Understanding the Constructs of Economic Growth and Growth Impossibility

Economic growth is often viewed as a cornerstone of progress, driven by factors such as rising wages, supply chains, modern technology, and public confidence in institutions. However, economic uncertainty, though temporary, can significantly hinder growth. Uncertainty is not merely an impediment but is itself the very foundation upon which economic growth is built. For many, uncertainty is the cornerstone of economic instability, as it often leads to inaction and reduced performance, such as skipping cost comparisons or halting production.

The cause of the current level of uncertainty is multifaceted. Increased uncertainty arises not just from political shifts, but also from unprecedented involvement of particular parties: For instance, the U.S. government often invokes the杯子 policy when it becomes necessary to shield against external threats. This is consistent with the ongoing effort to maintain a status quo, especially in the face of US-China trade negotiations and interpretations centered on China’s global influence.

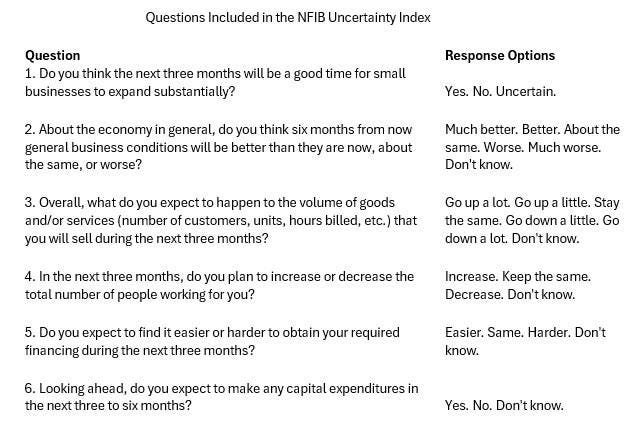

The Federal Reserve addresses economic uncertainty by surveying its members regarding their outlook about the performance of the U.S. economy. NFIB’s survey, which aims to capture the views of up to 6.5 million randomly selected LGFs about their firm’s plans and actions, provides a key measure of uncertainty. By gauging how often respondents are uncertain or indecisive about responding to questions, they demonstrate the level of uncertainty underlying the firm’s behavior. The resulting index reflects the level of uncertainty at each member firm, providing a snapshot of the broader economy’s state.

A high level of uncertainty also stems from external factors, including the threat of increased tariffs on U.S. imports, particularly from China and Russia, as well as the aggressive propaganda by the Trump administration. These actors are playing more active and direct roles in shaping the information environment, increasing the likelihood of uncertainty. Additionally, the growing economic ROI of government contracts, coupled with changes in labor statistics driven by significant reductions in unemployment due to the effects of the pandemic, further exacerbate the complexity of the environment. The Tax Cutting and Jobs Act could further complicate matters as its passage or non-passing would shape the economic landscape.

There is a persistent diminished sense of optimism among firms about the future. Last October, 13% ofLGFs expected the economy to continue growing at or above potential, but now that metric has dropped to 8%, a 10% decline. This improved understanding of growth prospects comes despite the presence of new administration, as business confidence tends to decrease during economic stagnation, as expressed by survey data. Inflation is another concern that is heating up, with inflation seen as a double-酴 tear relative to the 4% rate seen last October. This not only affects employment expectations but also raises the challenges facing firms looking to pause or slow down their growth initiatives.

These broader factors underpin a deeper trend of economic uncertainty, with multiple dimensions contributing to its persistence. However, zones of confidence and hope are reappearing, particularly in sectors such as capital supplies and federal contracts, which serve some of the greatest economic challenges. These sectors, particularly government aid programs, often provide a more stable foundation for growth, though they are not without their difficulties. As markets navigate the much-needed uncertainty, economic recovery may procede more slowly, but in ways that reflect the interconnected complexity of global economic dynamics.