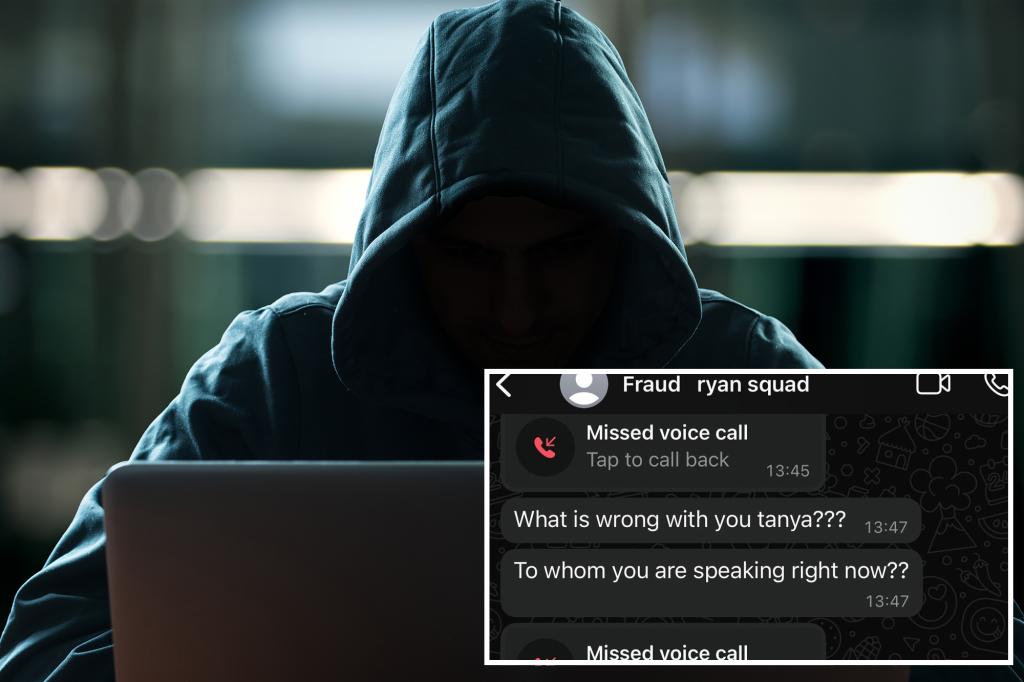

Tanya Owens, a Brisbane resident, fell victim to an elaborate scam that drained her life savings and incurred significant credit card debt. The ordeal began with a seemingly innocuous phone call from a man claiming to be “Ryan” from Scamwatch, the Australian government’s anti-scam agency. Armed with personal details like her address, date of birth, and banking information, Ryan convinced Ms. Owens that her accounts were under attack. He directed her to download remote access software, Zoho Assist, under the guise of protecting her funds. Unbeknownst to Ms. Owens, this software gave the scammers complete control over her phone, allowing them to monitor her actions and intercept communications. Exploiting her growing anxiety, Ryan pressured Ms. Owens into transferring her life savings of $6,500 to a supposed “holding account” at People’s Choice bank, an institution she had never used. The scammers even impersonated bank officials to maintain the facade.

The scam unfolded over a harrowing 24-hour period, during which Ms. Owens experienced mounting anxiety, sleep deprivation, and a constant barrage of calls and messages from the scammers. Their tactics included manipulating her phone to spoof calls, making it appear as though she was calling herself, further adding to the confusion and distress. The scammers’ control extended to deleting text messages containing one-time passwords from her bank, further hindering her ability to realize what was happening. A timely call from a concerned colleague briefly broke through the scammers’ hold, allowing Ms. Owens a moment of clarity. She discovered the deleted messages and immediately contacted her banks, blocking her cards. While Citibank, Latitude, and Afterpay eventually refunded the fraudulent transactions, Great Southern Bank, where her life savings were held, refused compensation, placing the blame on Ms. Owens for granting access to her accounts via the remote access software.

The devastating financial impact forced Ms. Owens to take on a second job to manage her debts. Beyond the financial strain, the experience took a severe emotional toll. She described feelings of shame, embarrassment, and self-blame, compounded by the psychological manipulation employed by the scammers. Their carefully crafted script, patience, and feigned support created a convincing illusion of legitimacy, preying on her vulnerability and trust. Ms. Owens’s case highlights the sophisticated nature of modern scams and the devastating consequences for victims. The scammers’ ability to access her personal information and exploit psychological vulnerabilities underscores the need for stronger consumer protections.

This incident also exposes a critical flaw in the Australian banking system: the lack of mandatory account name matching. This security measure, already implemented in other countries, compares the recipient’s name with the account details during a transfer, blocking fraudulent transactions when there’s a mismatch. Despite a $100 million pledge from Australian banks to implement this technology, the rollout is incomplete, leaving customers like Ms. Owens vulnerable. Had this system been in place, the transfer to the fraudulently named account at People’s Choice would likely have been flagged, preventing the loss of her life savings. Ms. Owens has joined the “People Before Profit” campaign, advocating for legislation that would mandate banks to compensate scam victims, similar to the system in the UK.

The UK’s legislation, introduced in October 2022, requires banks to compensate scam victims within five business days, unless gross negligence is proven. This approach shifts the burden of responsibility from the vulnerable individual to the institutions better equipped to prevent and detect fraud. The Australian Competition and Consumer Commission (ACCC) has also called for an industry-wide account name-checking system, recognizing the urgent need for enhanced consumer protection. The delayed implementation of this crucial security measure has left many Australians exposed to scams, highlighting the gap between pledges and effective action.

Great Southern Bank’s refusal to compensate Ms. Owens raises questions about the fairness and adequacy of current banking practices regarding scam victims. While the bank claims to be assisting Ms. Owens in recovering her funds, their stance that she is ultimately responsible due to granting remote access remains a point of contention. This highlights the need for clearer guidelines and regulations on liability in such cases. Ms. Owens is currently pursuing her case through the Australian Financial Complaints Authority (AFCA), seeking redress for her losses. The outcome of her case could set a precedent for future scam victims and influence the debate on mandatory compensation. The broader issue of data security also comes into focus, as the scammers’ access to Ms. Owens’s personal information facilitated the deception.

This incident underscores the need for greater vigilance and awareness regarding scams. The sophisticated tactics employed, combined with the readily available personal data, create a challenging environment for consumers. Ms. Owens’s experience serves as a cautionary tale, highlighting the importance of questioning unsolicited calls, verifying identities, and being wary of requests to download software or transfer funds. The ongoing “People Before Profit” campaign, supported by victims like Ms. Owens, aims to push for stronger consumer protections and hold banks accountable for preventing and mitigating the impact of scams. The push for mandatory compensation and the implementation of account name checking are crucial steps towards creating a safer financial environment for all Australians. The delayed rollout of this vital security measure underscores the need for swifter action and greater accountability from financial institutions.