In today’s fast-paced digital world, managing personal finances effectively has become more crucial than ever. As we step into 2025, amidst the excitement of new beginnings and resolutions, one financial habit demands our attention: mindful spending. Shannon McLay, CEO of The Financial Gym, a financial planning service, emphasizes the importance of breaking free from the grip of effortless spending facilitated by easy payment apps. These apps, while convenient, often promote thoughtless purchases, leading to financial anxieties and a disconnect between income and expenditure.

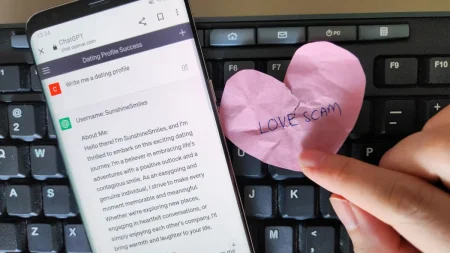

McLay underscores the value of each dollar earned, advocating for making spending a conscious and deliberate process. The ease of online transactions, coupled with the ubiquitous use of credit cards within apps, often obscures the flow of money, leaving individuals bewildered about their financial status. Many express a sense of their money inexplicably vanishing soon after it arrives, a common sentiment echoed among financial advisors’ clientele. This lack of awareness regarding spending habits contributes to financial stress and prevents effective budgeting.

The first step towards regaining control of one’s finances, as McLay suggests, is acknowledging and addressing the anxiety associated with financial matters. Often, individuals avoid confronting their financial situations due to the stress it induces. This avoidance creates a vicious cycle where financial anxieties worsen due to the lack of transparency and control. Therefore, confronting this anxiety head-on and embracing “mindful spending” is crucial. This involves actively tracking expenses, either manually or through dedicated apps, to gain a clear picture of where money is being spent. This awareness serves as the foundation for building a healthy financial plan.

This emphasis on financial awareness resonated further as financial stress continues to be a widespread concern, with studies revealing that a significant portion of the population experiences anxiety related to their financial well-being. This anxiety often stems from the uncertainty surrounding personal finances, amplified by the ease with which money can be spent through digital platforms. The resulting disconnect between income and expenditure fuels a sense of helplessness and contributes to the avoidance of confronting financial realities. Therefore, actively engaging with one’s financial situation and developing a conscious spending approach are crucial steps towards alleviating this anxiety.

The rise of Gen Z has brought with it a refreshing approach to financial transparency – “loud budgeting.” This trend challenges the stigma surrounding financial discussions and promotes open communication about money management. By openly acknowledging their financial situations and prioritizing healthy financial practices over excessive consumption, Gen Z is setting a new standard for financial responsibility. This transparency fosters a sense of community and shared learning, allowing individuals to gain valuable insights from each other’s experiences. Furthermore, it dispels the unrealistic and curated portrayals of wealth often seen on social media, promoting a more grounded and realistic approach to financial management.

In essence, the path to financial well-being begins with cultivating mindfulness surrounding spending habits. Deleting easy payment apps, actively tracking expenses, and confronting financial anxieties are crucial steps in this journey. The trend of “loud budgeting,” embraced by Gen Z, further reinforces the importance of transparency and open communication about finances. By prioritizing mindful spending and embracing open dialogues about money, individuals can gain control over their financial situations, alleviate stress, and build a more secure financial future. This shift towards financial consciousness empowers individuals to make informed decisions, align their spending with their values, and ultimately achieve greater financial stability and peace of mind.