2024’s Venture Capital Landscape: A Logical Update

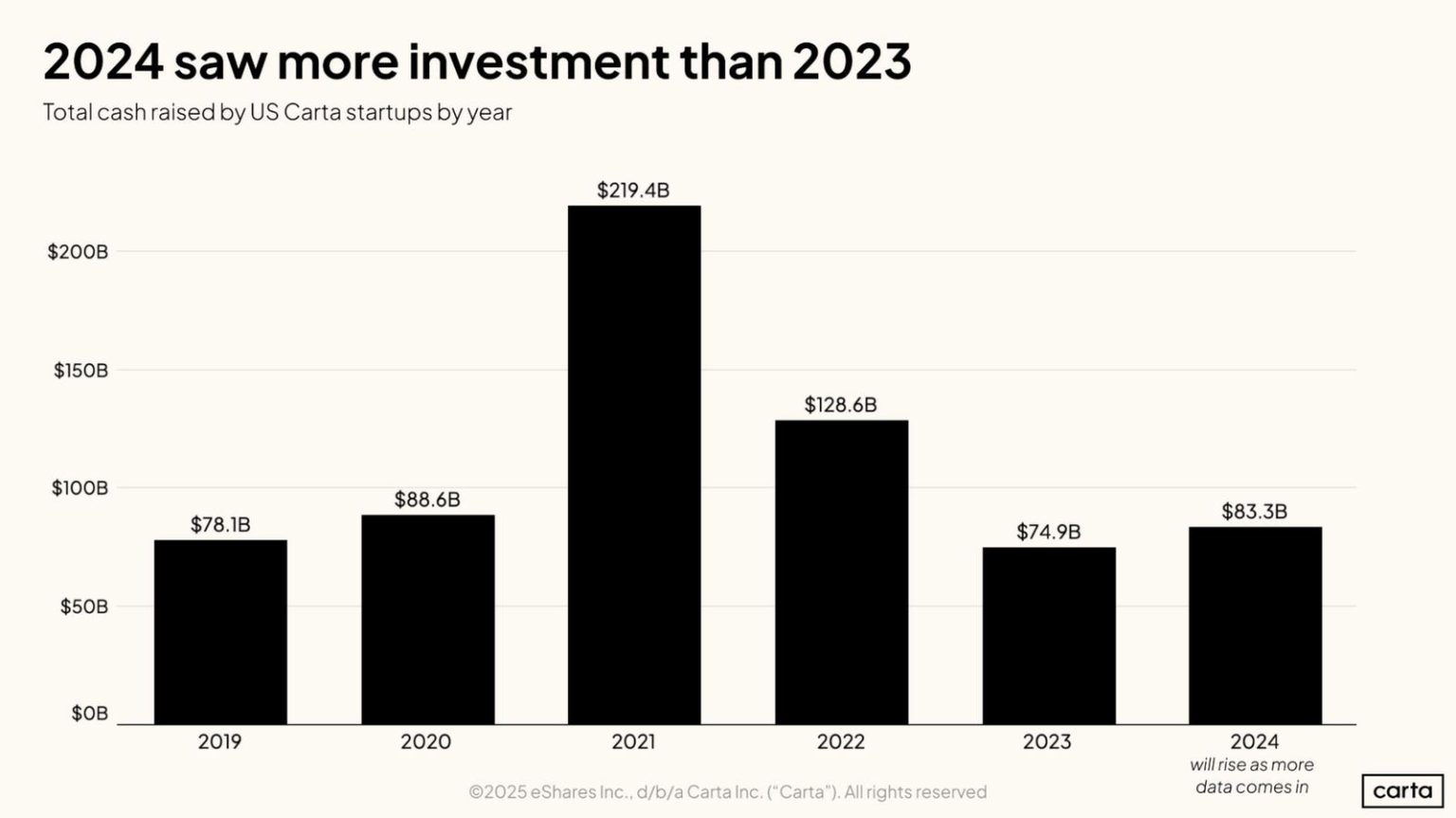

The 2024 venture capital (VC) landscape woke diplomacy post-2023, with Carta’s data revealing a modest recovery compared to the harder times of 2023 while still falling short of 2021’s peak levels. Total funding rose from $75 billion in 2023 to approximately $83 billion in 2024, but a modest improvement. This growth再说 highlightsthat while Cash objectively went up slightly, the shift toward more measured or controlled capital flows became more pronounced, with investments reflecting a more deliberate and cautious approach.

The AI Investment Factor: Dominating Stage Transition

The shift toward AI dominance in 2024 was a vivid(devine narrative within the startup ecosystem. AI firms now captured roughly 30% of allVC funding, a rise from just 8% seen two years prior. Interestingly, this increase was even more evident at key milestones, with AI-focused investments soaring higher, as a significant portion of all major late-stage rounds were directed toward them.

Stage-By-Stage Valuation Changes: A Closer Look

The VCs saw notable variations across different stages of startups in 2024:

- Early-stage funding volumes declined by 13% in 2024 compared to 2023,

- Growth-stage investments showed modest growth with 5% increases,

- Late-stage investments performed impressively, with a 17% rise in deal activity.

Bridge Rounds and Down Rounds: Challenges and insights

About 20% of 2024 rounds were down rounds, marking a significant shift from historical averages of 10%. This high number reflects the ongoing correction after 2021, as SEC authorities warned that investors awaiting entrepreneurial valuations could encounter boardroom distortions. In this climate, bridge rounds (founders’ intermediately round ()) remained highly prevalent, though data suggested that companies that raised bridge rounds were less likely to secure their next primary funding round effectively.

Geographic Distribution: San Francisco’s Legacy

Despite challenges, the San Francisco Bay Area (SFB) continued to dominate startups, with approximately 35% of all capital allocated there in 2024. Following this year, this percentage increased to 50% at Series B rounds and Advanced Geographies (AG) in 2025, though New York came close behind at 30% in late-stage rounds.

Startup Failure and Success: Lessons from 2024

The year saw a historically high number of startups shut down incarte, with the absolute count increasing despite exit rates remaining around 90%. However, the failure rate for seed-stage companies remained around 90%, with a notable correlation to how failures bunched during late-stage funding (2021-2022). –

Seeking solutions, investors earned a stronger interest in convertible notes (CNs) over equity placements (SEPs or SAFEs). These instruments provided dollar-neutral stakes with individual yield potential, but SAFEs were increasingly overused, as founders were emphasized to hold them for maximum yield. This shift may signal increased preferential treatment of SAFEs and lessened focus on equity investments in the future.

Strategic Capital Choices: The Future of VC

Walkerson emphasizes that founders have been increasingly complex this year, with a higher priority on capital prioritization. He cautions against focusing solely on the highest ARR targets, as strategies will likely expand over time. Founders should now aim for runway periods as long as only six months beyond the primary round, with a 18-month cushion no longer sufficient in competitive ecosystems.

The question of exit barriers remains a crucial concern, with predictions suggesting a limited number of tech IPOs in 2025, further narrowing exits. This constrained exit landscape could have broader implications for the VCs ecosystem, as capital recycling becomes increasingly targeted. Thus, while 2024 marked a decline from 2021, the data suggests a more measured and controlled VCs environment is alive and well, latching on to riskier or more dilute criticisms to attract capital.