The Survey Research Center (SRC), a leading entity in survey research, began its journey in the 1960s with the honor of hosting one of the most renowned survey sampling experts, Leslie Kish, in the field. This establishment was supported by a stable interviewing team, enabling surveys on a variety of topics. The most groundbreaking survey from the SRC was the Survey of Consumer Finances, which focused on understanding consumer behavior. This survey utilized a massive sample of about 1,500 in-person interviews, spread across the U.S., and took over an hour to complete each survey. Key points about this survey include its efficient process and its status as a benchmark for time-constrained surveys. Later, the survey was adopted by the Federal Reserve via phone, showcasing its enduring relevance.

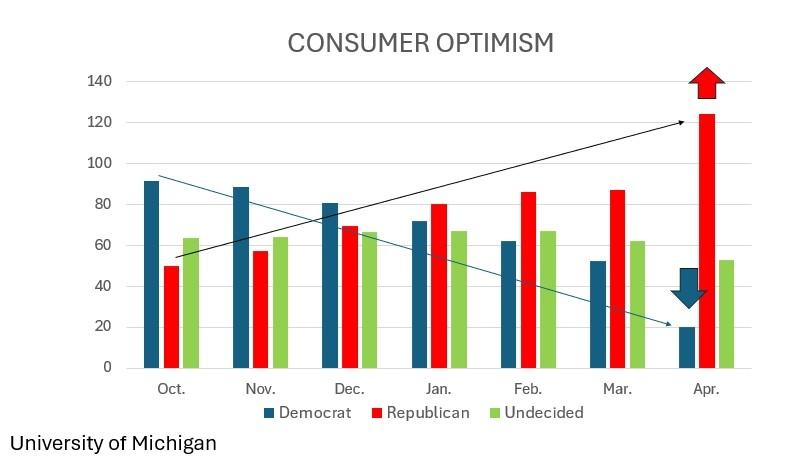

The Survey of Consumer Sentiment by Dr. George Katona remains a cornerstone for tracking consumer optimism and pessimism. With a strong focus on Octoberthrough March coverage, the index dropped from 70.5 to 57.0, reflecting changing market conditions and economic data. Notably, the impact of political elections influenced sentiment differently by party affiliation. On election day, the Index for Democrats declined by 50.1 points, while Republicans saw an Increase of 30.8 points, while independent respondents nearly remained unchanged. This demonstrates how election results can have a tangible effect on public sentiment.

The NFIB’s Small Business Optimism Index stands as a vital measure of the U.S. small business economy. Constructed over 100 variables reflecting forward-looking expectations, it serves as a monthly data point. The index surged from 93.7 to 97.4 between October 2024 to March 2025, with the 51-year average at 98, indicating a strong economic recovery. However, the Index stayed consistently below 98, particularly over a year post-election, as concerns for businesses and employment grew. The expected business conditions and expected real sales accounted for most increases. The rapidly evolving uncertainty period highlighted a significant change in expectations, as seen in the Uncertainty Index, which rose to 110 in October 2024 and dropped to 86 afterward, before rebounding again in February at 104 when policy changes relaxed uncertainty.

The survey’s reliability is bolstered by its small sample-to-population ratio and reliability coefficients, which arefeasible to replicate. centrovers sample sizes range from 100 to 5,000, ensuring that findings are applicable across varied groups. The survey design combines insights from social media and traditional methods, leveraging digital tools for more dynamic data collection. The questions are crafted to avoid bias and are structured to ensure responses are interpretable. Regular testing for bias helps maintain trust in the survey tools.

Access to the survey data is crucial for breaking down interpretation variability, especially for complex questions. Tools like SPSS can reveal deeper patterns of insight. When取出数据,研究人员可以进一步分析。The survey’s reliance on self-reported scales provides nuanced insights into self-perceived well-being. Its emphasis on optimism, anxiety, and other psychological aspects sets it apart, offering richer insights for policy analysis and consumer behavior research.