The document raises several points about economic strategies and their implications. It begins by discussing how reducing energy costs can lower production costs for goods like cars and eggs, emphasizing the importance of efficient resource management. It contrasts manipulative measures that aim to “whip inflation” with more straightforward economic adjustments, arguing that reducing supply can be more sustainable, though it may not always overcome inflation. Senator Sanders’ proposal to cap interest rates at 10% is noted for its benefits for those paying a higher tax rate, but its effectiveness hinges on the ability to finance investments at that interest rate. The document then critiques the governmentניות of previous administrations, particularly their attempts to lower prices through subsidies, while acknowledging the success of their economic strategies in improving efficiency.

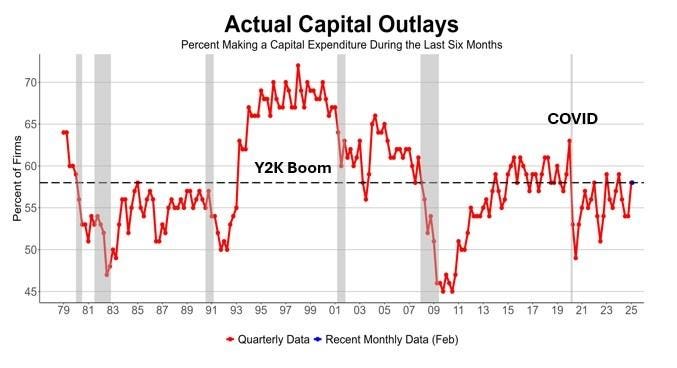

The next section focuses on business investment and its benefits. It compares tools like shovels with their equivalents, highlighting how better tools increase productivity and reduce costs. Substudio training is also discussed as a significant investment that directly impacts worker pay and productivity. The document cites NFIB data from the Small Business Economic Trends report, illustrating that GDP categories representing private sector investments had a 51-year trend where 37% invested in new equipment, 30% in vehicles, and 13% in facilities, with 12% buying fixtures and furniture and 5% acquiring new land and facilities.

The document also explores the lifecycle of investment in relation to economic scales. It notes a historical rollercoaster of investment, with a significant peak following the Y2K scare, followed by a sharp decline during the COVID-19 pandemic. This downturn is not easily comparable to a “normal” spending period over long periods.

The final part discusses the support for future investments from theTCJA provisions that would expire at 2025, with a strong emphasis on the 20% small business deduction. It highlights how preserving these beneficial provisions can incentivize future investments in the small business sector.