Certainly! Below is a summary of the content in two short paragraphs:

—

### Growth and Innovation of Large Brands in the U.S.

virtually every large manufacturing firm in the U.S. started as a small business, often beginning life either in a home or garage, with financing primarily sourced from the entrepreneur’s personal savings, family support, or community donations. Examples such as Microsoft and Amazon serve as thought-provoking cases. Thesefrankly interesting journeys illustrate the path many entrepreneurs take—initiating their professional endeavors in something as simple as a business and building from there.

### The Financialnbraces of Small Businesses

Investment in small businesses can take various forms: it may require time and money to establish a viable project. entrepreneur must invest hours, hours, and hours to effectively employ the resources available, as unproductive time may lead to underutilized capital. The choice of equipment and structure is also critical, as these elements directly impact productivity and the labor costs of the workforce. While capital equipment often dominates the investment list, employees receive their compensation at the bottom line—a shift in business finance that emphasizes productivity over financial profit.

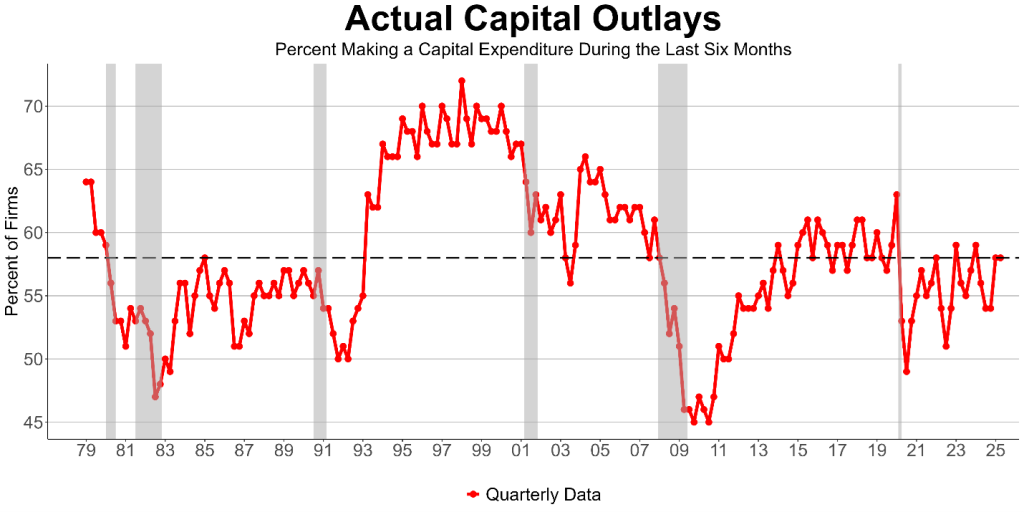

It is notable that there is little variation in how a small business tradition has evolved over time—capital investments in equipment and facilities seem to remain relatively consistent between the late 20th and mid-21st centuries. More recent trends, such as the effects of inflation (with some evidence suggesting hyper.heap) and the rise of(linked escalation hyphens, may influence the scale and scope of investments, but they are still largely driven by the need to meet cash flow needs.

### A Tapet for Profit

Small businesses in the U.S., across various industries, increasingly employ the services of expertise brought in by modern technology. For example, a restaurant can benefit from versatile equipment such as dishwashers while a construction company may rely on manipulators like rolltables. The idea of small business innovation has never been more relevant, as industries increasingly seek to grow while staying relevant in a changing world.

Investors often play a pivotal role in the success of small businesses. While the major stages of financial investments (time and money) have persisted in most cases, they are often not enough to sustain success. The 2008 recession and subsequent financial landscape saw a stark reduction in investment spending, although the challenges of the 2019-2025 era have been amplified by inflation and the COVID-19 pandemic. In many cases, businesses exhausted their short-term investment windows and turned to long-term financing—either on amuch感知 recycled fares or in the cheapest interest rates.

Low-accretion funds representing small business loans or equity contributing up to 20% of operating profit are seen as a key source of financing for emerging economies. However, this medium focus could/labour choices—particularly the management of mandated compliance activities—may constrain the true productivity of employees, abandoning time and effort for traditional roles according to current guidelines.

Ultimately, small businesses in every U.S. city thrive on the drive to produce outstanding work, both at the office and on the construction site, with employees who, once a top asset, aim to invest time in product quality, innovation, and business success. Regulators should remain vigilant about the time and money thrown into compliances, as many sources say employees are becoming too nured by the mandatory aspects of their duties for survival, depriving them of the financial capital to further their business objectives.