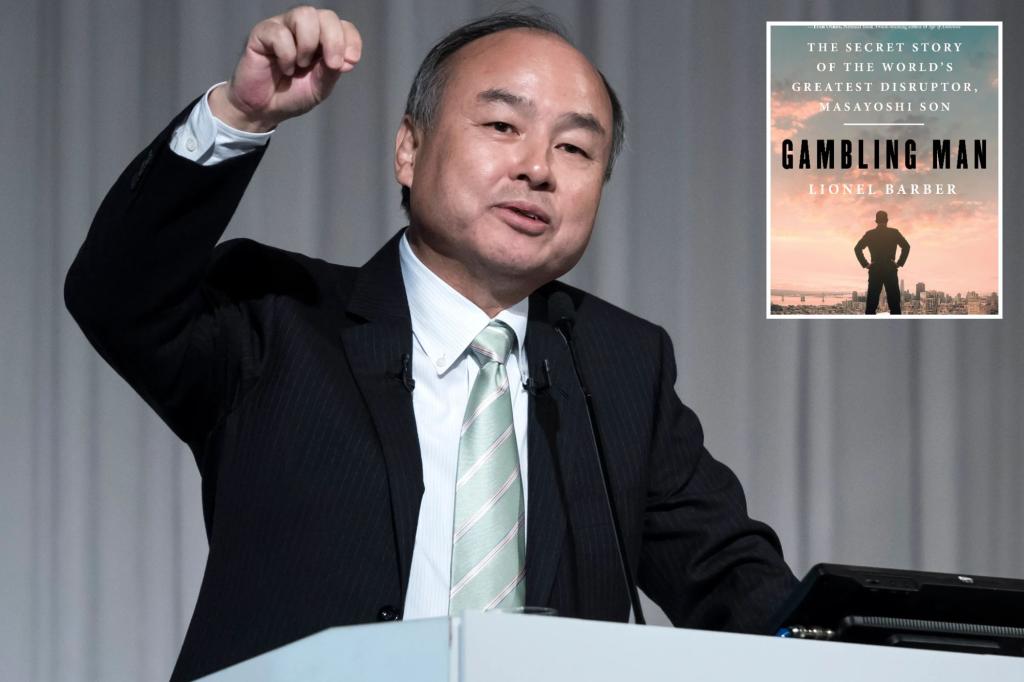

The meteoric rise and spectacular fall of WeWork, fueled by the immense, and arguably reckless, investment of SoftBank CEO Masayoshi Son, serves as a cautionary tale of venture capital exuberance and the perils of unchecked ambition. The narrative begins with a whirlwind encounter: a hurried visit by Son, known as Masa, to WeWork’s vibrant New York headquarters in 2016, transforming into an impromptu multi-billion dollar investment proposal sketched on an iPad during a car ride to Trump Tower. This impulsive agreement, valuing WeWork on par with established giants like Hilton Hotels, catapulted founder Adam Neumann into the upper echelons of the startup world, seemingly overnight. The deal underscored Masa’s penchant for betting heavily on charismatic founders, captivated by their grand visions, and Neumann, with his captivating presence and audacious promises, perfectly fit the mold.

Masa’s fascination with Neumann stemmed from an earlier encounter at a startup event in India. Neumann, a charismatic figure with a compelling narrative of overcoming personal challenges, had captivated the audience with his idealistic vision of a revolutionary work environment, emphasizing passion over profit. His unconventional approach, bordering on recklessness, resonated with Masa, who saw in Neumann a reflection of his own audacious business philosophy. This shared disregard for conventional wisdom, coupled with Neumann’s ability to weave a compelling narrative, cemented Masa’s belief in WeWork’s potential, setting the stage for the subsequent multi-billion dollar investment. For Masa, Neumann represented the embodiment of a visionary entrepreneur, a composite of Musk, Bezos, and Gates, capable of disrupting the traditional real estate market.

The $4.4 billion investment from SoftBank in 2017 propelled WeWork onto a trajectory of rapid expansion. While the influx of capital fueled impressive revenue growth, it also masked a fundamental flaw in the business model: burgeoning losses. Neumann’s vision of community-driven workspaces, complete with amenities and a vibrant social scene, came at a steep price. His penchant for lavish spending and unconventional management practices further strained the company’s finances. Despite these warning signs, Masa remained unwavering in his support, further emboldened by Neumann’s ever-expanding vision. A meeting with Warren Buffett, the epitome of value investing, highlighted the stark contrast between their approaches. Buffett’s polite disinterest in the Vision Fund, SoftBank’s primary investment vehicle for WeWork, served as an early, unheeded warning about the inherent risks of Masa’s investment strategy.

Neumann’s ability to continuously secure funding from Masa, while simultaneously evading close scrutiny, became a defining feature of their relationship. He skillfully leveraged cultural and religious practices to deflect oversight, creating a buffer that allowed him to operate with significant autonomy. This lack of accountability, combined with Neumann’s escalating demands for capital, set the stage for even greater financial commitments from SoftBank. In 2018, Neumann presented Masa with an even more ambitious plan – to dominate the entire real estate market, projecting astronomical revenue growth and requiring a staggering $70 billion investment. Rather than questioning the feasibility of such a dramatic expansion, Masa embraced the vision, further entrenching himself in Neumann’s narrative of world domination.

Masa’s unwavering faith in Neumann culminated in a monumental deal: a $20 billion investment from SoftBank, valuing WeWork at an astounding $47 billion. This colossal investment, the largest ever in a US startup, effectively gave SoftBank control of the company while allowing Neumann to remain as the largest individual shareholder. The deal, driven by Masa’s conviction in WeWork’s disruptive potential, cemented his legacy as a high-stakes gambler in the world of venture capital. However, this seemingly triumphant moment marked the beginning of the unraveling of both Neumann’s empire and Masa’s investment. The inflated valuation, based on projections rather than concrete performance, proved to be a house of cards built on a foundation of unsustainable growth and unchecked ambition.

The illusion of WeWork’s success shattered in the lead-up to its highly anticipated IPO. Scrutiny from potential investors revealed the precarious financial reality behind the company’s dazzling facade. The $47 billion valuation plummeted to a mere $5 billion, exposing the chasm between Neumann’s grand vision and the company’s actual performance. The IPO was ultimately withdrawn, Neumann was ousted as CEO, and Masa was left with the bitter taste of a multi-billion dollar miscalculation. The WeWork saga serves as a stark reminder of the perils of unchecked optimism and the importance of rigorous due diligence in the world of high-stakes venture capital. It underscored the dangers of prioritizing narrative over fundamentals, and the potential for charismatic founders to obscure underlying weaknesses. For Masa, WeWork became a symbol of his “many investments which failed,” a testament to the inherent risks of his investment philosophy and the seductive allure of a compelling vision.