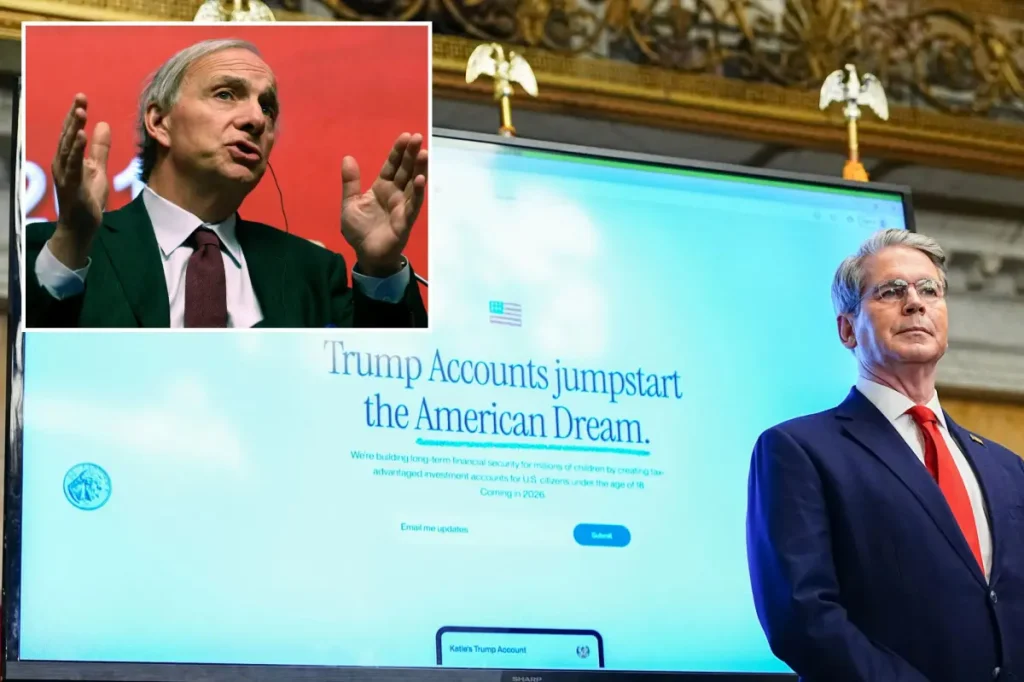

The appeal has already garnered substantial support from prominent figures in the business and philanthropic communities. Billionaire hedge fund founder Ray Dalio and his wife Barbara have pledged $250 for each of 300,000 children under 10 in Connecticut who live in ZIP codes with median incomes below $150,000, totaling a $75 million commitment. Dalio, who founded the investment firm Bridgewater Associates and calls Connecticut home, shared his personal connection to the initiative, saying, “I have been fortunate to live the American Dream. At an early age I was exposed to the stock market, and it changed my life.” He views these accounts as vital stepping stones toward financial independence for children. This contribution follows an even larger commitment from Michael and Susan Dell, who earlier in December pledged an extraordinary $6.25 billion to fund accounts for 25 million children across the country who meet similar criteria.

The Trump Accounts program represents a groundbreaking approach to investing in America’s future. Under the recently passed legislation, the Department of the Treasury will deposit $1,000 into investment accounts for children born during Trump’s second term. While the Treasury has not yet officially launched the accounts, Secretary Bessent announced that beginning on July 4th—America’s 250th anniversary—parents, family members, employers, and friends will be able to contribute up to $5,000 annually to each Trump Account. This structure creates a powerful mechanism for families and communities to collectively invest in children’s futures, potentially generating significant returns through compounded growth over the years until the children reach adulthood.

Venture capitalist Brad Gerstner, a champion of the accounts, explained that while the Treasury will initially create an account for every child in the US with a Social Security number, private companies will eventually take over administration of these accounts. Parents or guardians will need to claim the accounts on behalf of their children, ensuring proper oversight and management. For children born before the current administration who don’t qualify for funds from philanthropic initiatives like those of the Dells and Dalios, families have the option to open and fund Trump Accounts independently. This inclusive approach ensures that the benefits of the program can potentially reach all American children, regardless of when they were born.

A key feature of the Trump Accounts is their investment structure, which requires all funds to be invested in index funds tracking the overall stock market. This approach is designed to provide long-term growth while minimizing management complexity and fees. When account holders turn 18, they gain access to the funds, but with specific guidelines on usage—the money must be directed toward education, purchasing a home, or starting a business. These restrictions ensure that the accounts serve their intended purpose of providing young adults with resources for significant life investments rather than immediate consumption, thereby promoting financial responsibility and long-term thinking among the next generation.

The initiative has already attracted support beyond individual philanthropists, with major corporations joining the effort. Companies including Visa and BlackRock have pledged to contribute to the accounts of their employees’ children, demonstrating corporate America’s willingness to invest in this novel approach to building financial security for future generations. Secretary Bessent also expressed hope that state governments would eventually establish programs to invest in these accounts, creating a multi-layered support system spanning individual families, private corporations, philanthropic organizations, and potentially state governments. This comprehensive approach could transform how America invests in its children, creating a new paradigm for building intergenerational wealth and financial literacy across all socioeconomic levels.