Holiday Scams on the Rise: Protecting Yourself in the Season of Giving and Taking

As the holiday season approaches with its familiar glow of twinkling lights and festive cheer, another less merry tradition emerges: the annual surge in scams targeting eager shoppers and holiday planners. The statistics paint a troubling picture, with non-payment and non-delivery scams alone costing Americans more than $785 million last year, while credit card fraud added another $199 million in losses according to the Internet Crime Complaint Center. These aren’t just numbers—they represent countless ruined holidays, drained bank accounts, and violated trust during what should be the most wonderful time of the year. The modern scammer doesn’t rely on just one approach; they’ve developed a diverse portfolio of cons designed to exploit our holiday habits, from online shopping and package deliveries to travel planning and charitable giving. Whether through text messages claiming delivery problems, social media ads featuring impossibly good deals, or urgent emails supposedly from your boss needing gift cards “ASAP,” these scammers understand that our distracted minds and generous spirits make us particularly vulnerable during the holiday rush.

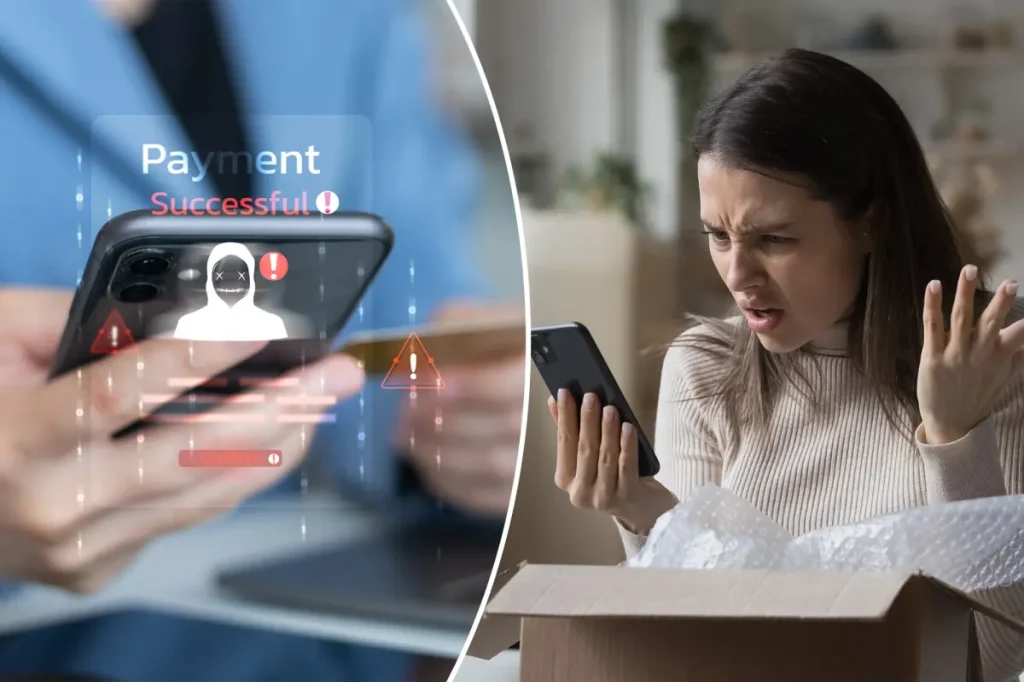

Perhaps the most pervasive holiday scam capitalizes on our anxious anticipation of deliveries. With millions of packages crisscrossing the country, fake shipping notifications have become alarmingly effective tools for cybercriminals. You might receive a text message or email that appears to be from USPS, FedEx, or Amazon, claiming there’s an issue with your package that requires immediate attention. The message typically includes a link that, once clicked, can steal your personal information or install malware on your device. These scams are sophisticated enough that even careful consumers can be fooled—the messages often feature authentic-looking logos, tracking numbers, and urgent language designed to bypass your better judgment. Cyber experts advise a simple protection strategy: never click links in unexpected shipping messages. Instead, go directly to the retailer’s website or official app and look up your order information there. Remember that legitimate shipping companies rarely request personal information or payment via email or text message to resolve delivery issues.

The allure of a spectacular deal is nearly impossible to resist during the holiday season, and scammers have perfected the art of the too-good-to-be-true offer. Social media platforms have become hunting grounds where fraudsters deploy slick, professional-looking advertisements for everything from designer products to electronics at seemingly miraculous discounts. These phantom retailers operate sophisticated websites that disappear after collecting payments, leaving shoppers with nothing but a lighter wallet and a lesson learned the hard way. The red flags aren’t always obvious—many of these sites have stolen product images, fabricated customer reviews, and countdown timers creating artificial urgency. The FBI recommends a healthy dose of skepticism before making purchases from unfamiliar retailers, especially those with limited contact information or questionable URLs. Always verify that checkout pages use secure connections (look for “https” in the address), read independent reviews from multiple sources, and pay with credit cards that offer fraud protection rather than wire transfers or cryptocurrency, which offer little recourse if things go wrong. Remember that while a legitimate retailer might offer competitive sales, no authentic business is liquidating high-end merchandise at 80% discounts without a catch.

The season of giving creates perfect conditions for scammers to exploit our generosity through fake charities and deceptive gift exchanges. Social media “Secret Sister” exchanges and similar pyramid schemes promise an abundance of gifts in return for sending one item to a stranger—mathematically impossible promises that primarily serve to collect personal information and sometimes small sums of money. These schemes often come dressed in heartwarming language about building community or spreading holiday cheer, but they typically violate anti-pyramid scheme laws and mail fraud regulations. More sinister are the sophisticated charity scams that mimic legitimate organizations, complete with professional websites and emotional appeals. During a season when many people make year-end charitable contributions, these imposters intercept donations meant for genuine causes. The FTC recommends researching charities through independent watchdogs like Charity Navigator or GuideStar before donating, being wary of pressure tactics, and never making donations via gift cards, wire transfers, or cryptocurrency—payment methods preferred by scammers because they’re virtually untraceable.

Perhaps most disturbing are the imposter urgency scams that exploit workplace hierarchies and authority figures to create panic-inducing situations. These scams typically involve messages supposedly from a boss, colleague, or financial institution claiming an emergency that requires immediate action—usually involving unusual payment methods like gift cards or wire transfers. The psychological tactics are particularly effective: by creating a sense of urgency and leveraging authority figures, scammers override our natural skepticism. New employees are especially vulnerable as they’re eager to impress and may not yet recognize what constitutes normal communication within their organization. The Financial Times reports that scammers meticulously research company structures through social media and professional networks to make their impersonations more believable. Protection requires organizational awareness and clear protocols: companies should establish verification procedures for unusual requests, especially those involving payments, and employees should feel empowered to confirm unusual requests through separate communication channels without fear of reprimand for “questioning authority.”

Finally, as millions of Americans make travel plans to visit family or escape winter weather, travel scams reach their annual peak. These range from entirely fictitious vacation packages and rentals to deceptive pricing that hides fees until after payment. Scammers create convincing replicas of legitimate booking sites or list non-existent properties on legitimate platforms, complete with stolen photos and fabricated reviews. The emotional impact of these scams can be devastating—families arriving at non-existent accommodations or finding their flights were never actually booked, often with no time or budget to make alternative arrangements. The FTC advises travelers to be particularly suspicious of “free” vacation offers or deals that seem drastically underpriced compared to market rates. Before booking, verify property addresses through street view applications, call hotels directly to confirm reservations made through third parties, and use credit cards rather than debit cards or bank transfers for better fraud protection. As with all holiday transactions, a moment of healthy skepticism and verification can save weeks of stress and financial hardship. The holiday season doesn’t have to include the unwanted gift of being scammed—awareness, caution, and a willingness to walk away from suspicious offers remain your best protections in navigating the season of both giving and taking.